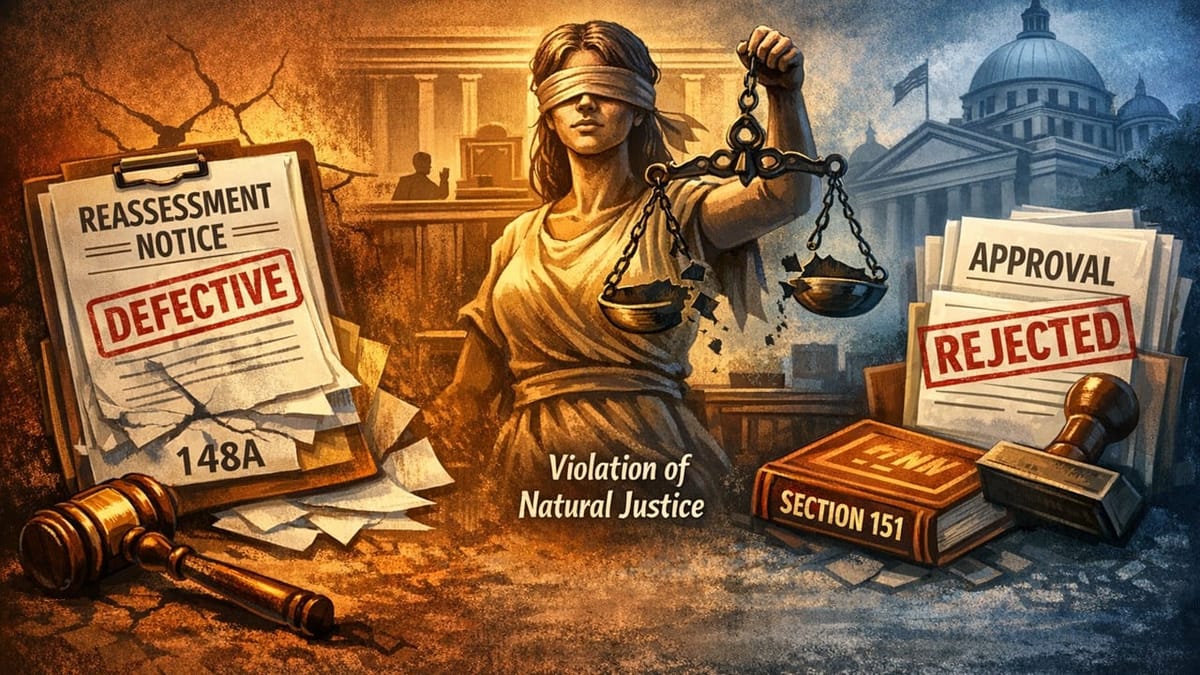

ITAT upheld the quashing of reassessment due to defective Section 148A proceedings, violation of natural justice, and invalid approval under Section 151.

Saloni Kumari | Jan 2, 2026 |

ITAT Upholds Taxpayer’s Relief Due to Defective Section 148A Proceedings and Invalid Approval

The present appeal has been filed by the Income Tax Officer (ITO) against a taxpayer named Pankaj Jain in the ITAT Delhi, challenging an order dated February 04, 2025, passed by the CIT(A)/NFAC. The case is related to the Assessment Year 2018-19.

For the year in consideration, the assessee did not file any Income Tax Return (ITR) within the statutory deadline. The AO (Assessing Officer) received information from the tax department that the assessee had made cash withdrawals of Rs. 63.06 lakh from HDFC Bank Limited and also made deposits of Rs. 2.04 lakh. Resulting in the AO issuing a notice dated March 31, 2022, to the assessee under Section 148A (b) of the Income-tax Act, 1961. However, the assessee did not respond to the notice. In conclusion, the AO issued the final order dated April 05, 2022, under Section 148A (d) and also issued a notice under Section 148 of the Act.

In answer to the notice, the assessee filed his ITR on May 06, 2022, for the year in consideration, declaring a net loss of 1.26 lakh. Later, the assessee also accepted his gross turnover at Rs. 7.85 crore and purchases at Rs. 7.50 crore. The AO asked the assessee to furnish relevant evidence explaining the sources for the same. The assessee furnished all the relevant documents. Among them, the AO considered the purchase of Rs. 5.42 crore as fake and disallowed the same under section 37(1) of the Act. The AO completed the reassessment, declaring the total income of the assessee at Rs. 5.41 crore.

The assessee challenged the reassessment before the CIT(A), wherein he argued that the section 148A(b) notice mentioned fake purchases pertaining to a different Assessment Year, i.e., AY 2015-16, while the section 148A(d) order discussed about cash withdrawals and deposits belonging to the AY 2018-19. Thus, the reasons in the notice and the order were completely different. He further argued that the AO issued the final order before the statutory time limit of responding, which is a violation of the principles of natural justice.

Another major objection by the assessee was regarding approval under section 151. Since the section 148 notice was issued three years after the end of the assessment year, approval should have been taken from higher authorities (like the Principal Chief Commissioner or Chief Commissioner). However, approval was taken merely from the PCIT, which is incorrect as per the law. The CIT(A) accepted these arguments and held that the reassessment itself was invalid. Therefore, they quashed the reassessment and deleted the additions made by the AO.

Thereafter, the Tax Department further challenged the decision of CIT(A) before the ITAT Delhi. However, the tribunal itself endorsed the findings of CIT(A) and dismissed the Tax Department’s appeal.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"