The RBI Governor said that the decision of the Monetary Policy Committee (MPC) keeps repo rate unchanged at 6.5%.

PRATEEK MAURYA | Apr 8, 2024 |

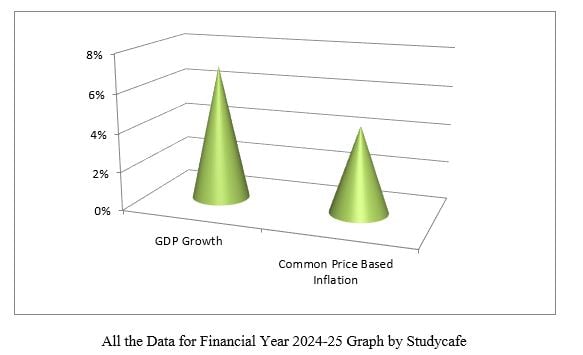

RBI Monetary Policy Update: Repo Rate Fixed at 6.5%; GDP Growth Outlook at 7%, No Immediate EMIs Reduction Expected, Why?

The Reserve Bank of India (RBI) Governor Shaktikanta Das said that the decision of the decision of Monetary Policy Committee (MPC) keeps the repo rate unchanged at 6.5%, on April 5. Governor Shaktikanta Das said that the GDP growth of the country excepted in this Financial Year 2024-25 is 7%. But It’s Lower than the Financial Year 2023-24 which is 7.6% and Common Price Based Inflation (CPI) is projected at 4.5%, But In February Common Price Based Inflation (CPI) was seen at 5.1%. The risks are uniformly balanced.

In this new financial year, where the RBI and MPC held their first meeting to discuss world economic uncertainty and growth, the US Federal Reserve initiated the rate cut cycle.

Were Economists and Data Analysts share the vision with the RBI and MPC to keep the unchanged Repo rate. According to the facts shared by RBI Monetary Policy, the economic GDP growth of India can be the third quarter of what was expected with a good number of 8.4%, and CPI inflation comes near about 2-6% in the RBI’s comfort zone.

The Reserve Bank of India (RBI) and Monetary Policy Committee (MPC) held meetings every two months to maintain the Repo rate to control the balance of GDP growth and inflation. The Repo rate is the rate at which commercial banks sell securities to the Reserve Bank of India (RBI) to maintain liquidity during funding shortages or statutory measures. It is most of the RBI’s main tools for keeping inflation under control. It works as the Repo rate increases borrowing costs, reducing the money supply and controlling inflation, while the reverse Repo rate encourages banks to park more cash with the RBI, decreasing the money supply.

In 2022 RBI started to increase the rate cycle that the Repo rate by 250 vital points to 6.5%. Economists said that the stop button hit on the repo rate has been on for several quarters now.

Economists and analysts believe rate-cut cycles are expected to start in the second half of the year. Where all expectations come from our overall global economic conditions and a good economic growth number, which is given by the RBI to our country.

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"