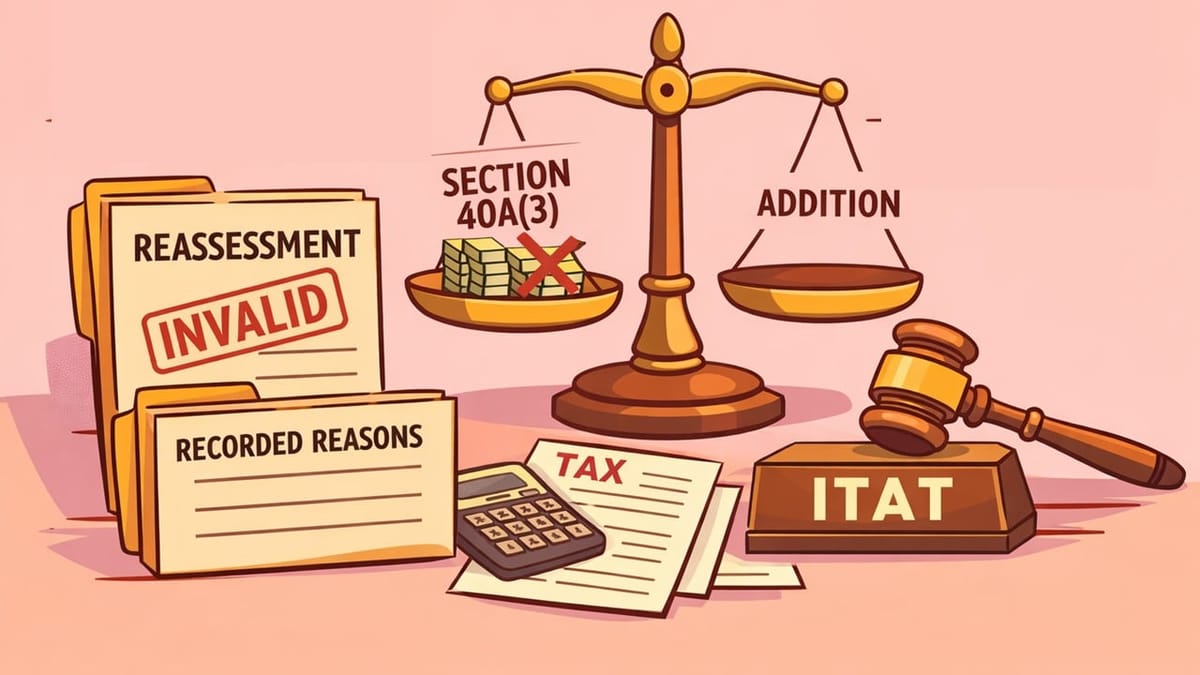

ITAT Quashes Reassessment as AO Made New Addition Without Assessing Escaped Income Cited in Reasons for Reopening

Meetu Kumari | Dec 20, 2025 |

Reassessment Invalid Where No Addition Made on Recorded Reasons; Section 40A(3) Addition Unsustainable

Sri Krishna Traders had not filed a return for AY 2017-18. On noticing cash deposits of Rs. 2.03 crore in its ICICI Bank account, the Assessing Officer reopened the assessment under Section 147 on the ground that the deposits were unexplained. During reassessment, the assessee explained that it was engaged in the business of trading used and rebuttoned tyres, with sales largely in cash, and furnished supporting details.

The Assessing Officer accepted that the cash deposits were explained and made no addition on the very issue for which the assessment was reopened. However, he proceeded to make an addition of Rs. 3.08 crore under Section 40A(3), alleging violation of cash payment limits, and completed the reassessment on that basis. The CIT(A) upheld the addition.

Issue before ITAT: Whether reassessment is valid when no addition is made on the issue recorded for reopening, and a fresh addition is made on an unrelated issue without recording new reasons.

ITAT Decided: The ITAT held that the reassessment was invalid. It noted that once the AO accepted the explanation for the recorded reason and made no addition on unexplained cash deposits, he could not travel to a new issue and make an independent addition under Section 40A(3) without issuing a fresh notice under Section 148.

Relying on the decisions in Jet Airways (I) Ltd., Martech Peripherals (P) Ltd. and Anand Cine Services (P) Ltd., the Tribunal held that Explanation 3 to Section 147 does not permit additions on new issues unless the original escaped income is first assessed. Since that condition was not met, the addition was deleted.

To Read Full Judgment, Download PDF Given Below

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"