CA Pratibha Goyal | Jan 8, 2023 |

ITC Mismatch GSTR-3B and GSTR-2A: Format of Supplier Certificate

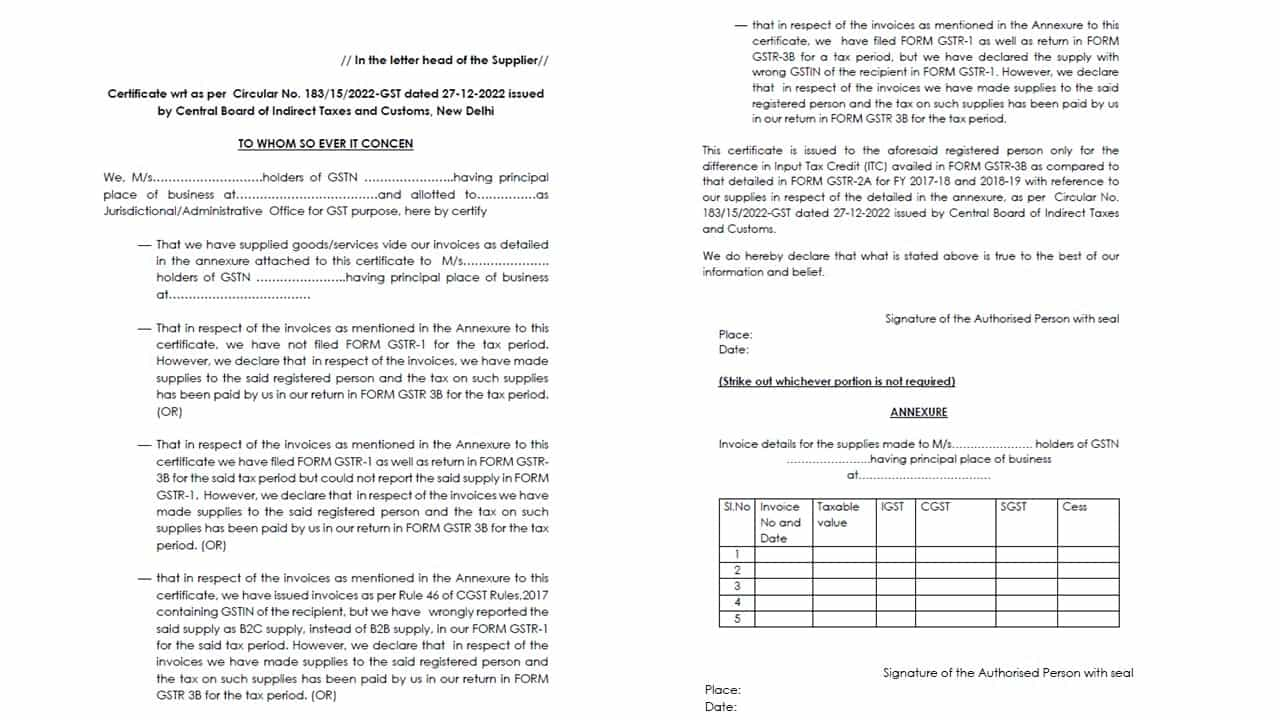

As per Circular Number Circular No. 183/15/2022-GST dated 27-12-2022 issued by Central Board of Indirect Taxes and Customs (CBIC), in case, of difference between the Input Tax credit (ITC) claimed in FORM GSTR-3B and that available in FORM GSTR 2A.

In cases, where difference between the ITC claimed in FORM GSTR-3B and that available in FORMGSTR 2A of the registered person in respect of a supplier for the said financial year is upto Rs 5 lakh, the proper officer shall ask the claimant to produce a certificate fromthe concerned supplier to the effect that said supplies have actually been made by him to the said registered person and the tax on said supplies has been paid by the said supplier in his return in FORM GSTR 3B.

In case, where difference between the ITC claimed in FORM GSTR-3B and that available in FORM GSTR 2A. of the registered person in respect of a supplier for the said financial year exceeds Rs 5 lakh, the proper officer shall ask the registered person to produce a certificate for the concerned supplier from the Chartered Accountant (CA) or the Cost Accountant (CMA), certifying that supplies in respect of the said invoices of supplier have actually been made by the supplier to the said registered person and the tax on such supplies has been paid by the said supplier in his return in FORM GSTR 3B.

Certificate issued by CA or CMA shall contain UDIN. UDIN of the certificate issued by CAs can be verified from ICAI website and that issued by CMAs can be verified from ICMAI website.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"