The ITR cannot be filed for FY 24-25 if you do not have Aadhaar Number

CA Pratibha Goyal | May 30, 2025 |

ITR cannot be filed for FY 24-25 if you do not have Aadhaar Number

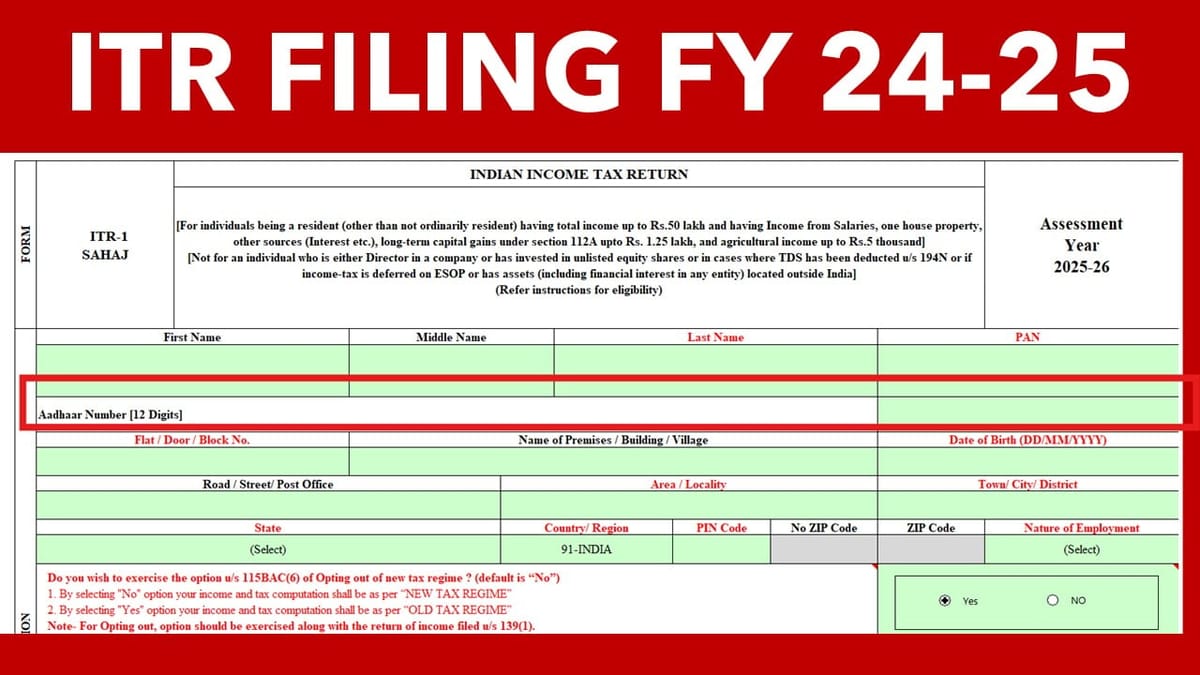

The Income Tax Return (ITR) Forms for Financial Year 2024-25 have been notified. ITR Filing utilities for ITR-1 and ITR-4 have also been released for the relevant Financial Year.

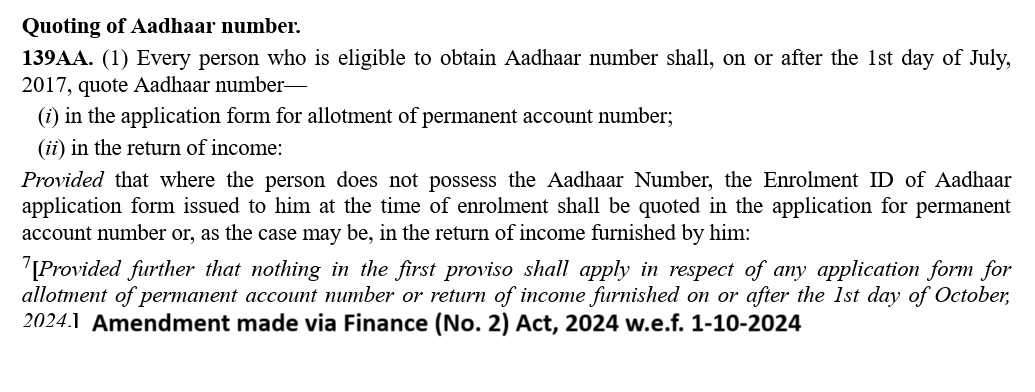

This year, ITR Forms come with many changes. One of the important changes is that the ITR forms for FY 2024-25 (AY 2025-26) do not have the Aadhaar Enrolment ID column this year. This means, if the taxpayers do not have an Aadhaar number, then they will not be able to file ITR this year.

However, this is applicable to Resident Taxpayers, and Non-Resident Taxpayers can still file the ITR without Aadhaar.

This is in line with the amendment made via Finance (No. 2) Act, 2024.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"