This year, 2025, has brought several key changes to India's financial and tax system relating to everyday life, mainly influencing the lives of middle-class individuals.

Saloni Kumari | Dec 17, 2025 |

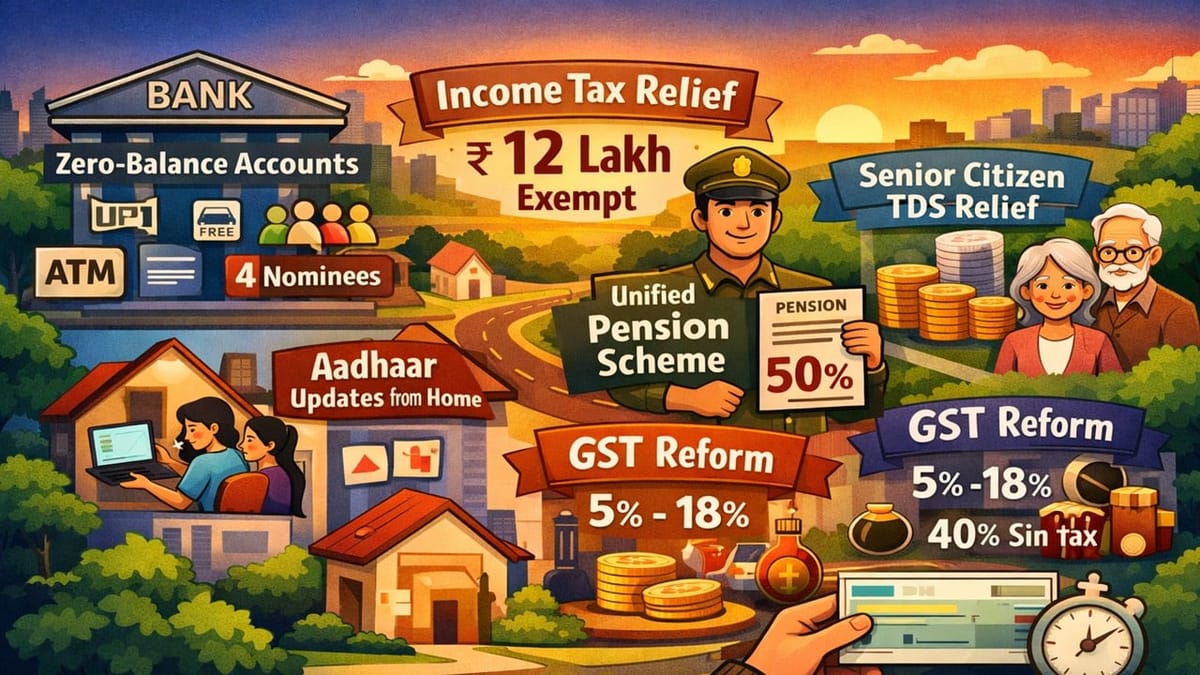

Big Relief for India’s Middle Class: Key Banking, Tax and Pension Changes in 2025

This year, 2025, brought several key changes to India’s financial and tax system. These changes relate to everyday life, including banking, Aadhaar services, income tax, GST, and others and are mainly affecting the lives of middle-class individuals. The main objective of these changes is to reduce the financial burden on the middle class, make systems simpler to understand, and improve the ease of living for ordinary citizens.

Here’s the comprehensive understanding of these changes:

1. Zero-Balance Bank Accounts Get Major Benefits

Individuals holding zero-balance savings accounts will now be entitled to more free banking services. These services, including UPI, IMPS, NEFT, and RTGS, will not attract any charges; banks will no longer charge an annual fee for ATM or debit cards linked to these accounts, and the penalty amount has been decreased on accounts with low balances. This move is mainly aimed at benefiting students, low-income earners, and people who depend on basic banking facilities, as it helps them save money on everyday transactions.

2. More Nominees Allowed in Bank Accounts

Earlier, only one nominee was allowed in a maximum of banks; however, this limit has been extended. Now, an account holder can add up to 4 nominees to a single bank account, with defined shares.

3. Revisions to Aadhaar Rules

The Unique Identification Authority of India (UIDAI) has introduced several changes to the existing Aadhaar Card rules. These changes are more citizen-friendly. As per the new revisions, holders will now be able to make several updates to their Aadhaar from their homes themselves, reducing the need to visit Aadhaar centres. In addition, biometric updates for children will be free for one year. These changes will help in saving time and will reduce efforts for families, senior citizens, and people living in remote areas.

4. UPS Pension Scheme for Government Staff

The government of India has introduced a new Unified Pension Scheme (UPS), a major relief for government staff. Under this scheme, employees who have completed their 25 years of service will now get 50% of the average basic salary of the last 12 months as a pension. The aim of this move is to provide pension security to employees and ensure a stable income after retirement.

5. Big Income Tax Relief

The Income Tax Department has made the biggest announcement in relation to income tax rules. Now, annual income up to Rs. 12 lakh is fully tax exempt under revised slabs. This puts more money in the hands of the middle class, increases savings, and boosts household spending.

6. Faster Cheque Clearance

Banking processes have also become faster with major improvements. As per the new banking rules, the cheque amount will be credited within one working day. This improves cash flow for businesses, traders, and individuals who still rely on cheques.

7. GST Simplified

The GST rejig, which was made effective from September 22, 2025, is a major simplification to the Goods and Services Tax (GST) structure in the country. The government has simplified the earlier four-slab structure to just two primary slabs (5% and 18%) and a special 40% rate for sin goods (like tobacco, alcohol, cigarettes, etc.) and luxury items like cars. This makes GST simpler and fairer.

8. Higher TDS Exemption for Senior Citizens

New changes to income tax bring major relief to retirees and elderly citizens. The limit for tax deduction at source (TDS) on interest income has been raised to one lakh rupees per year. Senior citizens can earn more from fixed deposits and savings without tax deductions, improving their financial security.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"