ITAT Delhi dismisses Revenue appeal and partly allows assessee’s cross objection, quashing reassessment on jurisdictional and sanction defects

Meetu Kumari | Dec 20, 2025 |

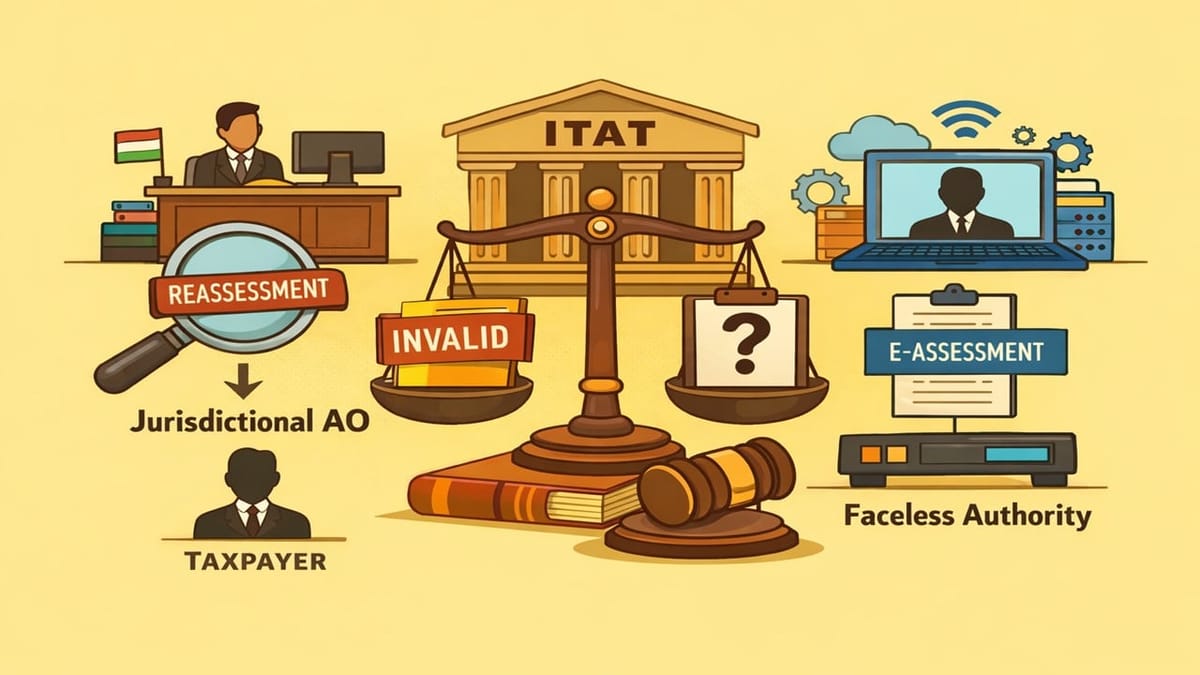

Reassessment Invalid as Notices Issued by Jurisdictional AO Instead of Faceless Authority: ITAT

The assessee, a partnership firm, filed its return for AY 2016-17 declaring income of Rs. 2,55,790. Based on a survey conducted under Section 133A in the case of a third party, wherein alleged accommodation entries of bogus purchases and sales were admitted, the Assessing Officer reopened the assessee’s case. An order under Section 148A(d) and notice under Section 148 were issued on 19.07.2022, followed by a reassessment order under Section 147 read with Section 144B dated 26.05.2023. The AO made additions of Rs. 1,44,15,042 on account of alleged bogus purchases and Rs. 44,66,376 treating alleged bogus sales as unexplained credits.

The NFAC quashed the reassessment holding that notices under Sections 148A and 148 were issued by the jurisdictional AO instead of the faceless AO, contrary to the statutory faceless scheme. The Revenue appealed before the ITAT, and the assessee filed a cross-objection challenging the validity of the sanction under Section 151.

Main Issue: Whether reassessment proceedings were invalid when notices under Sections 148A and 148 were issued by the jurisdictional Assessing Officer instead of the faceless authority under the notified schemes.

ITAT’s Decision: The ITAT upheld the order of the NFAC and dismissed the Revenue’s appeal, holding that initiation of reassessment by the jurisdictional AO was contrary to the faceless reassessment scheme framed under Sections 151A and 144B, rendering the proceedings void.

The Tribunal further allowed the assessee’s cross objection on the legal issue that, since the notice under Section 148 was issued beyond three years from the end of AY 2016-17, sanction ought to have been obtained from the Principal Chief Commissioner under Section 151(ii). Approval taken from the Principal Commissioner was held to be invalid. Thus, the reassessment proceedings were quashed. Other grounds on merits were rendered academic and kept open.

To Read Full Judgment, Download PDF Given Below

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"