As per Budget 2025 Memo, it has been clarified that No Rebate on Special Rate Income will be given.

CA Pratibha Goyal | Feb 1, 2025 |

No Rebate on Special Rate Income: Clarification made in Budget Memo

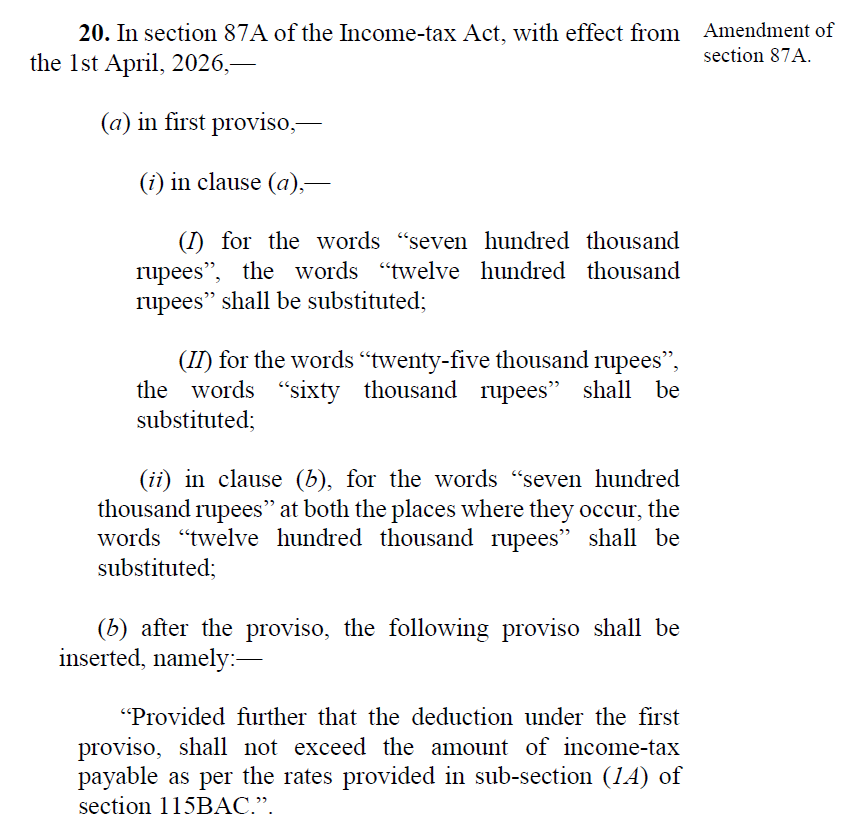

The good news for taxpayers is that From assessment year 2026-27 onwards, for an assessee, being an individual resident in India whose income is chargeable to tax under the New Tax Regime, the limit of rebate under section 87A has been enhanced from Rs. 25,000 to Rs. 60,000.

The benefit of rebate is available if income does not exceed Rs. 12,00,000 (Applicable From assessment year 2026-27 onwards). The Income Limit is Rs. 700,000 for AY 2025-26.

However, the budget Memo has specially clarified that such rebate of income-tax is not available on tax on incomes chargeable at special rates (for e.g.: capital gains u/s 111A, 112 etc.).

The provisions of sub-section (1A) of section 115BAC are subject to the other provisions of Chapter XII i.e. determination of tax in certain special cases. Hence, proviso to section 87A clearly provides that tax on incomes chargeable at special rates (for e.g.: capital gains u/s 111A, 112 etc.) as specified under various provisions of Chapter XII, are not included while determining the rebate of income-tax under the first proviso to section 87A.

Finance Bill 2025

This also clarifies stand of Income Tax Department, that no rebate benefit will be provided by them for matters of AY 2024-25, where ITRs were specially revised by Taxpayers to claim Rebate benefit as per directive of Bombay High Court.

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"