ITR Filing is mandatory in India for those individuals who are eligible for it and even for those who don't come under the threshold limit of filing ITR.

Reetu | Jul 10, 2024 |

ITR Filing 2023-24: Who needs to File Income Tax Return (ITR)?

The ITR Filing deadline is approaching soon i.e. July 31. Taxpayers are filing their tax returns as soon as they can to avoid penalties and other issues.

As the ‘salary credited’ message drops to the people, it also comes with the hassle of filing taxes. The complexity and compliance requirements of the Income Tax Act makes the entire process sound difficult. However, Filing an Income Tax Return (ITR) is mandatory in India for certain categories of individuals. The criteria depend on the Income of an individual and various other factors.

It might be a possibility that your income is less than slab, but still you are required to file ITR as per rules of Income Tax.. In this article, we’ll cover the ITR filing requirements, exemptions, due dates, and repercussions of not filing.

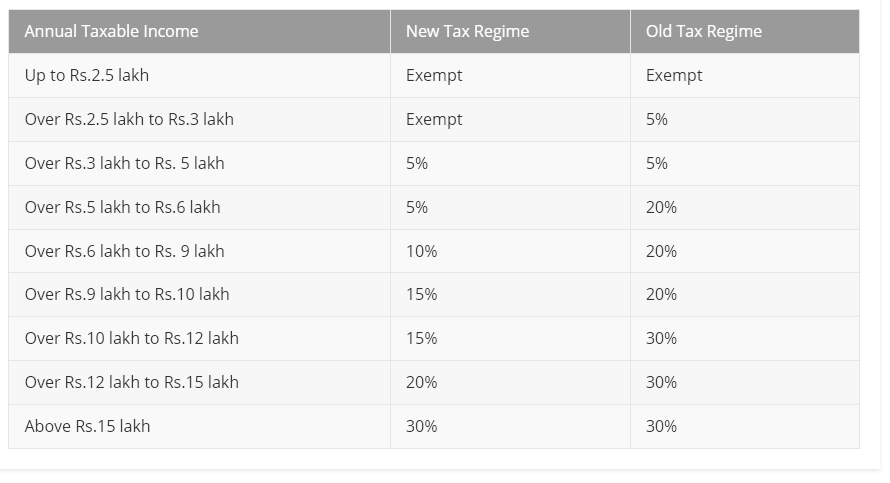

Under the old regime, individuals under 60 years of age must file an ITR if their income exceeds Rs.2.5 lakhs, while those over 60 must file an ITR if their income exceeds Rs.3 lakhs.

However, under the new tax regime, the basic exemption limit for any individual is Rs. 3 lakhs.

If you are submitting an ITR for FY 2023-24, the basic exemption limit under the new tax regime is Rs. 3 lakhs. This limit was raised to Rs. 3 lakhs from Rs. 2.5L in the budget 2023, and it applies to ITR filing in the financial year 2023-24.

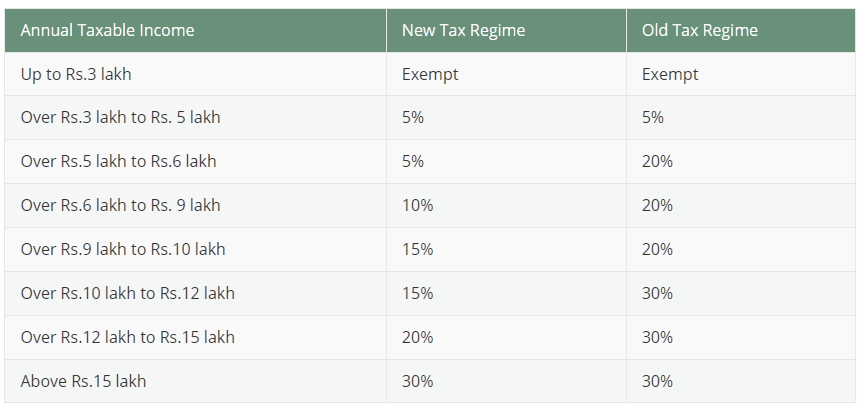

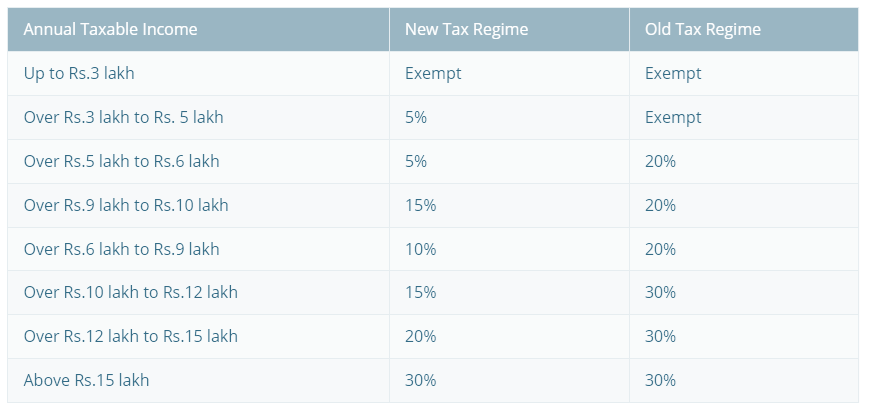

The tax slab rates for FY 2023-24 are listed here, both under the old and new tax regimes.

