Reetu | Sep 19, 2023 |

Mera Biil Mera Adhikaar Scheme: How to Participate in Scheme; Know Details

The Government of India, in association with State Governments, has launched an ‘Invoice incentive Scheme’ by the name ‘Mera Bill Mera Adhikaar’.

The ‘Mera Bill Mera Adhikaar’ invoice incentive plan was created by the Indian government to encourage consumers to seek bills for their purchases and to promote the use of real invoices in business-to-consumer interactions.

Customers who file GST invoices on the authorised mobile app will be eligible for cash rewards ranging from Rs.10,000 to Rs.1 crore.

The scheme was planned to begin on September 1st and its pilot has already started in the states of Haryana, Assam, Gujarat, and the UTs of Dadra & Nagar Haveli, Daman & Diu, and Puducherry. The scheme’s principal goal is to encourage consumers to demand correct invoices from merchants for their transactions. This aids in the reduction of tax evasion and the promotion of transaction transparency.

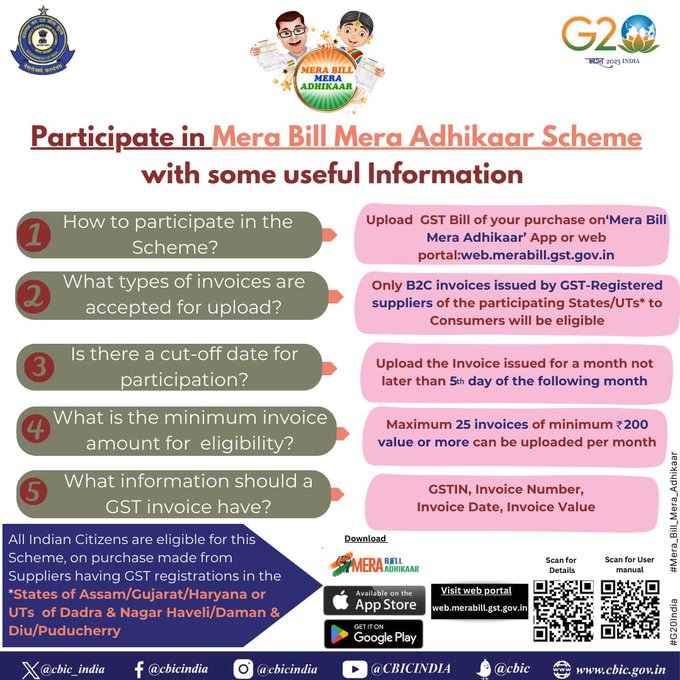

Participate in Mera Bill Mera Adhikaar Scheme

Upload GST Bill of your purchase on’Mera Bill Mera Adhikaar’ App or web portal.

Only B2C Invoices issued by GST-Registered suppliers of the participating States/UTs to Consumers will be eligible.

Upload the Invoice issued for a month not later than 5 day of the following month.

Maximum 25 invoices of minimum 200 value or more can be uploaded per month.

GSTIN, Invoice Number, Invoice Date, Invoice Value.

All Indian Citizens are eligible for this Scheme, on purchase made from Suppliers having GST registrations in the *States of Assam/ Gujarat/ Haryana or UTS of Dadra & Nagar Haveli/ Daman & Diu/ Puducherry.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"