The IT department has sent a notice for submitting details related to the transaction of Rs 12.23 crore.

CA Pratibha Goyal | Apr 10, 2023 |

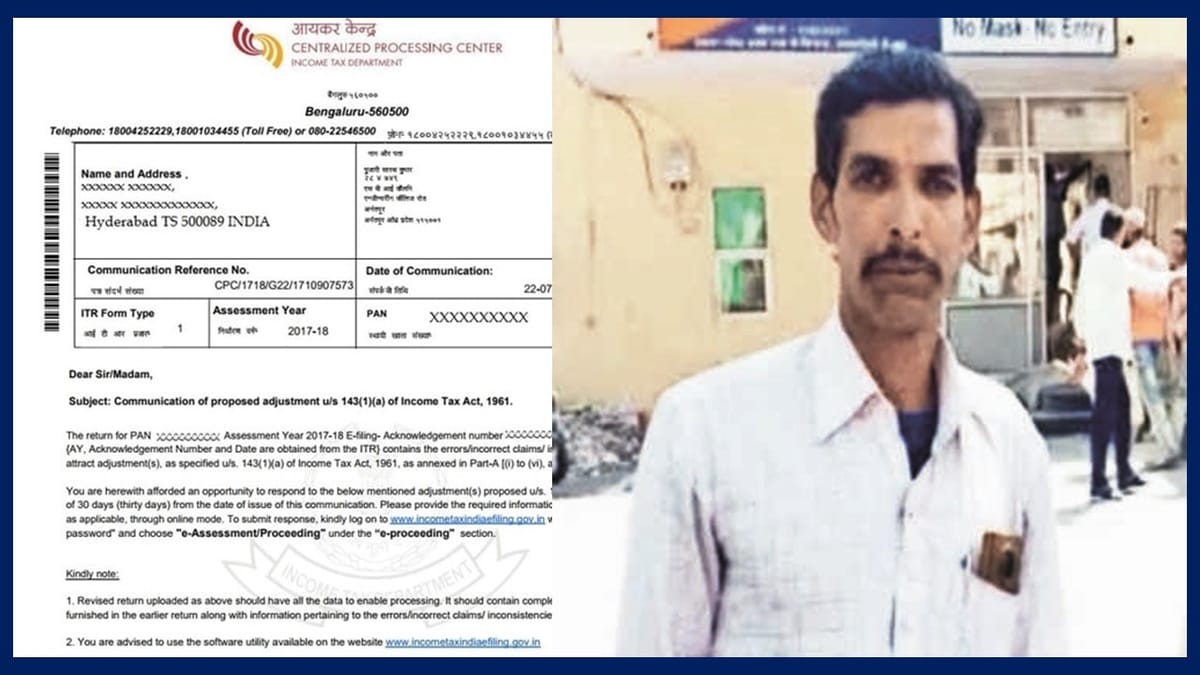

Physically Challenged Small shop owner receives Income Tax Notice of Rs 12 crore

In another case of PAN misuse, a physically challenged stationery shop owner, Kishan Gopal Chaparwal on Wednesday said he has received a (SCN) show-cause notice from the Income Tax department for a transaction of Rs 12.23 crore which he did not do.

Kishan Gopal Chaparwal who is 38, a resident of Sanjay Nagar, Bhilwara. He said he has lodged a complaint with Subhash Nagar police station, stating that someone is misusing his PAN details. The notice, received by post on March 28, has shocked him and his family, he said.

He said when he consulted a Chartered Accountant (CA), he told him that his PAN was misused in Mumbai and Surat to float two diamond shell companies to do bogus transactions running into several crores. “I set up the shop after taking a loan. I am unable to pay the installments. I earn Rs 8,000 to 10,000 per month. I have nothing to do with these bogus companies. Some fraudsters have cheated me,” he told reporters.

“The I-T department has sent a notice to me for submitting details related to a transaction of Rs 12.23 crore. I do not know who is using my card numbers. I appeal to the authorities to provide relief in the matter,” he added. Subash Nagar police said they are verifying the facts.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"