For Individuals below 60 years of age –

For Senior Citizens (60-80 years of age) –

For Super Senior Citizens (Aged > 80 years) –

According to the Income Tax Act of India, people are required to file an ITR only if their annual Gross Total income exceeds the basic exemption limit. However, under certain conditions, you may be obliged to file an ITR even if your income is within the basic exemption limit.

Below is the list of such conditions –

Bank Deposits of 50 lakhs or more: Individuals who have an annual savings bank deposit of Rs.50 lakhs or more in one or more accounts are required to file ITRs.

Current Account Deposits of more than Rs. 1 Crore: If an individual deposits Rs.1 crore or more into one or more current accounts throughout the financial year, he or she must file an ITR.

Annual Sales Turnover above Rs.60 lakhs: Individuals with an annual sales turnover of more than Rs.60 lakh are required to file an Income Tax Return (ITR).

Professional income above Rs.10 lakh: If a professional’s income exceeds Rs.10 lakh within a financial year, he or she is required to file an ITR.

Electricity Bill Exceeding Rs. 1 Lakh: If the electricity bill of an individual for the year exceeds Rs.1 lakh, he or she must file an ITR.

TDS/TCS of Rs.25,000 or more: If a person’s TDS/TCS is Rs.25,000, or more they must file an ITR. Senior citizens, on the other hand, face a Rs.50,000 threshold.

Foreign Assets Income: If an individual owns or receives an asset in a foreign country, he or she is required to file an ITR.

Foreign Travel Expenses: Individuals who spend more than Rs. 2 lakh on international travel for themselves or others throughout the financial year are required to file an ITR.

Resident taxpayers with overseas assets or signing authority: If you are deemed a resident for tax purposes in India and have any assets or interests abroad, you must file an ITR. This includes assets that you directly own or from which you benefit as a beneficiary owner.

Even if you are an authorized signatory to an account managed outside of India, you must file an income tax return. The assets you own outside of India may be movable or immovable. For example, if you travelled abroad and opened an account but failed to close it when you returned to India, you must file an ITR.

Easy Approval of Loan: When asking for a loan, banks frequently want your ITR as verification of your income. As a result, filing an ITR simplifies the approval process for your loans.

Tax Refund Claim: TDS may have been deducted from your income even if it is less than the basic exemption limit, or if the TDS deducted exceeds your actual taxable income. In such circumstances, you may claim a tax refund while filing your ITR.

Acts as Income and Address Proof: Your income tax return serves as documentation of your income and investments to various banks and financial institutions.

Quick Processing of Visa: Most embassies require you to provide prior years’ income tax returns when applying for a visa. As a result, filing an ITR can actually help speed up the visa process.

Carry Forward of Losses: Individuals can carry forward losses from the previous year under the Income Tax Act. These losses can be adjusted against future income. However, this benefit is only accessible if you file your ITR within the specified time period.

Help in Buying Term Insurance: Insurance companies frequently demand clients submit their income tax returns as proof of income. The entire coverage amount is decided by the individual’s salary.

Section 194P, passed in Budget 2021, exempts persons over the age of 75 from filing income tax returns under certain conditions. However, this exemption is subject to the following conditions:

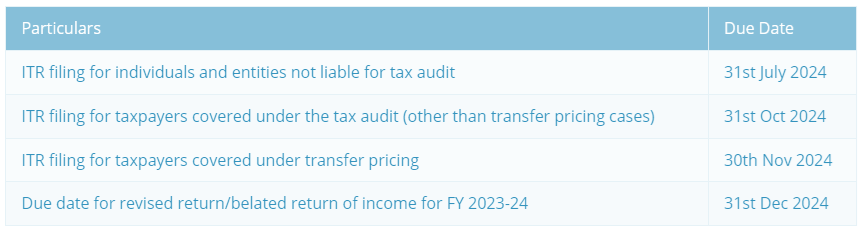

The deadline for filing an ITR is July 31st of each year. However, if you miss the ITR filing deadline, you can file a late return before December 31st.

Hence, the ITR filing deadline for FY 23-24 is 31st July 2024.

If you do not file an ITR by the required date, you may face a variety of implications. The following is a list of the consequences.

Filing an Income Tax Return (ITR) might be difficult if you are new to taxes, but CA consultants offer CA-assisted ITR filing services that make the process simple and comfortable for you. Whether you need help with deductions, exemptions, or just comprehending your taxable income, online or offline CA services ensure accurate and maximum tax refunds, you can get help from them.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"