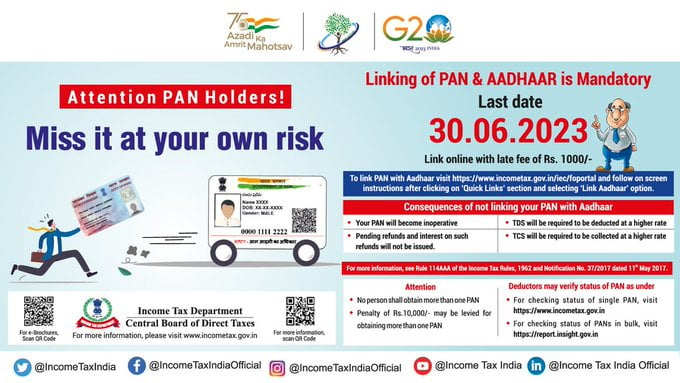

Taxpayers who have not yet linked their Aadhaar with their PAN are encouraged to do so by 30th, June 2023 to avoid having their PAN card deactivated. The IT department has also clarified the consequences of a PAN card going out of service.

Reetu | Jun 14, 2023 |

Link PAN with Aadhaar: Mandatory Linking of PAN with Aadhaar to all PAN holders before Due Date

The Income Tax Department has extended the deadline for linking Aadhaar to PAN cards last month. Taxpayers who have not yet linked their Aadhaar with their PAN are encouraged to do so by June 30 to avoid having their PAN card deactivated. The IT department has also clarified the consequences of a PAN card going out of service.

Income Tax Department again notified it via tweet on their twitter handle, “Kind attention PAN holders!. As per Income-tax Act, 1961, it is mandatory for all PAN holders, who do not fall under the exempt category, to link their PAN with Aadhaar on or before 30.06.2023. Please link your PAN & Aadhaar today!”

Now you can link your PAN with Aadhaar online with late fees of Rs.1000. To link PAN with Aadhaar visit Income Tax Official Portal and follow on screen instructions after clicking on ‘Quick Links’ Section and selecting ‘Link Aadhaar‘ option.

1. Your PAN will become inoperative.

2. Pending refunds and interest on such refunds will not be issued.

3. TDS will be required to be deducted at a higher rate.

4. TDS will be required to be collected at a higher rate.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"