The tribunal set aside the CIT(A)'s order and directed the matter to be sent back to the CIT(A) for a fresh decision.

Nidhi | Dec 19, 2025 |

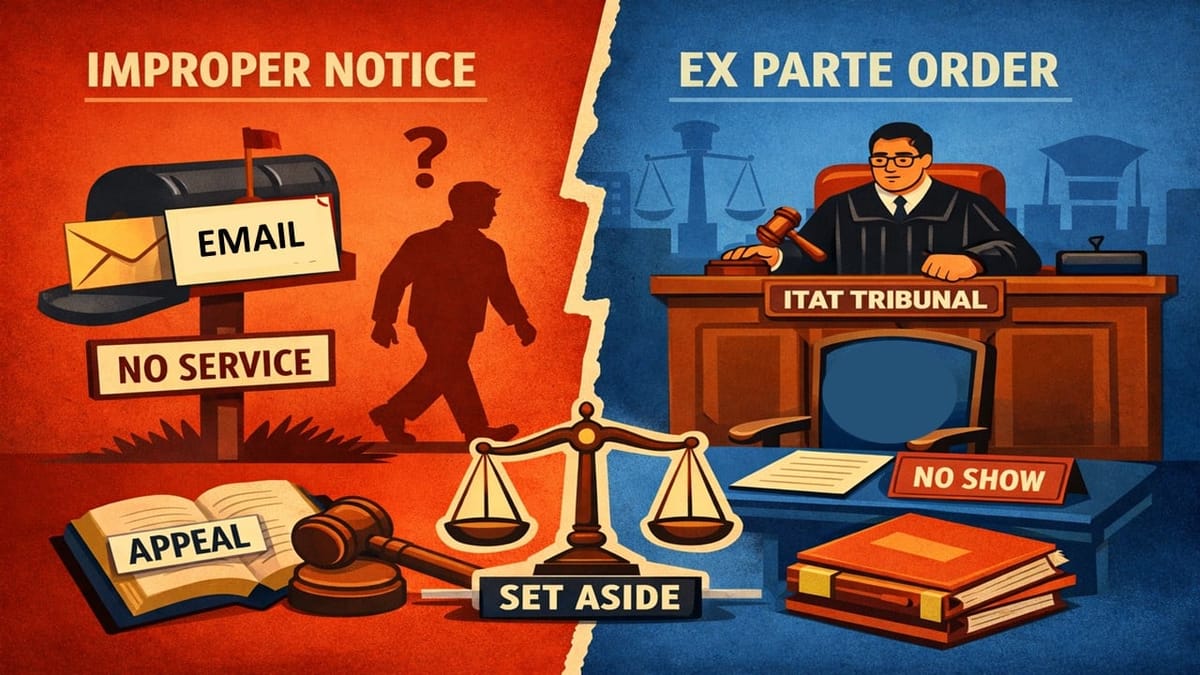

ITAT Sets Aside Ex Parte Order for Lack of Proper Hearing Due to Improper Service of Notice

The assessee, Ramniwas Sharma, failed to file his ITR for A.Y. 2013-14, due to which his case was reopened. During the assessment, the AO made an addition of Rs 2,07,49,380, treating them as income from undisclosed sources under section 69A of the Income Tax Act. The assessee challenged these additions before the CIT(A). However, even after multiple communications being sent to the assessee by the CIT(A), he failed to respond to them. This resulted in passing an ex parte order by the CIT(A). Therefore, the appellant filed an appeal before the Income Tax Appellate Tribunal (ITAT), Delhi.

The main contention of the assessee was that the CIT(A) had not provided a proper opportunity for a hearing because of the improper service of communication under section 250 of the Act, violating the principles of natural justice.

The ITAT analysed CIT(A)’s order, which stated that the hearing notice was delivered to the appellant on the Email ID and there was no proof of the proper service of notice. Therefore, the ITAT concluded that the appellant was not given an effective hearing. The tribunal set aside the CIT(A)’s order and directed the matter to be sent back to the CIT(A) for a fresh decision.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"