Deepak Gupta | Apr 19, 2019 |

New Order of ITC Utilization as per new Rule 88A of CGST Rules

Rule 88A of CGST rules was notified by CBIC vide notification number 16/2019, dated 29-3-2019. This has brought some relief to business Houses who anticipated blockage of working capital requirements due to amendment made to section 49 vide CGST Amendment Act 2018 made to effective from 1st Feb, 2019.

Lets Analyse the changes brought in by CBIC by introducing Rule 88A.

Legal Text

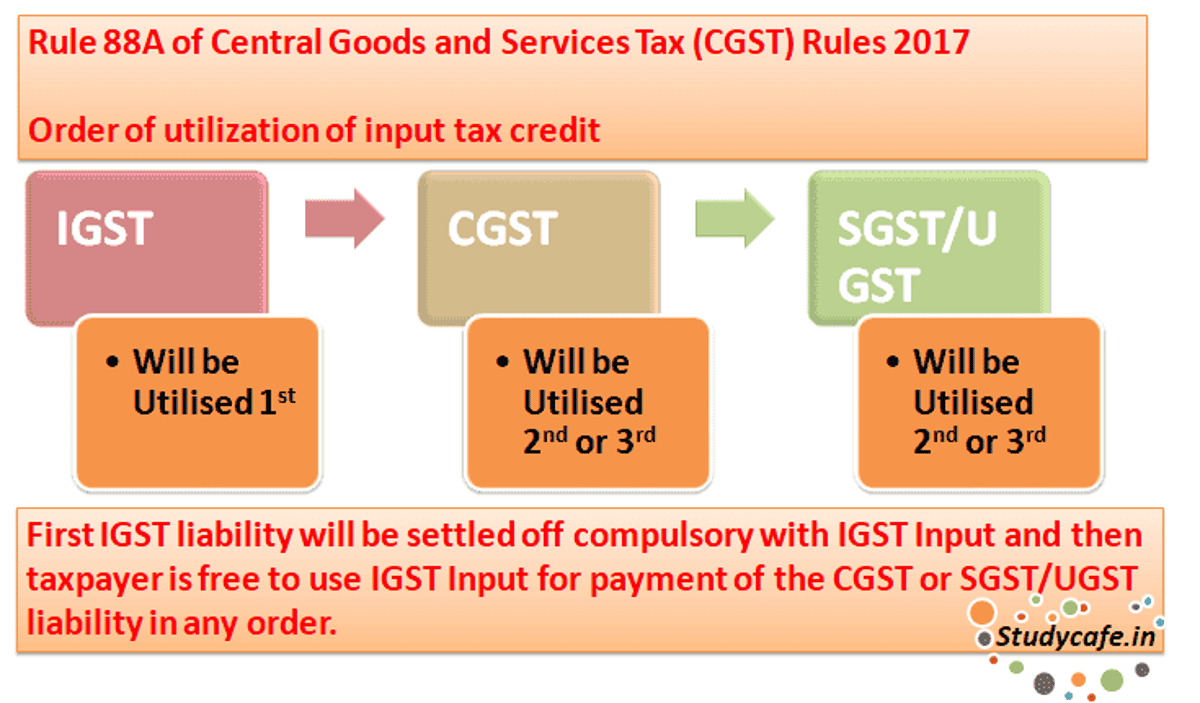

Rule 88A of Central Goods and Services Tax (CGST) Rules 2017

Order of utilization of input tax credit- Input tax credit on account of integrated tax shall first be utilised towards payment of integrated tax, and the amount remaining, if any, may be utilised towards the payment of central tax and State tax or Union territory tax, as the case may be, in any order:

Provided that the input tax credit on account of central tax, State tax or Union territory tax shall be utilised towards payment of integrated tax, central tax, State tax or Union territory tax, as the case may be, only after the input tax credit available on account of integrated tax has first been utilised fully.

What is the the Relaxation : As per CGST Amendment Act the order of utilization after the set-off of IGST liability was CGST and then SGST/UGST. Now the order has been relaxed wherein either CGST or SGST/UGST liability can be set off.

So the New Set-Off Order is as follows :

| Particulars | IGST Liability | CGST Liability | SGST Liability | Remarks |

| IGST Credit | 1st | 2nd or 3rd | 2nd or 3rd | First IGST liability will be settled off compulsory with IGST Input and then taxpayer is free to use IGST Input for payment of the CGST or SGST/UGST liability in any order. |

| CGST Credit | 2nd | 1st | NA | |

| SGST Credit | 2nd | NA | 1st |

Disclaimer: The entire contents of this document have been prepared on the basis of relevant provisions and as per the information existing at the time of the preparation. Although care has been taken to ensure the accuracy, completeness and reliability of the information provided, I assume no responsibility therefore. Users of this information are expected to refer to the relevant existing provisions of applicable Laws. The user of the information agrees that the information is not a professional advice and is subject to change without notice. I assume no responsibility for the consequences of use of such information. In no event shall I shall be liable for any direct, indirect, special or incidental damage resulting from, arising out of or in connection with the use of the information.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"