For years 2023-24, understanding how to choose between the old and new tax regimes is crucial.

Anisha Kumari | Jul 9, 2024 |

ITR Filing: Steps of Filing ITR in Old Tax Regime for FY23-24

Filing your income tax return (ITR) can be straightforward if you know the steps to follow. For years 2023-24, understanding how to choose between the old and new tax regimes is crucial. Here’s how you can opt for the old tax regime when filing your ITR.

Yes, you can still choose the old tax regime even though the new tax regime is the default. The government gives taxpayers the flexibility to select a regime that best suits their financial situation. The old tax regime includes various deductions and exemptions. These might be beneficial for some taxpayers.

Here’s a simple guide to help you select an old tax regime when filing your ITR:

1. Log in to the e-filing Portal: Go to the Income Tax Department’s e-filing portal and log in using your credentials.

2. Start the ITR Filing Process: Select the appropriate assessment year (AY 2024-25) and choose the correct ITR form based on your income sources.

3. Personal Information Section: In the initial section where you enter personal details, you will find the option to select the tax regime.

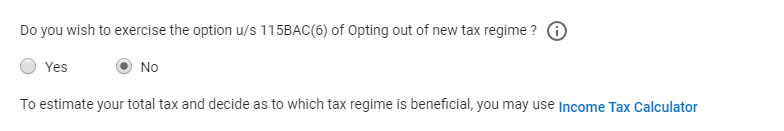

4. Choose Old Tax Regime: Select the option of old tax regime from the dropdown menu or checkbox provided.

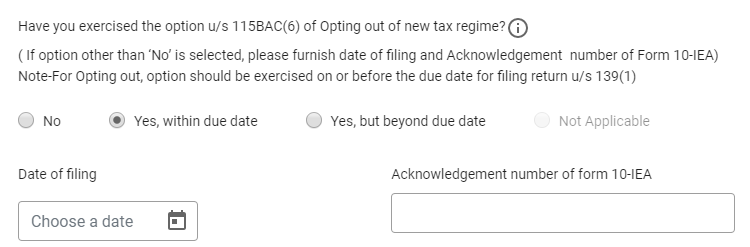

In case you have ITR Form other than ITR 1 and ITR 2, you need to file Form 10IEA for opting old tax regime and share the details of the form in your ITR.

Depending on your income sources, you may need to file different ITR forms. Here’s how to select old tax regimes in various forms:

ITR 1: Suitable for individuals with income from salary. The income from salary should not be more than Rs.50 Lakhs. Select the old tax regime option in the personal information section.

ITR 2: For individuals with income from salary, multiple house properties and capital gains. Choose the old tax regime in the tax details section.

ITR 3: For individuals and HUFs with income from business/profession. The old tax regime option will be available in the income details section.

ITR 4: For individuals HUFs and firms with presumptive income schemes. Select the old tax regime in the personal information section.

ITR 5: For firms, LLPs AOPs, and BOIs. The old tax regime can be selected in the initial section where business details are entered.

Yes, you can switch to the old tax regime while filing your ITR. Even if you opted for a new tax regime earlier in a financial year and TDS was deducted accordingly. Follow these steps:

1. Calculate Total Income and Deductions: Calculate your total income and eligible deductions under the old tax regime.

2. Fill in the ITR Form: Begin ITR filing, in the tax regime section select the old tax regime.

3. Adjust TDS Details: Ensure to adjust TDS details in the form to reflect the switch in tax regimes.

Choosing an old tax regime while filing your ITR for years 2023-24 is a straightforward process if you know where to look. Carefully consider your financial situation. Evaluate deductions available to you under the old regime before making a decision. Follow the outlined steps mentioned above. You can easily select the old tax regime and file your ITR accurately.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"