CA Pratibha Goyal | Feb 24, 2024 |

ITC rejected due to non-reflection in GSTR-3B: HC allows claim on basis of GSTR-2A and GSTR-9 returns

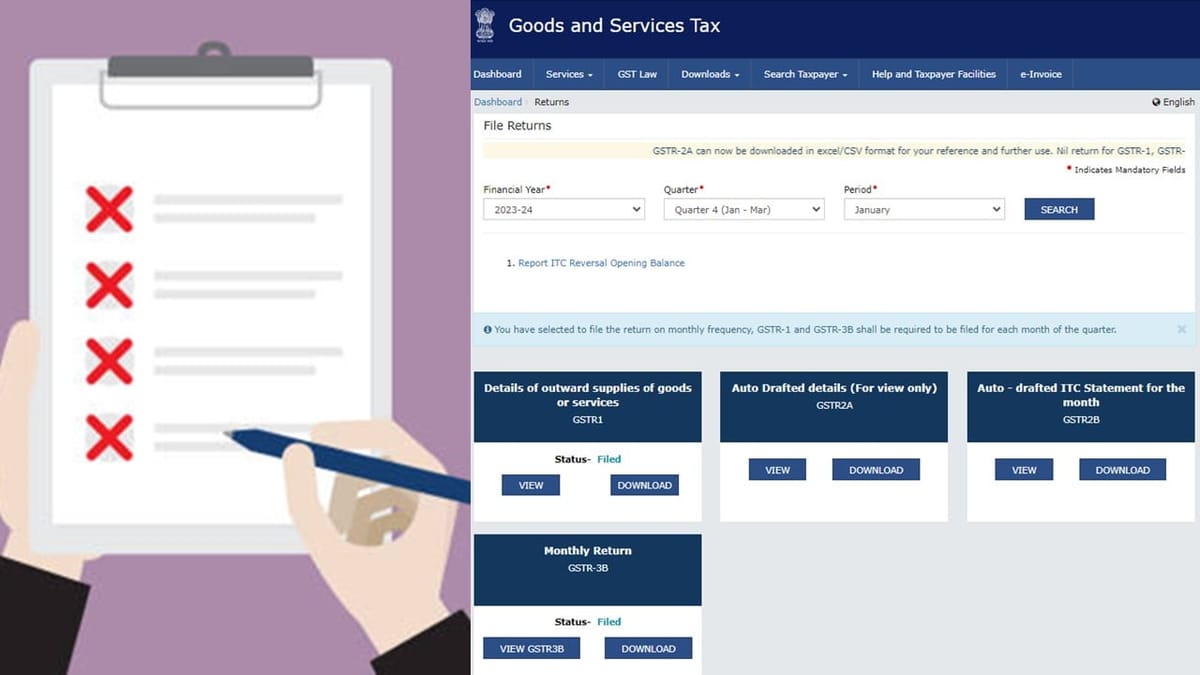

Madras High Court in the matter of M/s. Sri Shanmuga Hardwares Electricals V/S The State Tax Officer has held that the Input Tax Credit (ITC) cannot be rejected entirely on the ground that the GSTR-3B returns did not reflect the ITC claim. The Court said that the assessing officer should examine whether the ITC claim is valid by examining all relevant documents, GSTR-2A and GSTR-9.

Facts of the Case:

Nil returns were erroneously and inadvertently filed in the GSTR-3B returns by petitioner.

Petitioner states that he is eligible for Input Tax Credit (ITC). This ITC is duly reflected in the GSTR-2A returns.

Consequently, the petitioner states that GSTR-9 (annual) returns were filed duly reflecting the ITC claims of the petitioner.

Consequently, the petitioners were rejected by the GST Department.

The ITC claim was rejected solely on the ground that the petitioner had not claimed ITC in the GSTR-3B returns.

Contention of the Department:

The petitioner should have availed of the statutory remedy and not approached this Court.

The burden of proof is on the registered person to establish ITC eligibility. Since such burden was not discharged by the petitioner, no interference is called for with the orders impugned herein.

Court’s Order:

6. When the registered person asserts that he is eligible for ITC by referring to GSTR-2A and GSTR-9 returns, the assessing officer should examine whether the ITC claim is valid by examining all relevant documents, including by calling upon the registered person to provide such documents. In this case, it appears that the claim was rejected entirely on the ground that the GSTR-3B returns did not reflect the ITC claim. Therefore, interference is warranted with the orders impugned herein.

7. For reasons set out above, the orders impugned herein are quashed and these matters are remanded for reconsideration. The petitioner is permitted to place all documents pertaining to its ITC claims before the assessing officer within a maximum period of two weeks from the date of receipt of a copy of this order. Upon receipt thereof, the respondent is directed to provide a reasonable opportunity to the petitioner, including a personal hearing, and thereafter issue fresh assessment orders within a maximum period of two months from the date of receipt of documents from the petitioner.

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"