Reetu | Sep 18, 2021 |

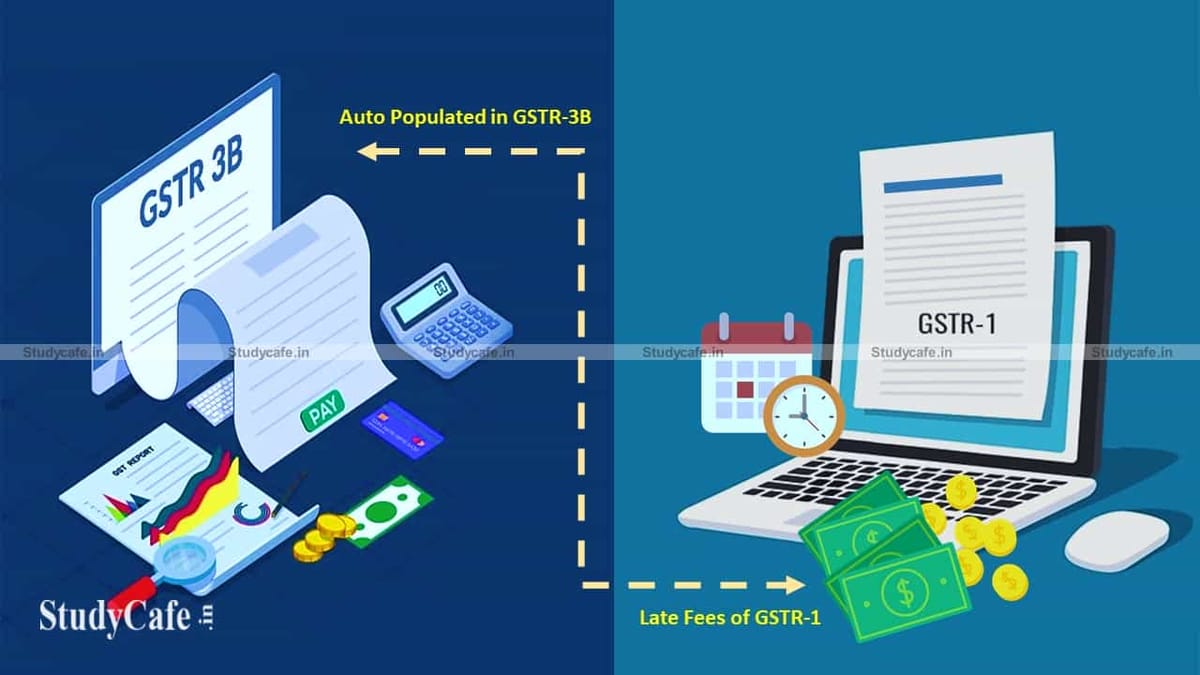

Late fees for delayed GSTR-1 filing to be auto-populated in GSTR-3B : 45th GST Council Meeting

Auto-Population of GSTR-1 Late Fees in GSTR-3B

As per the announcement made in 45th GST Council Meeting, the Late fee for delayed filing of FORM GSTR-1 is to be auto-populated and collected in the next open return in FORM GSTR-3B.

What is the Amount of Late Fees Applicable on Late Filing of GSTR-1?

Initially as per Sec 47, GSTR-1 Late Fees was: Rs 200 per Day (Rs 100 + Rs 100), Max: 10000 (Rs 5000 + Rs 5000)

It was later waived to Rs 20 per Day (Rs 10 + Rs 10), Max: 10000 for nill return (Rs 5000 + Rs 5000) and Rs 50 per Day (Rs 25 + Rs 25), Max: 10000 (Rs 5000 + Rs 5000) for other.

For taxpayers having nil tax liability in GSTR-1, the late fee to be capped at Rs 500 (Rs 250 CGST + Rs 250 SGST)

For other taxpayers:

GSTR-1 is a monthly or quarterly return that must be filed by every registered GST taxpayer, with the exception of a few exceptions detailed in the following sections. It comprises information on all outward supply, such as sales. The return is divided into 13 sections, as follows:

The GSTR-1 deadlines are determined by your turnover. Businesses with sales of up to Rs.5 crore can use the QRMP scheme to file quarterly returns, which are due by the 13th of the month following the relevant quarter.

Those who do not opt for the QRMP plan or who have a total turnover of more than Rs.5 crore must file the return on or before the 11th of the following month.

Regardless of whether or not there were any transactions during the period, every registered person is required to file GSTR-1. From the first week of July 2020, nil GSTR-1 filers will be able to file by SMS. The GSTR-1 is not required for the following registered persons:

1. Distributors of Input Services

2. Dealers in Composition

3. Online information and database access or retrieval service providers (OIDAR), who must pay tax (as per Section 14 of the IGST Act)

4. Taxpayer who is non-resident.

5. Taxpayer responsible for TCS

6. Taxpayer is required to deduct TDS.

Once a return is filed, it cannot be changed. Any errors in the return can be corrected in the GSTR-1 for the following period (month/quarter). This means that if a mistake is made in the GSTR-1 for August 2021, it can be corrected in the GSTR-1 for September 2021.

1. Is it possible to file GSTR-1 after filing GSTR-3B?

GSTR-3B is a monthly summary return that must be filed by taxpayers ( or quarterly basis if QRMP scheme is chosen). GSTR-1 is required to be filed before the GSTR-3B return as of January 1, 2021. A quarterly GSTR-1 filer would have filed his quarterly GSTR-1 at the end of the month following the quarter, which would have been after submitting GSTR-3B, prior to this date.

2. Should I file GSTR-1 even if no sales occur in a given month?

GSTR 1 is required to be filed. If your total sales for the year are less than Rs.5 crore, you can file your tax return quarterly. Invoice furnishing is also accessible, which allows you to upload sales invoices on a monthly basis (for the first two months of the quarter).

3. Is it possible to make changes to a bill that has been published to the GST Network?

You can edit bills several times after they’ve been uploaded. After an invoice has been uploaded, it is not possible to change it. However, you can only make changes to an invoice before submitting a return. The numbers are frozen once they’ve been submitted.

4. Is it possible to only upload an invoice when filing a return?

Invoices can be uploaded at any time. To avoid bulk uploading at the time of submitting your return, it is highly recommended that you upload invoices at regular periods throughout the month. This is due to the fact that mass upload takes a long time.

5. The composition scheme is what I’ve gone with. Is it necessary for me to submit a GSTR-1 form?

You are not required to file GSTR-1. Taxpayers who have chosen the composition plan must utilise Form CMP-08 to make quarterly tax payments.

6. Is it possible to make changes to details that have already been filed in GSTR-1? If that’s the case, when will you be able to file amendments?

Yes, you can make changes to a GSTR-1 that has already been filed for a certain tax period by reporting the changes in the return. For example, on August 30, 2021, Mr. X of Kerala sold products to Mr. Y of Karnataka for Rs. 1,00,000, which he recorded in the GSTR-1 for August 2021. Now that he realises he made a mistake in the invoice’s date, he can issue an amended invoice with the proper invoice date, i.e August 16, 2021. The GSTR-1 for September 2021 will include this updated invoice.

To Read GST Council 45th Meeting Official Press Release Download PDF Given below :

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"