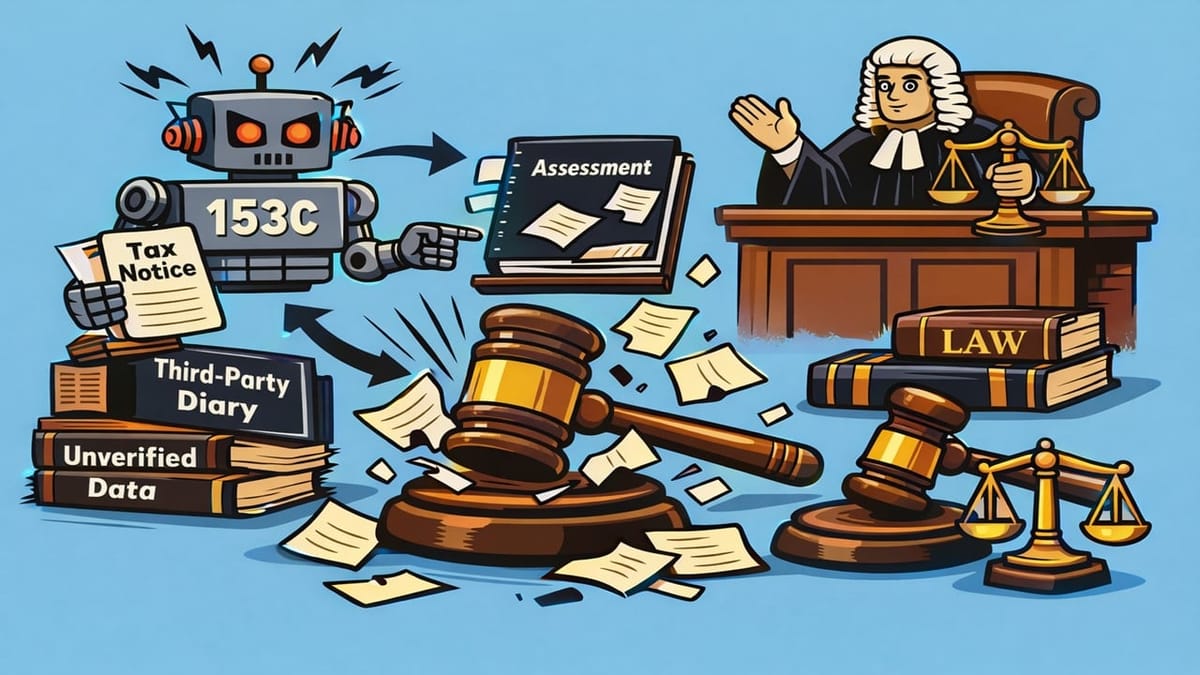

Bench Holds That Mere Diary Entries Seized From Third Party, Without Recording Income Impact, Cannot Sustain Section 153C Action

Meetu Kumari | Dec 21, 2025 |

Mechanical 153C Invocation Fails: ITAT Quashes Assessments Based on Third-Party Diary

A search and seizure operation was conducted on 23.07.2019 in the case of the Kuldeep Bishnoi Group and its associates. During the search, a diary belonging to Late Shri Sukumar Poria was seized, containing certain handwritten entries. Based on these diary notings, the Assessing Officer initiated proceedings under Section 153C against Ms Shabnam Bharatinder Singh for AYs 2018-19 and 2019-20, alleging unaccounted cash receipts.

The assessee had already filed regular returns declaring her income, and no defects were pointed out in her books of account. Additions were made, treating alleged cash receipts as unaccounted business income. The Commissioner (Appeals) upheld the assessments, leading the assessee to approach the Income Tax Appellate Tribunal.

Main Issue: Whether proceedings under Section 153C can be validly initiated when the satisfaction note merely states that seized documents “pertain” to the assessee, without recording how such material has a bearing on the determination of the assessee’s total income for the relevant assessment years.

ITAT’s Decision: The ITAT allowed the appeals of the assessee and quashed the assessments for both AYs 2018-19 and 2019-20. The Tribunal held that for valid initiation of proceedings under Section 153C, the Assessing Officer must record a clear satisfaction that the seized documents not only pertain to the assessee but also have a bearing on the determination of total income. Relying on Saksham Commodities Ltd., the Tribunal observed that Section 153C does not permit a mechanical or blanket assumption of jurisdiction merely because some third-party material mentions the assessee.

The satisfaction note failed to demonstrate how the diary entries seized from Late Shri Sukumar Poria impacted the assessee’s income. The Tribunal held that the very foundation of the 153C proceedings was invalid. Therefore, the assessments framed under Section 153C read with Section 143(3) were declared null and void. Since the legal ground succeeded, the Tribunal declined to adjudicate the additions on merits, leaving those issues open.

To Read Full Judgment, Download PDF Given Below

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"