The ITAT directed the AO to adjust the TCS amount against the liability of the assessee.

Nidhi | Dec 21, 2025 |

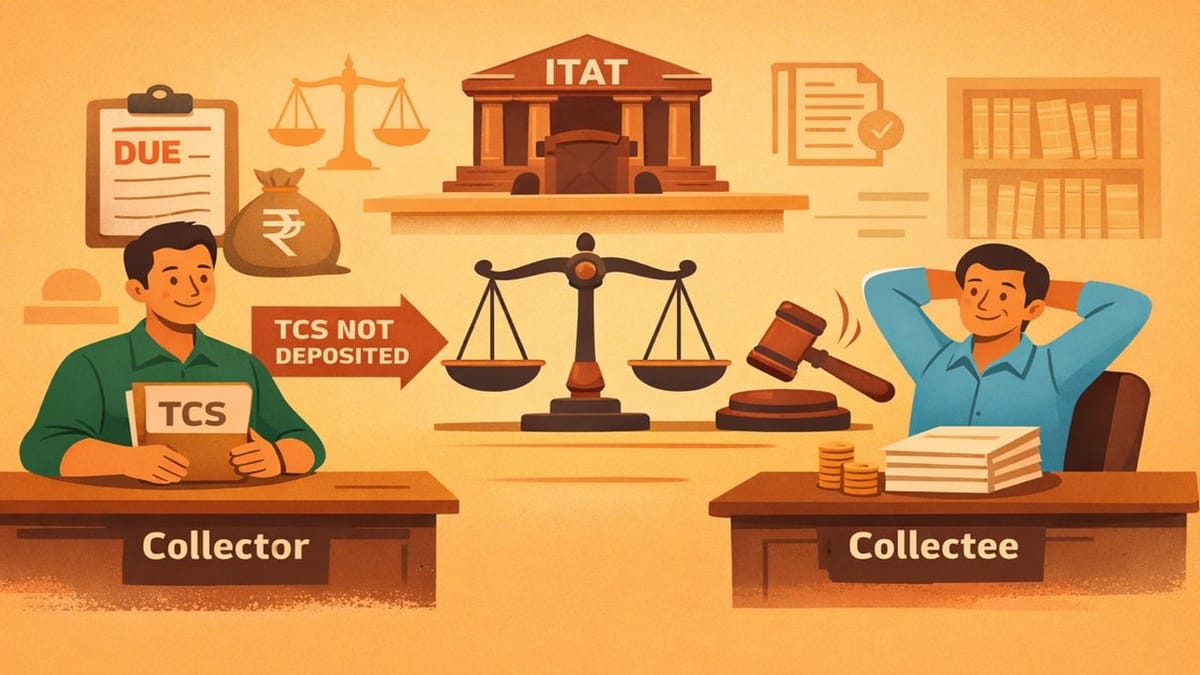

No Action Against Collectee if TCS Not Deposited by Collector: ITAT

The assessee, Amit Ashok Chandwani, being a wholesale dealer of Indian Made Foreign Liquor (IMFL), declared an income of Rs 2,23,60,175 in his Income Tax Return (ITR). During the assessment proceedings, the assessing officer disallowed Rs 3,60,000 out of the sales promotion expenses of Rs 35,97,042, debited by the assessee under various heads. The AO claimed that these expenses were backed by self-made vouchers, which cannot be relied on. The AO also rejected the TCS (Tax Collected at Source) credit of Rs 74,14,161, collected from the assessee by the supplier of IMFL. In the final assessment, the Revenue raised a demand of Rs 93,35,000 instead of the refund of Rs 9,73,610 claimed by the assessee.

The assessee appealed before the CIT(A), but did not succeed. Therefore, the assessee approached the Income Tax Appellate Tribunal (ITAT), Pune, challenging the tax addition and the TCS denial.

The assessee submitted that the TCS amount was collected from the assessee by Cromex Liquor Pvt. Ltd., but the same was not deposited with the Government by the supplier. Due to this, the TCS did not reflect in Form 26AS of the assessee, which resulted in the denial of the TCS claim.

The ITAT reviewed section 205 of the Income Tax Act and Instruction No.275/29/2014-IT-(B) dated 01.06.2015 & office Memorandum dated 11-03-2016 cited by the assessee, where it was clearly mentioned that the AO cannot take action against the assessee to pay the demand just because the deductor/collector failed to deposit it. Based on the same, the ITAT directed the AO to adjust the TCS amount against the liability of the assessee. However, the tribunal said that the refund cannot be issued to the assessee as the TCS amount was not deposited by the collector in the Government Treasury.

The ITAT upheld the addition made by the AO out of sales promotion expenses after finding no errors in it.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"