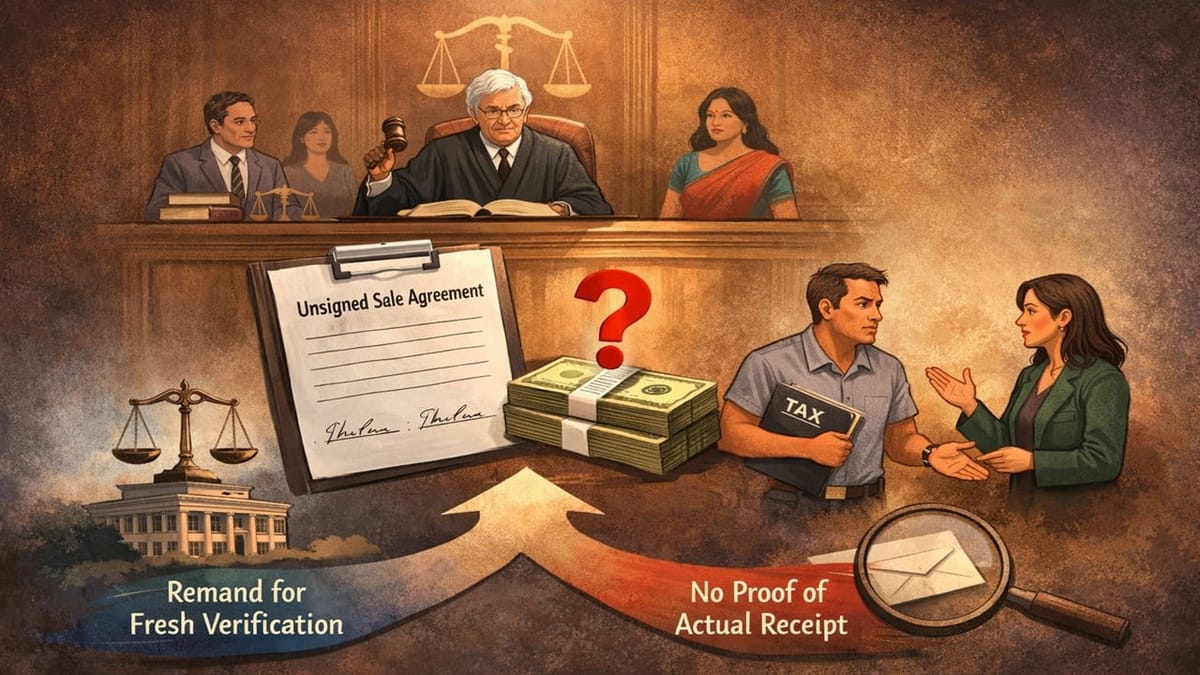

ITAT remands the case for fresh verification, holding that an unsigned sale agreement alone cannot justify capital gains addition without independent proof of actual receipt.

Saloni Kumari | Dec 19, 2025 |

ITAT Remands Case Over Unsigned Sale Agreement; Orders Fresh Verification of Rs. 13 Lakh Receipt

Smt. Nomula Narmada filed the present appeal before the Income Tax Appellate Tribunal (ITAT) Hyderabad, challenging an order passed by the CIT(A) Hyderabad on June 28, 2025.

Nomula filed her return for the relevant financial year, declaring the total income of Rs. 76,83,250. Later, the return was selected for the purpose of scrutiny, where the Assessing Officer (AO) noticed that Nomula had sold seven plots. During verification, the assessee admitted the sale consideration of the plot No. 233 at Rs. 6,44,000, while during the search operation, officials found an unsigned agreement of sale mentioning the sale consideration of Rs. 37,26,500. Considering the agreement, AO treated the difference amount of Rs. 30,82,500 as undisclosed sale consideration and made the addition of the same to the assessee’s income under the head “Capital Gains.” AO completed the assessment, declaring the total income of the assessee at Rs. 10,765,750.

The assessee approached CIT(A), challenging the decision of AO; however, CIT(A) upheld the addition made by AO and dismissed the assessee’s appeal. Thereafter, the assessee filed an appeal before the ITAT Hyderabad. The tribunal examined both the unsigned sale agreement and the registered sale deed and discovered that the buyer, the property, and the role of the assessee’s son (as GPA holder) were the same in both documents. The assessee’s son had also admitted that part of the sale amount was received in cash.

However, the tribunal ruled that an unsigned agreement alone cannot be considered as proof of a higher sale value unless there is independent proof and it is properly signed. The unsigned agreement mentioned payment of Rs. 13 lakh; however, there is no clear and valid evidence showing this amount was actually received through the bank or cheque.

Hence, based on the above findings, the tribunal remanded the case to the Assessing Officer (AO) to freshly verify whether the Rs. 13 lakh was received through banking channels by the assessee or her son. If the bank receipt is found, that means the addition made by the AO may be valid, and if no such receipt is found, then the addition cannot be sustained. The AO must freshly consider the case, giving the assessee a proper chance of hearing. The appeal has been allowed for statistical purposes.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"