Reetu | Dec 3, 2020 |

Multiplex operator found guilty of GST Profiteering says NAA

The Relevant Text of the Order as follows :

3. In respect of the current proceedings, the DGAP has reported that the complaint made by Applicant No. 1 was based on a copy of a movie ticket dated 04.01.2019 that he had enclosed with his Application and that the date of the said movie ticket fell within the period for which profiteering has been ascertained against the Respondent and his claim to the benefit was also established.

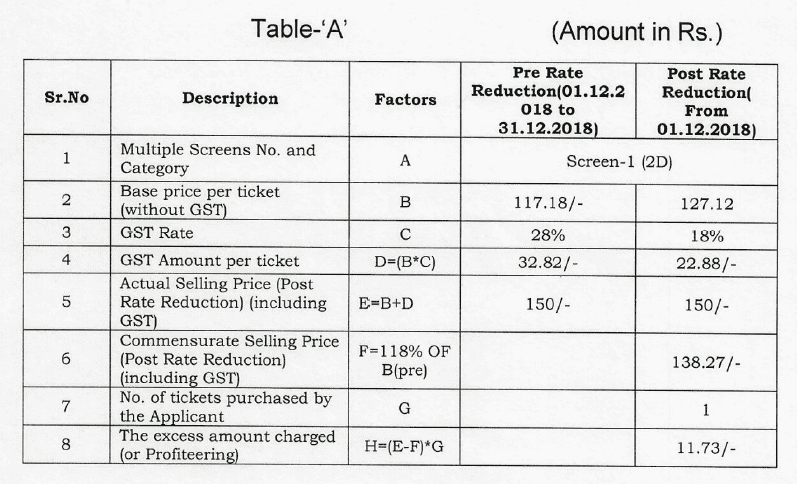

4. On the issue of quantification of the amount of benefit that the Respondent was required to pass on to the Applicant, the DGAP has reported as follows that there were two classes of screens within the multiplex, 2D and 3D screens; that the prices of tickets for Screens 1 to 5 (2D Movies) were different from the tickets for Screen 6 (3D Movies); that the ticket pricing varied, based on the screen where a movie was exhibited; that the case of Applicant No.1 pertained to a 2D movie KGF screened in Screen No. 1 of Respondent’s multiplex having Rs 150/- as the ticket price; that the computation of profiteering in respect of Applicant No. 1 was worked out as per Table-A below :-

5. The DGAP has thus concluded that the Respondent has realized an excess amount of Rs. 11.73/- from Applicant No.1 (inclusive of GST) and that this amount stood included in the profiteering of Rs. 3013058/- by the Respondent as computed in DGAP’s previous Report F.No. 22011/NAA/96/PMC/2019 dated 25.10.2019. The DGAP has also submitted that in these proceedings, any reference to the CGST Act, 2017 and CGST Rules, 2017 includes a reference to the corresponding provisions under the relevant SGST/UTGST/IGST Acts and Rules.

6. The instant investigation report was received by this Authority on 15.06.2020. It was decided to hear Applicant No.1 and thus a notice dated 23.06.2020 was issued to him to explain as to whether he agreed with the above said Report of the DGAP anf to file his submissions on the matter by 03.07.2020. However, since Applicant No.1 did not respond, this Authority, its vide Orders dated 14.07.2020 and 30.07.2020, again directed Applicant No.1 to file his submissions. Applicant No.1, vide e-mail dated 12.08.2020, filed his submissions and stated that he agreed with the DGAP’s report and requested that it be accepted. Given that above submissions of Applicant No.1, further hearings were closed by this Authority vide its Order dated 20.08.2020.

7. Further, vide its Order dated 25.09.2020, hearings in the instant case were re-opened to grant the Respondent an opportunity of being heard in the interest of natural justice. Thus the Respondent was asked to file his submissions against the report of the DGAP, if any, by 12.10.2020. In response thereto, the Respondent, vide his submissions dated 08.10.2020, submitted that the earlier report of the DGAP on the same matter had culminated in Order No. 37/2020 dated 07.07.2020 of this Authority, vide which the allegation of profiteering against him had stood confirmed. He also submitted that he had filed a writ petition (Diary No. 600763 of 2020) before the Hon’ble Court of Delhi challenging this Authority’s Order No. 37/2020 dated 07.07.2020 on various legal grounds, including the constitutional validity of the Anti-Profiteering provisions. The respondent further submitted that the DGAP report has itself found that the allegedly profiteered sum of Rs. 11.73/- already stood included in the earlier proceedings and that the instant case was only an issue of overlap of the period and the quantum of profiteering. The Respondent further submitted that since the Writ petition was sub-judice before the Hon’ble High Court of Delhi, the present proceedings might be disposed of as being duplication.

8. Thereafter, vide its Order dated 12.10.2020, this Authority forwarded the above-mentioned submissions of the Respondent to the DGAP seeking clarification thereon under Rule 133(2A) of the CGST Rules, 2017. The DGAP, vide his clarification furnished under Rule 133(2A) of the CGST Rules 2017, reported that aggrieved with the Authority’s order No. 37/2020 dated 07.07.2020, the Respondent had filed a Writ Petition (Civil) No. 7736/2020 before the Hon’ble High Court of Delhi at New Delhi. The Hon’ble High Court vide order dated 08.10.2020 directed the Respondent “to deposit the principal profiteered amount i.e. Rs. 2553454/- (Rs. 3013058/- minus Rs. 459604/-) in six equated installments commencing 02nd November, 2020. The interest amount directed to be paid by the Respondents as well as penalty proceedings are stayed till further orders.”

