When buying property, from Non-Resident, often you are confused about the compliances to be done. Wheater you need to deduct TDS or Not? In which Section do you need to deduct TDS? How to pay Tax to the government? All the things have been discussed in this article.

CA Pratibha Goyal | Mar 29, 2024 |

Purchasing Property from NRI: Do I need to deduct TDS? Here is what compliance you need to do

When buying property, from Non-Resident, often you are confused about the compliances to be done. Whether, you need to deduct TDS or Not? In which Section do you need to deduct TDS? How to pay Tax to the government? All the things have been discussed in this article.

Please note that Section 194IA of Income Tax which provides for, TDS @ 1% on the sale of the property is for resident sellers. Now what if your seller is a Non-Resident? The appropriate section in this case will be Section 195 and not Section 194IA. Now how to calculate TDS in this case? The TDS calculation mechanism here is much complicated.

Mechanism for calculation of TDS

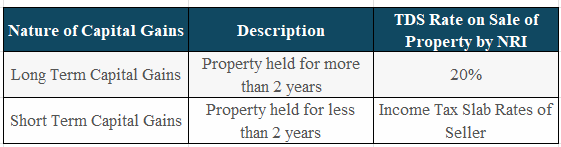

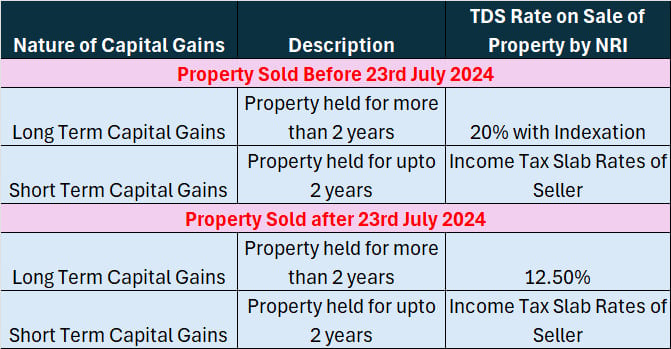

First we need to find out if it is a Long Term capital gain (LTCG) or short-term capital gain (STCG) for the Non-resident seller. If the property is held for more than 2 years, it will be a LTCG, else it will be STCG. The LTCG are taxed at rate of 20% and STCG are taxed at slab rates for Non-Resident.

Tax Calculations Upto FY 2023-24

Tax Calculations From FY 2024-25

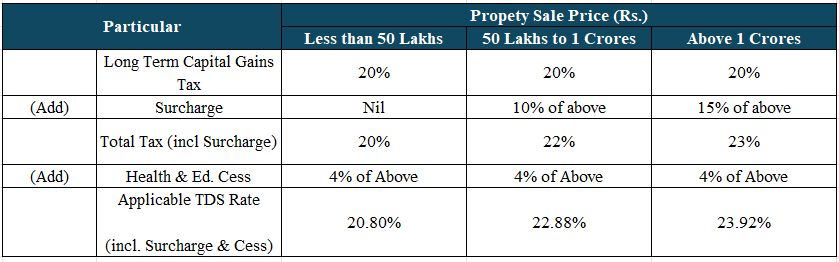

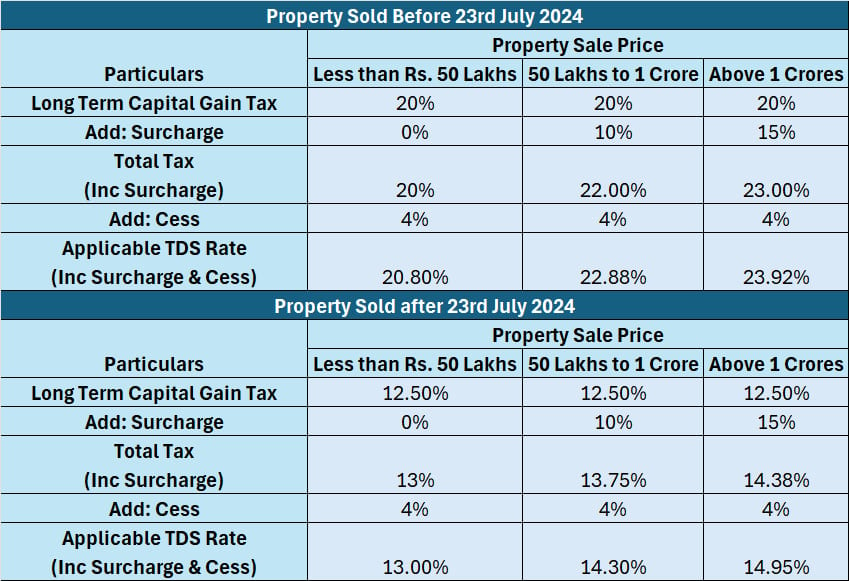

Surcharge and cess is also applicable in case of Non-Resident. Accordingly the TDS Rate for LTCG will be as follows:

Tax Calculations Upto FY 2023-24

Tax Calculations From FY 2024-25

In case of STCG, TDS will be calculated on Slab Rates. Unlike Section 194IA, in this case TDS will be deducted even if the value of property is less than Rs. 50 Lakhs.

Please note that the TDS is deducted on Sale Price and not Capital gain.

Can NRI Obtain a Lower Tax Deduction Certificate?

Yes the same can be obtained by the NRI seller and it is beneficial to do so. Let me explain why it is beneficial. According to Section 195, TDS must be withheld from the sale of the property made to an NRI, and preferably, it should also be withheld from any capital gains. But the seller would not do this capital gains computation on his own; instead, an income tax officer would have to handle it.

The seller would provide the income tax department with the application on Form 13 and request that they compute his capital gains. The seller would choose to use a chartered accountant to provide the application to the income tax department because it is a more difficult form to fill out.

The income tax department would compute the seller’s capital gains and issue a certificate for a zero or reduced TDS deduction based on the capital gains from the sale of the property.

The buyer would deduct the TDS according to the rates specified in the income tax certificate, and the seller would have to provide the buyer with the same certificate.

Again in this case also TDS will be deducted from Sale Price only, but at lower rate.

Payment of TDS and Filing TDS Return

Again in this case Buyer is required to apply for Tax Deduction and Collection Account Number (TAN) for deducting TDS. Once the TDS is deposited u/s 195, we need to file TDS Return in the Form 27Q. Once the Return is processed, a TDS Certificate is generated and the same is to be provided to the seller.

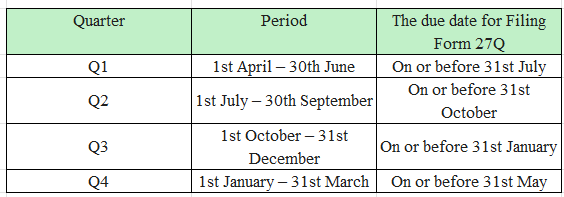

TDS has to be deducted at the time of payment or registry, whichever is earlier. Interest of one percent is applicable if TDS is not deducted and Interest of 1.5% is applicable if the same is deducted but is not deposited. The Due date of depositing the TDS is the 7th of next month in which the transaction has taken place. The Due Date of filing TDS Return is as follows:

Points to note:

Indian citizens living abroad can also be Non-Resident. We need to check the status as per Income Tax Act and not the citizenship of the person.

Person having valid PAN and Aadhaar can also be Non-resident.

The seller’s residential status is unaffected by the type of bank account that they hold. The individual will continue to be recognized as a non-resident if he does not transfer his resident savings account to an NRI bank account.

Non-Resident sellers should have a Tax Residency Certificate in case they want to take Double Tax Avoidance Agreement (DTAA) Benefit.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"