The Minister of State of Finance has stated that No recommendation from GST Council for GST Removal on Agricultural Implements, Machinery and Fertilizers.

Reetu | Aug 6, 2024 |

No recommendation from GST Council for GST Removal on Agricultural Implements, Machinery and Fertilizers

The Minister of State in the Ministry of Finance Shri. Pankaj Chaudhary has stated in response to a question raised in Lok Sabha that No recommendation from GST Council for GST Removal on Agricultural Implements, Machinery and Fertilizers.

The Minister SHRI VIRENDRA SINGH and SHRI DILESHWAR KAMAIT asked the question in Lok Sabha:

Will the Minister of FINANCE be pleased to state:

(a) whether the Government proposes to remove Goods and Services Tax (GST) from agricultural implements, machinery, fertilizers, seeds and chemical pesticides so as to reduce the production cost borne by the farmers;

(b) if so, the details thereof along with the time by which it will be proposed;

(c) the manner in which the Government is likely to make the produce of the farmers profitable;

(d) the details of agricultural equipment included under the purview of GST at present; and

(e) the details of the percentage of GST applicable on the said items, equipment-wise?

The Minister of State in the Ministry of Finance Shri. Pankaj Chaudhary replied:

(a) and (b): The GST rates and exemptions are notified on the basis of recommendations of the GST Council, which is a constitutional body comprising members from both the Union and State Governments.

There is no recommendation from the GST Council for a change in the GST rate in this regard.

(c): The government has taken several policy measures, reforms, developmental programmes and schemes for making agriculture a more profitable profession. The details are given in Annexure.

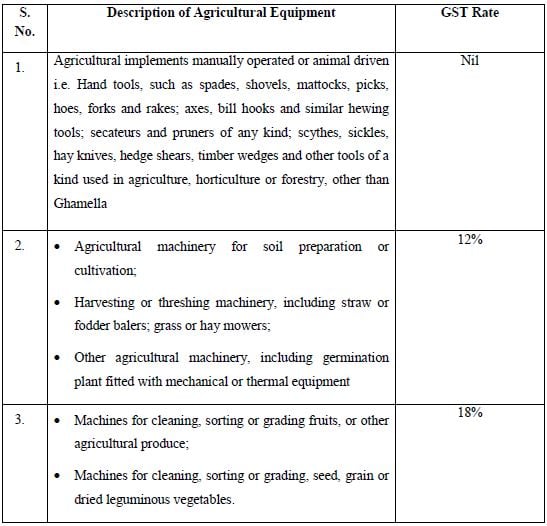

(d) & (e): The details of agricultural equipment under the purview of GST and the rate of GST applicable on such items are as under: –

Government has taken several policy measures, reforms, developmental programmes and schemes to make agriculture a more profitable profession. These include:

(i) PM-KISAN provides supplemental income transfers of Rs 6000 per year in three equal installments,

(ii) Increase in Minimum Support Price (MSP) for all Kharif and Rabi crops, assuring a profit margin of at least 50% on production costs,

(iii) Crop insurance under Pradhan Mantri Fasal BimaYojna (PMFBY),

(iv) Better access to irrigation under Pradhan Mantri Krishi Sinchai Yojana (PMKSY),

(v) Special focus on infrastructure development through the Agri Infrastructure Fund (AIF) with a size of Rs. 100,000 crore.

(vi) New procurement policy under PM-AASHA in addition to FCI operations,

(vii) Kisan Credit Cards (KCC) offering production loans to even dairy & fishery farmers besides agricultural crops,

(viii) Formation and promotion of 10,000 FPOs,

(ix) National Mission for Sustainable Agriculture (NMSA), which aims to evolve and implement strategies to make Indian agriculture more resilient to the changing climate.

(x) Adoption of drone technologies in agriculture which has the potential to revolutionize the Indian agriculture.

(xi) Benefits from Bee-Keeping, Rashtriya Gokul Mission, Blue Revolution, Interest Subvention Scheme, Agro-forestry, Restructured Bamboo Mission, Implementation of New Generation Watershed Guidelines, and so on.

(xii) Focus on the application of digital technology at all stages of the agricultural value chain, and

(xiii) Supply of fertilizer to farmers at subsidized price so as to reduce input cost.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"