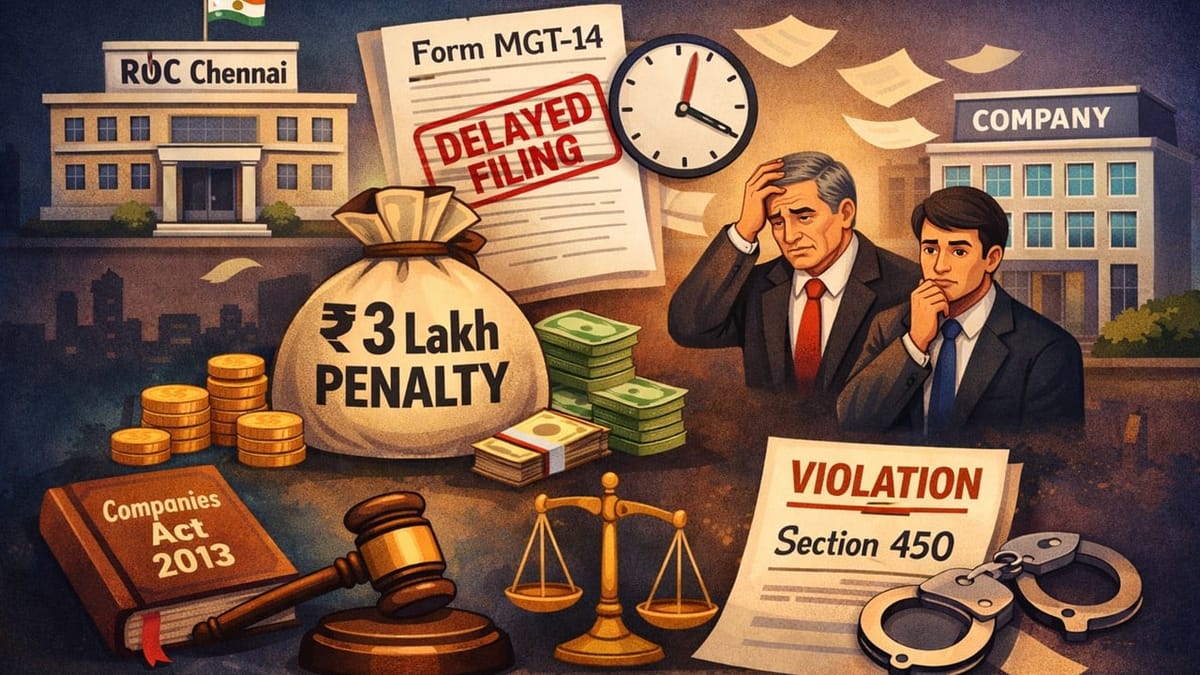

ROC imposed a Rs. 3 lakh penalty on the company and its two directors for delayed filing of Form MGT-14, in violation of Section 450 of the Companies Act, 2013.

Saloni Kumari | Jan 8, 2026 |

ROC Imposes Rs. 3 Lakh Penalty on Company and Directors for Delayed MGT-14 Filing

The Registrar of Companies (ROC) Chennai under the Ministry of Finance (MCA), Government of India, has issued an Adjudication Order dated January 07, 2026, under Section 454 of the Companies Act, 2013, imposing a penalty on a company and its two directors for the contravention of Section 450 of the Act.

The case is related to a company, namely Mulagumoodu Vicariate Catholic Nidhi Limited, with CIN U65991TN1995PLC030938, and its two directors named Savarimuthu Sekhar and Davidson Benjamin, with DIN 07559450 and 02897454, respectively.

The ministry had rejected the form NDH-4 furnished by the concerned company through the issuance of an order dated July 04, 2024. The order mentioned that the form was rejected because the company failed to file Form MGT-14 for the Board Resolution approving the financial statements for FY 2020-21, as required under the Companies Act, 2013.

The company later on furnished Form MGT-14 on June 14, 2025, with a delay of 1316 days from the statutory time limit. This delay holds both the company and its director liable for a penalty under Section 450 of the Act.

In conclusion, the Adjudicating Authority issued a notice dated October 06, 2025, against the company. The company responded to the notice through a letter dated October 21, 2025, wherein it mentioned that they believe that they are not required to furnish Form MGT-14 and also that they have now completely filed Form MGT-14 for all years with late fees. They also said that after the NDH-4 rejection, they had explained the issue to the Ministry but were not given a chance to correct the mistake, and therefore requested the authority not impose any penalty on the company and its officers.

After analysing the arguments of the company, the officer concluded that the company is liable for the imposition of a penalty under Section 450 of the Companies Act, 2013, hence levying a penalty of Rs. 3 lakh on the company and its directors (50,000 each). The company has been asked to rectify the default and pay the penalty amount within the time period of 90 days from receiving the order.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"