Reetu | Jul 20, 2022 |

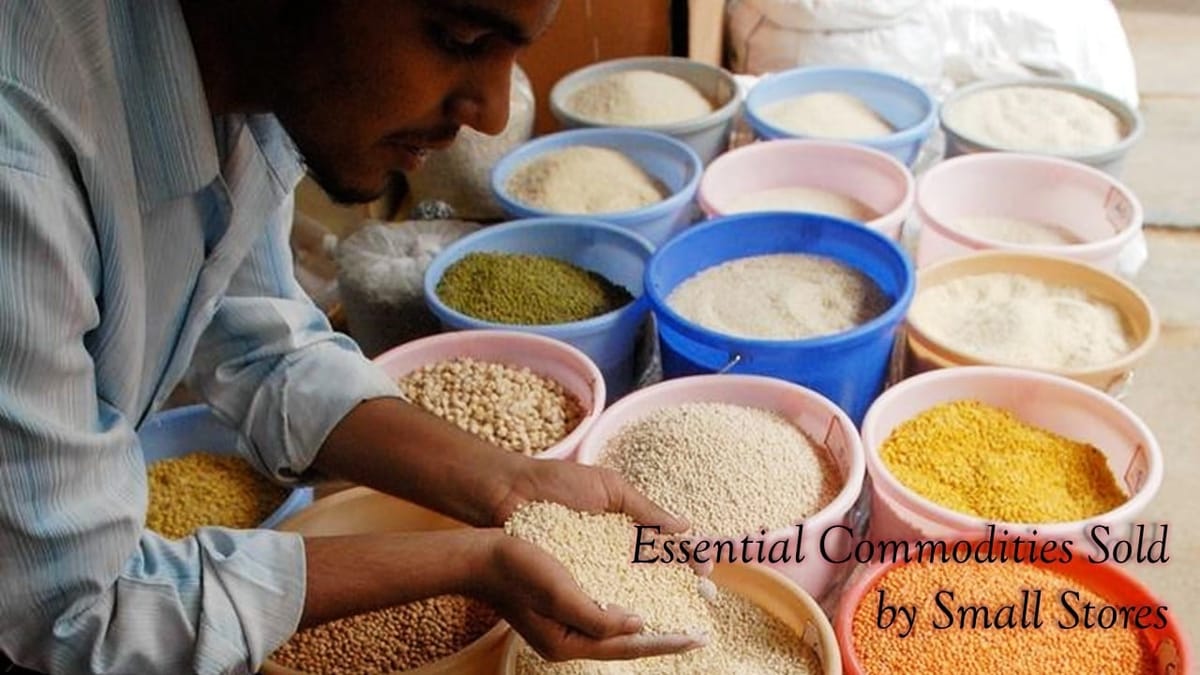

Kerala won’t impose GST on Essential Commodities sold by Small Stores

Kerala Finance Minister KN Balagopal said that the state will not charge Goods and Service Tax (GST) on essential commodities sold by small retailers and Kudumbashree (a network of women self-help groups).

On Tuesday, Balagopal declared in the Kerala Assembly that the tax will not be imposed to commodities sold in loose packets or by Kudumbashree and other businesses in 1 or 2 kilograms packets.

K N Balagopal, the state’s finance minister, told the Kerala Assembly that the decision might lead to issues with the central government but the state was not ready to compromise.

“At any rate, in Kerala, we don’t intend to tax goods that are sold in small shops, by nonprofit organisations like Kudumbashree, or in packages weighing 1 or 2 kg. Even if this causes problems with the Center,” Balagopal informed the assembly. “We are not ready to compromise on this. We had already said this there.”

“The CM wrote to them about these issues yesterday as well. We won’t be imposing it on independent retailers and small-scale traders. There can be no argument on this,” Mr Balagopal added.

The Finance Minister further claimed that Pinarayi Vijayan, the chief minister, had sent a second letter to the Centre after the government had already written to it once. The minister also promised that small business owners would be taken into account so they wouldn’t run into any problems.

“We sent a letter earlier, and CM wrote a letter yesterday as well. The small-scale manufacturers and traders won’t be impacted by its implementation,” he added

One of the most well-known initiatives for women’s empowerment in the nation is Kudumbashree, a women’s self-help organisation run by the government of Kerala. It runs numerous businesses, including small-scale food processing facilities.

According to Mr. Balagopal, branded businesses must pay a 5% tax on packaged goods, but this tax is waived if the packaging clearly states that the company is not “claiming the brand.”

“So the centre introduced the rule to catch such companies, although there is still some confusion existing over this”, he continued.

Mr. Vijayan drew attention to the fact that a lot of small shops and millers pre-packaged and have the commodities available for purchase so that consumers can acquire them right off the shelf without having to wait while the items are weighed and packed.

In the letter, Mr. Vijayan claimed that this pre-packing was a standard practise in the majority of Keralan retail stores and that the current shift will negatively affect the many regular consumers who frequent these stores for their necessary purchases.

Finance Minister Nirmala Sitharaman claimed that all states, including those not governed by the BJP, had approved the decision to impose a 5% goods and services tax (GST) on a list of pre-packaged foods, including pulses, cereals like rice, wheat, and flour (atta), etc. amid growing protests over the decision.

She said that the non-BJP-ruled states of Punjab, Chhattisgarh, Rajasthan, Tamil Nadu, West Bengal, Andhra Pradesh, Telangana, and Kerala have consented to enact the 5% levy.

In a series of tweets, Sitharaman claimed that prior to the implementation of the Goods and Services Revenue (GST), states imposed sales taxes or VAT on foodgrains and that the current duty on cereals, pulses, flour, curd, and lassi is an effort to stop tax leakage.

She said that the GST Council, which is composed of representatives from all 50 states, made the decision.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"