F&O Traders can opt for Presumptive Taxation Scheme u/s 44AD of Income Tax

CA Pratibha Goyal | Jun 17, 2023 |

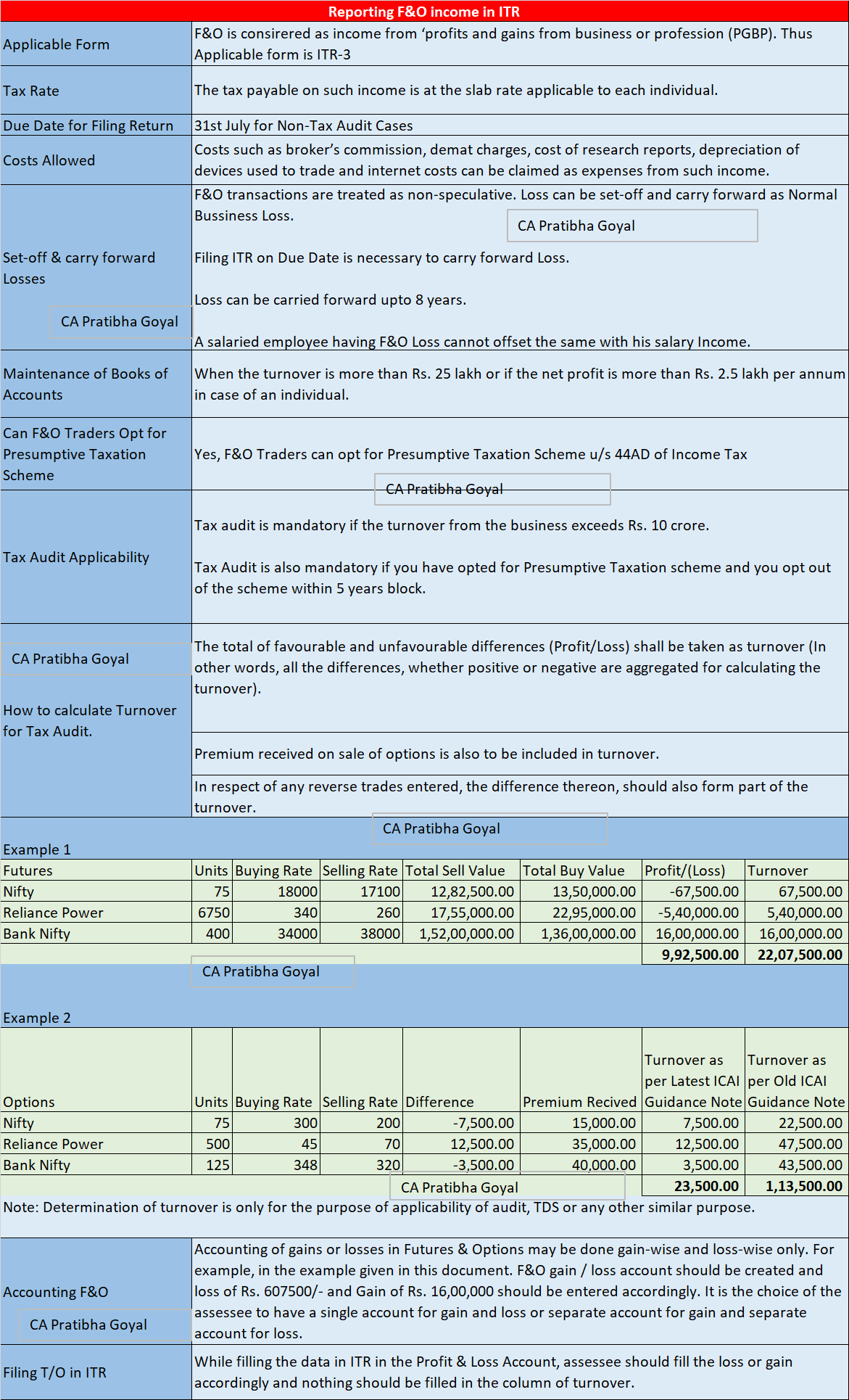

Reporting F&O income in ITR

Applicable Form: F&O is consirered as income from ‘profits and gains from business or profession (PGBP). Thus Applicable form is ITR-3

Tax Rate: The tax payable on such income is at the slab rate applicable to each individual.

Due Date for Filing Return: 31st July for Non-Tax Audit Cases and 31st Oct if Tax Audit is applicable

Costs such as broker’s commission, demat charges, cost of research reports, depreciation of devices used to trade and internet costs can be claimed as expenses from such income.

When the turnover is more than Rs. 25 lakh or if the net profit is more than Rs. 2.5 lakh per annum in case of an individual.

Yes, F&O Traders can opt for Presumptive Taxation Scheme u/s 44AD of Income Tax

Accounting of gains or losses in Futures & Options may be done gain-wise and loss-wise only. For example, in the example given in this document. F&O gain / loss account should be created and loss of Rs. 607500/- and Gain of Rs. 16,00,000 should be entered accordingly. It is the choice of the assessee to have a single account for gain and loss or separate account for gain and separate account for loss.

While filling the data in ITR in the Profit & Loss Account, assessee should fill the loss or gain accordingly and nothing should be filled in the column of turnover.

Reporting F&O income in ITR

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"