Reetu | Mar 21, 2024 |

Revised Schedule of CS Exam June 2024

The Institute of Company Secretaries of India (ICSI) has released the Revised Schedule of the Company Secretary Examination in June 2024.

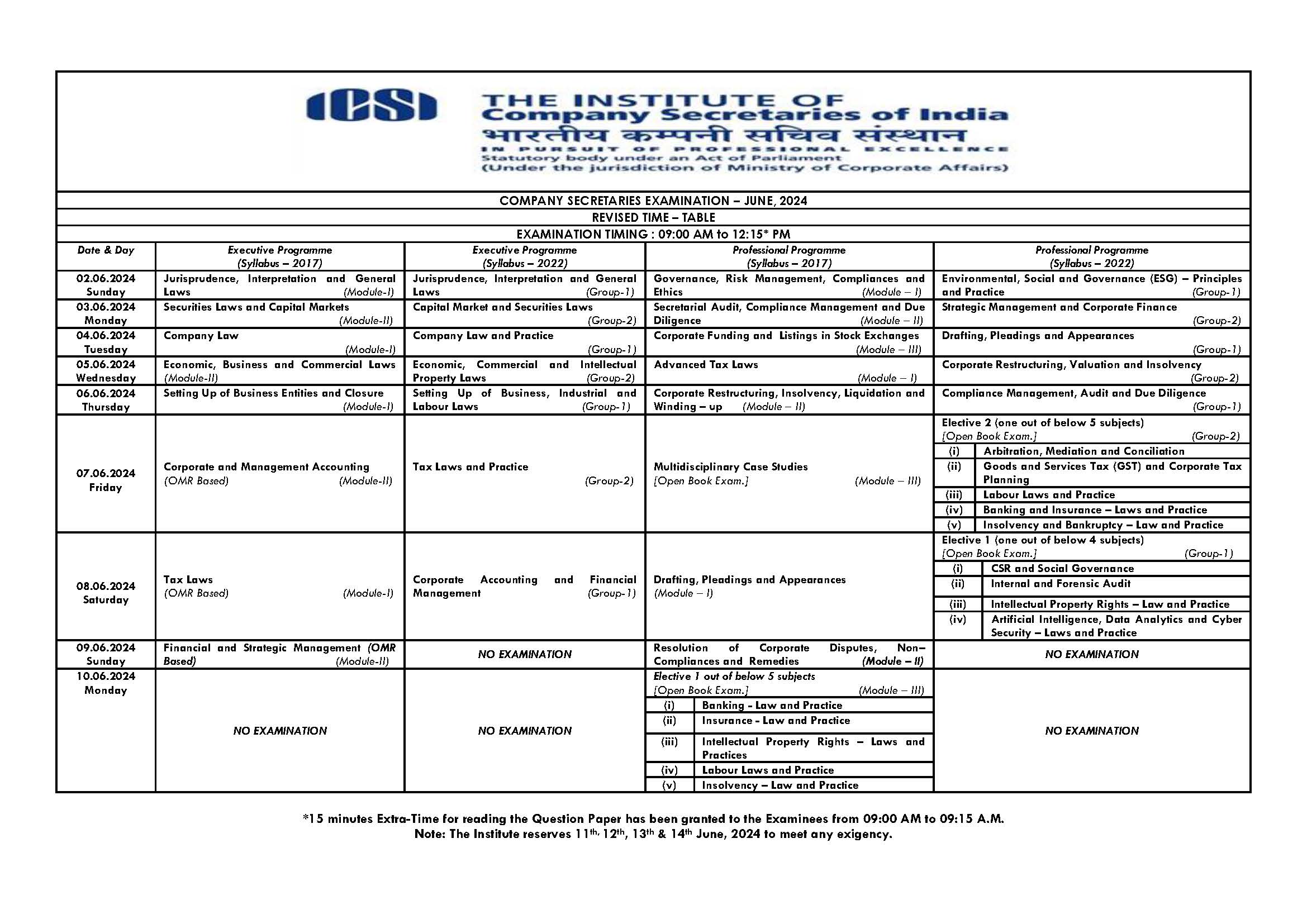

The revised timetable has been released for the Executive program (Syllabus 2017, 2022) and Professional program (Syllabus 2017, 2022).

As per the Official release, the exams are scheduled to be conducted from June 2 to 10, 2024. The exam will be conducted from 9.00 AM to 12.15 PM. Candidates will be given 15 minutes from 9.00 AM to 9.15 AM for reading the question paper. Previously, the exam was scheduled to begin on June 1 and end on June 10.

The examination covers topics ranging from Jurisprudence and General Laws to Securities Laws and Capital Markets. Each day covers a distinct set of subjects, including Company Law, Economic Laws, and Corporate Accounting. Syllabus modifications and alignment with current industrial practices and regulatory frameworks are notable developments.

The students can download the revised timetable from the official website of ICSI.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"