9. Further, the Respondent, vide his subsequent submission dated 29.10.2020, reiterated his previous submissions dated 08.10.2020 and submitted that he was depositing the profiteered amount as directed by the Hon’ble High Court in its interim order dated 08.10.2020. After considering the above submissions of the Respondent, hearings were closed in the instant matter.

10. On examining the various submissions of the Applicants, the Respondent, and the case records, we are clear that the reports of the DGAP dated 12.06.2019, is acceptable, not only because it has been agreed to by both, the applicant No.1 and the respondent, but also because the main issue of profiteering by the Respondent has already been addressed and settled by this Authority vide its Order No. 37/2020 dated 07.07.2020 on the same matter, whereby the Respondent was found to have profiteered in terms of Section 171 of the CGST Act 2017. It is pertinent that the above Order was passed in pursuance of an earlier complaint filed by Principal Commissioner, Central Tax & Central Excise Hyderabad, GST Commissionerate, GST Bhavan, LB Stadium Road, Basheerbagh, Hyderabad-500004 and the resultant investigation Report of the DGAP dated 25.10.2019 which covered the period from 01.01.2019 to 30.06.2019. Based on the same, vide its Order No. 37/2020 dated 07.07.2020, this Authority had upheld that the allegation of profiteering against the Respondent and determined that the Respondent had realized an additional benefit amounting to Rs. 3013058/- (inclusive of GST). The Respondent had therefore been directed to reduce the prices of his tickets as per the provisions of Rule 133(3) (a) of the CGST Rules, 2017, keeping in view the reduction in the rate of tax so that the benefit was passed on to the recipients. Further, the Respondent had been directed to deposit the profiteered amount of Rs. 3013058/- along with the interest to be calculated @18% from the date when the above amount was collected by him from the recipients till the above amount was deposited, Since the recipients, in this case, were not identifiable, the Respondent had been directed to deposit the amount of profiteering of Rs. 1506529/- (along with interest thereon at the applicable rate) in the Central Consumer Welfare Fund (CWF) and Rs. 1506529/- (along with interest thereon at the applicable rate) in the Telangana State CWF as per the provisions of Rule 133 (3) (c) of the CGST Rules, 2017.

11. In the present case, we find that investigation by the DGAP had revealed that the Application filed by Applicant No.1 against the Respondent also covers the same issue and the same period as the previous case and that the Respondent had realized an additional amount of Rs. 11.73/- from Applicant No.1 (inclusive of GST). It is also clear to us that this amount of Rs. 11.73/- stands already included in the total profiteering amount of Rs. 3013058/- determined against the Respondent vide its Order No. 37/2020 dated 07.07.2020 which had beeen ordered to be deposited in the CWFs because, at that time, no recipient could be identified for receiving the benefit. However, now that the entitlement of Applicant No.1 is entitled to be passed on an amount Rs. 11.73/- along with interest as applicable thereon.

12. Further, we take note of the decision of the Hon’ble High Court of Delhi in the matter arising out of the Writ Petition (Civil) No. 7736/2020, filed by the Respondent against Order No. 37/2020 dated 07.07.2020 of this Authority, and observe that the Hon’ble High Court, vide its interim order dated 08.10.2020, has directed the Respondent as follows – “to deposit the principal profiteered amount i.e Rs. 2553454/- (Rs. 3013058/- minus Rs. 459604/-) in six equated installments commencing 02nd November, 2020. The interest amount directed to be paid by the Respondents as well as penalty proceedings are stayed till further orders”. Accordingly, the Respondent has deposited an amount of Rs. 212788/- in the Central Consumer Welfare Fund and a similar amount of Rs. 212788/- in the Telangana State Consumer Welfare Fund. Further, as has been explained by us in above paras, the Applicant No.1 is entitled to be passed on an amount of Rs. 11.73 along with interest as applicable thereon since the amount has to be passed on equally from the Central CWF and the Telangana State CWF, the amount to be paid from each of the above two CWFs works out to be Rs. 5865/-, which, on rounding off, has to be read as Rs. 6/- (Rupees Six Only). Therefore, we order that an amount of Rupees Six only shall be paid to the Applicant No.1 from the Central Consumer Welfare Fund and Rupees Six only from the Telangana State Consumer Welfare Fund alongwith the interest as applicable thereon.

13. While deciding this matter as above, we take note of the fact that in terms of Para 30 of the Procedure and Methodology notified by this Authority in terms of Rule 126 of the CGST Rules 2017, any clerical, arithmetical, or factual mistake apparent from the record needs to be corrected within a period of 3 months from the passing of the order. In this case, this Authority has passed Order No 37/2020 on 07.07.2020 and hence three months period stipulated for any such correction has lapsed. However, due to the prevalent pandemic of COVID-19 in this Country, this order could not be passed within the stipulated period of three months from the date of Order No. 37/2020 dated 07.07.2020 of this Authority on the same matter due to force majeure in line with Para 30 of the ‘Procedure and Methodology’ notified by this Authority. Accordingly, this Order is being passed today i.e. 27.11.2020 in terms of Notification No. 65/2020-Central Tax dated 01.09.2020 issued by the Government of India, Ministry of Finance (Department of Revenue), Central Board of Indirect Taxes & Customs under Section 168A of the CGST Act, 2017.

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"