Anisha Kumari | Jul 30, 2024 |

New HDFC Bank Credit Card Rules Effective from August 1, 2024

HDFC Bank is introducing new rules and charges for credit card customers starting August 1, 2024. These changes will affect various types of transactions. They include rental payments, fuel purchases, international transactions and the use of Easy-EMI options. Here are the details you need to know.

If you use an HDFC Bank credit card to pay rent through services like CRED PayTM, Cheq MobiKwik, Freecharge and similar platforms, a 1% fee will be charged on the transaction amount. This fee is capped at Rs.3000 per transaction.

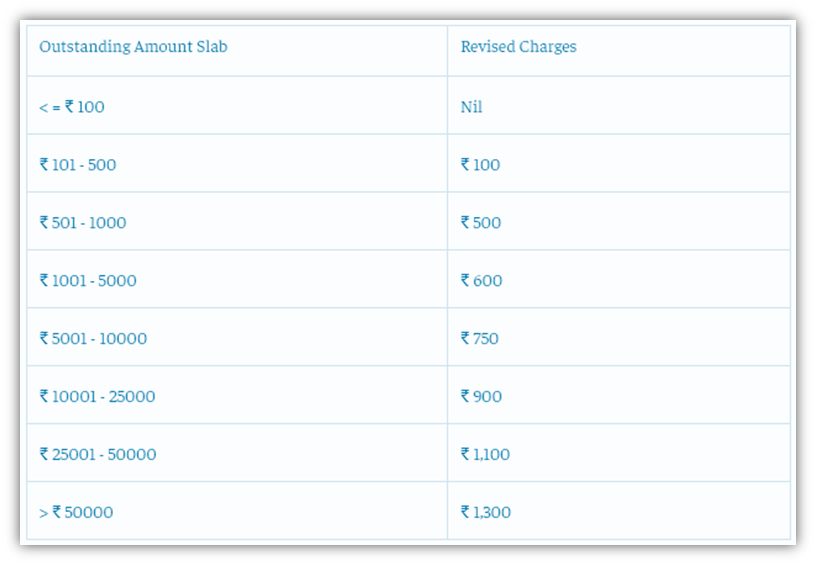

The late payment fee structure has been revised as follows:

For international or cross-currency transactions, a 3.5% markup fee will be applied. However, for premium cards such as Infinia, Infinia (Metal Edition), Diners Black, Diners Black (Metal Edition), Biz Black Metal Card, Regalia Gold, BizPower and Tata Neu Infinity HDFC Bank, the markup fee remains at 2%. For the 6E Rewards Indigo XL card, the fee is slightly higher at 2.5%.

If you choose to pay less than the total amount due on your monthly billing statement, the finance charges of 3.75% per month will apply. This is from the date of the transaction until the outstanding balance is fully paid. This applies to all monetary and retail transactions. For premium cards such as Infinia, Infinia (Metal Edition), Diners Black, Diners Black (Metal Edition) and BizBlack Metal finance charge will be lower at 1.99% per month.

When using the Easy-EMI option at any online or offline store, an EMI processing fee of up to Rs.299 will be charged. This fee will be included in the total EMI amount. It is subject to GST as per government regulations.

There will be no rewards redemption charge for select premium cards. This includes Infinia, Infinia (Metal Edition), Diners Black, Diners Black (Metal Edition) and BizBlack Metal. It also includes co-branded cards like Swiggy HDFC Bank and Flipkart Wholesale.

All fees mentioned are subject to GST as per government regulations. Merchant Category Codes (MCCs) determine how transactions are classified and charged. These are set by payment networks (Visa MasterCard, Rupay Diners), not by HDFC Bank.

These changes in HDFC Bank’s credit card terms aim at managing costs. They also ensure fair usage of credit card benefits. Make sure to review these changes carefully. Plan your credit card usage accordingly to avoid any unexpected fees. By understanding these new rules, you can better manage your finances. Make informed decisions about credit card usage.

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"