Despite the fact that IT Dept recently released the updated utility for filing ITR-2 and ITR-3, the portal is denying the Section 87A rebate claim.

Reetu | Jan 6, 2025 |

No Tax Rebate on Section 87A despite ITR Filing forms updated on the portal recently

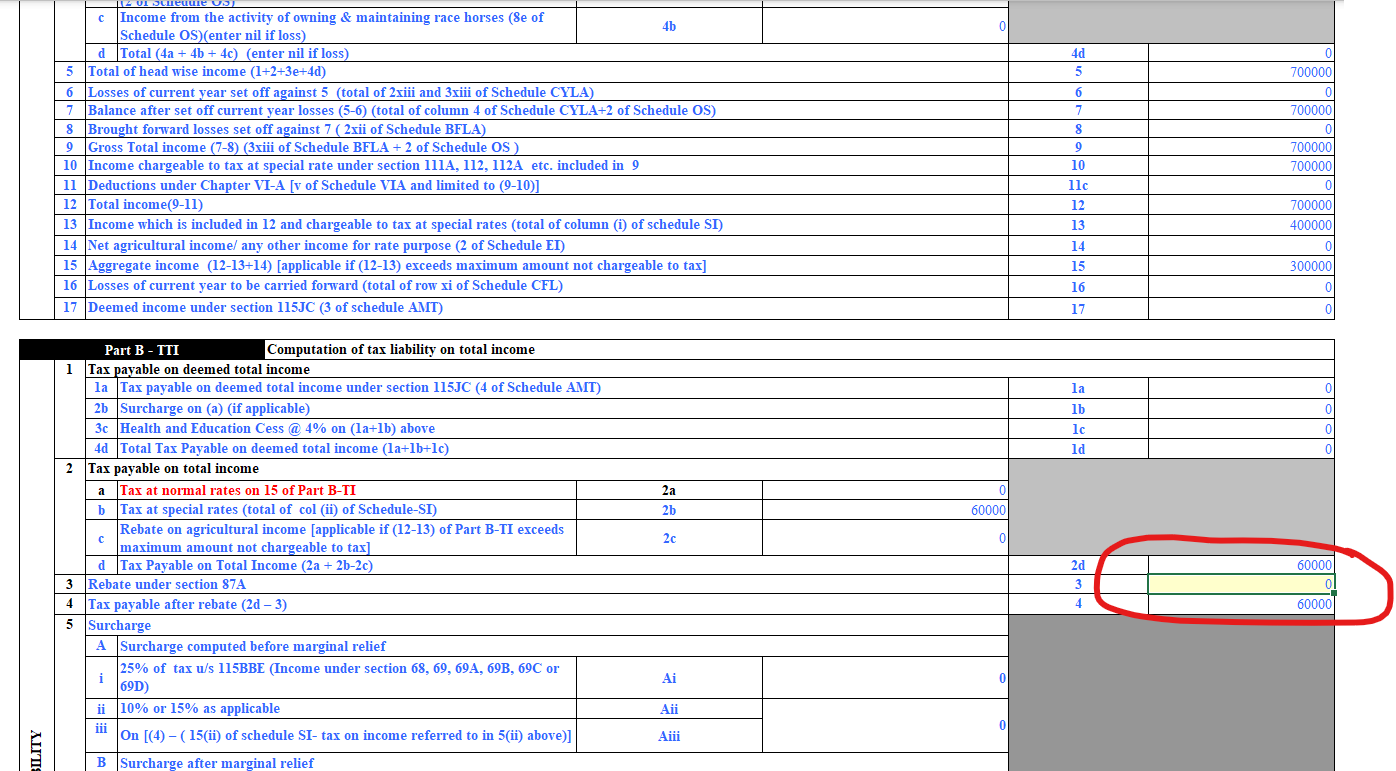

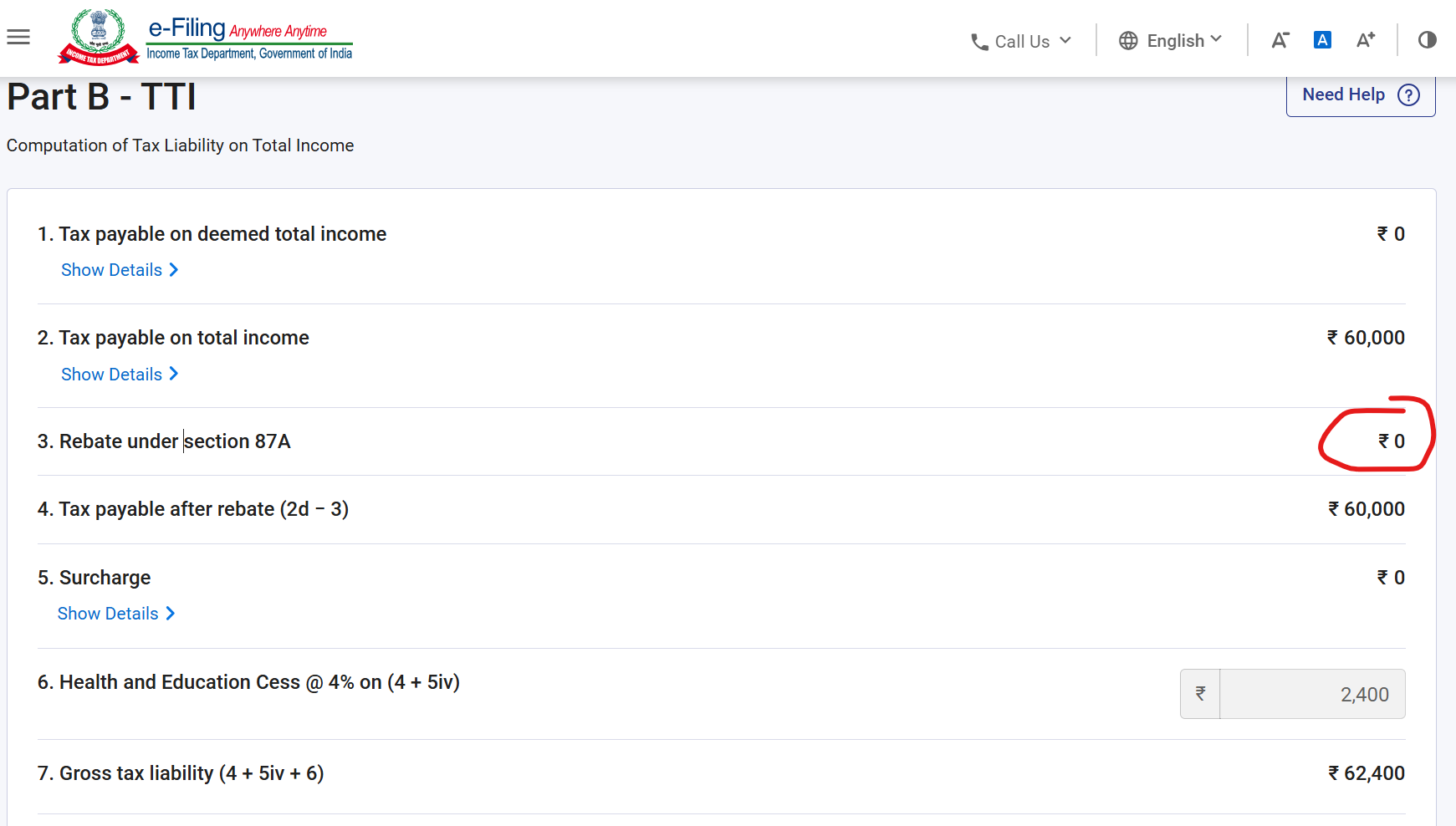

The Income Tax Department has recently released the updated utility for filing income tax return forms ITR-2 and ITR-3. The ITR forms have been revised to allow taxpayers to claim the Section 87A tax rebate on short-term capital gains on equity, which was refused in the July ITR filing.

Claiming Rebate: Users can manually modify the relevant field to avail of the Section 87A rebate on such income. This field was un-editable in earlier version of excel utility.

However, the Income Tax Return (ITR) Filing portal is still not showing the option to edit the rebate if you file the ITR via online mode.

Income Tax Rebate

Section 87A allows individual taxpayers to claim up to Rs. 25,000 in tax rebates under the new tax regime upto the total Income of Rs. 700,000. Under the old tax regime, eligible taxpayers could seek a tax rebate of up to Rs.12,500 under Section 87A, up to the total income of Rs. 500,000.

ITR Filing Due Date

The deadline for filing revised and belated returns for FY 2023-24 (AY 2024-25) has been extended to January 15, 2025, from December 31, 2024.

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"