The Member of Parliament Mansukhbhai Dhanjibhai Vasava has made a representation to include CMA in Accountant Definition under Income Tax Bill 2025.

Reetu | Mar 5, 2025 |

Representation on inclusion of CMA in Accountant Definition under Income Tax Bill 2025

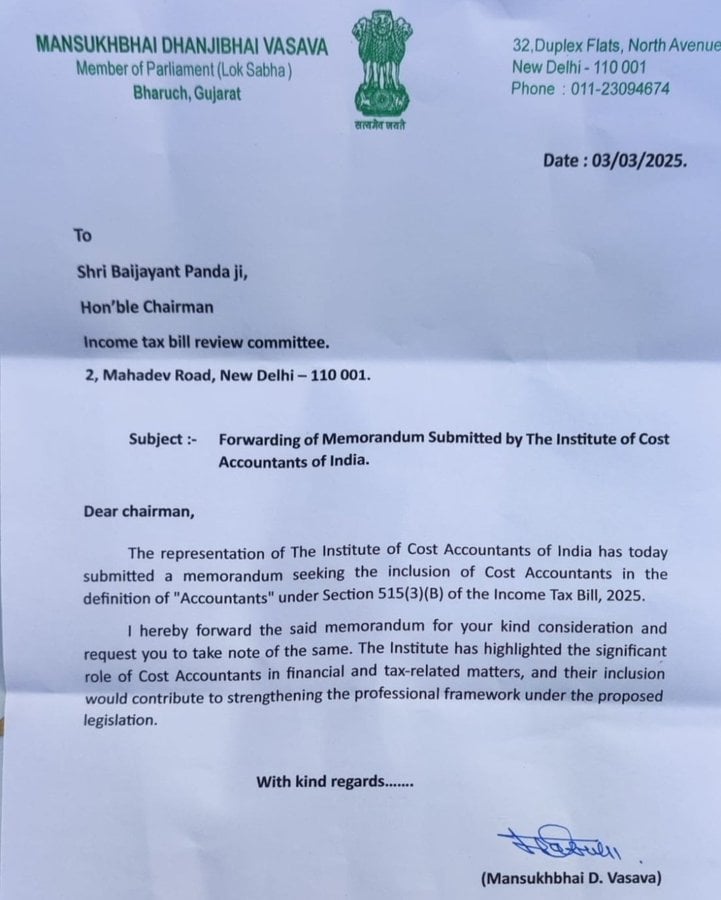

The Member of Parliament Mansukhbhai Dhanjibhai Vasava has made a representation before Select Committee Chairman, Shri Baijayant Panda Ji, to include CMA in Accountant Definition under Income Tax Bill 2025.

The representation of The Institute of Cost Accountants of India has today submitted a memorandum seeking the inclusion of Cost Accountants in the definition of “Accountants” under Section 515(3)(B) of the Income Tax Bill, 2025.

I hereby forward the said memorandum for your kind consideration and request that you take note of the same. The Institute has highlighted the significant role of Cost Accountants in financial and tax-related matters, and their inclusion. would contribute to strengthening the professional framework under the proposed legislation.

Earlier, ICMAI also sent a memorandum to Hon’ble Finance Minister Smt. Nirmala Sitharaman demanding that Cost Accountants be included in the term of “Accountant” under Section 515(3)(b) of the Income-Tax Bill of 2025.

Apart from changes in sections and clauses, this bill left CMAs hanging even after being given assurance that Cost Management Accountants will be included in the definition of accountant for tax audit.

The New Income Tax Bill 2025 was tabled in Lok Sabha on 13th Feb 2025, which goes into effect on April 1, 2026. The Bill represents a significant revision of the existing tax system. It consists of 536 clauses, 16 schedules, and 23 chapters that introduce significant changes to streamline and modernise tax administration. Key changes include the introduction of a “tax year” concept, the preservation of the old tax regime with current deductions, and the development of a new tax regime with updated rates.

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"