ROC levies penalty of Rs. 706250 on Company & its Directors for non-filing of Financial Statements

Deepak Gupta | Dec 2, 2022 |

ROC levies penalty of Rs. 706250 on Company & its Directors for non-filing of Financial Statements

Whereas, the company is in default for filing its Financial Statements for the financial years 2015- 16 to 2020-2021 with the office of Registrar of Companies, Patna. Hence, this office has issued a show cause notice for default under section 137 of the Companies Act, 2013 vide No ROC/PAT/SCN/137 /22919/1798-1800 dated 30.09.2022.

Whereas, this office has not received any reply from the company and its directors. Hence, it appears that the provisions of Section 1.37 of the Companies Act, 2013 have been contravened by the company and its directors/officers and therefore they are liable for penalty u/s 137(3) of the Companies Act, 2013.

ORDER

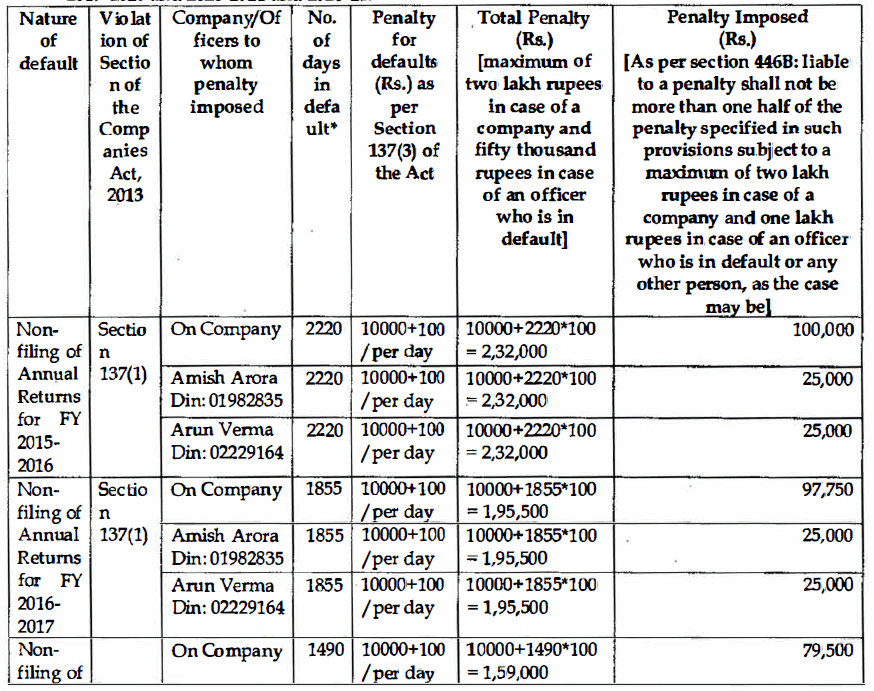

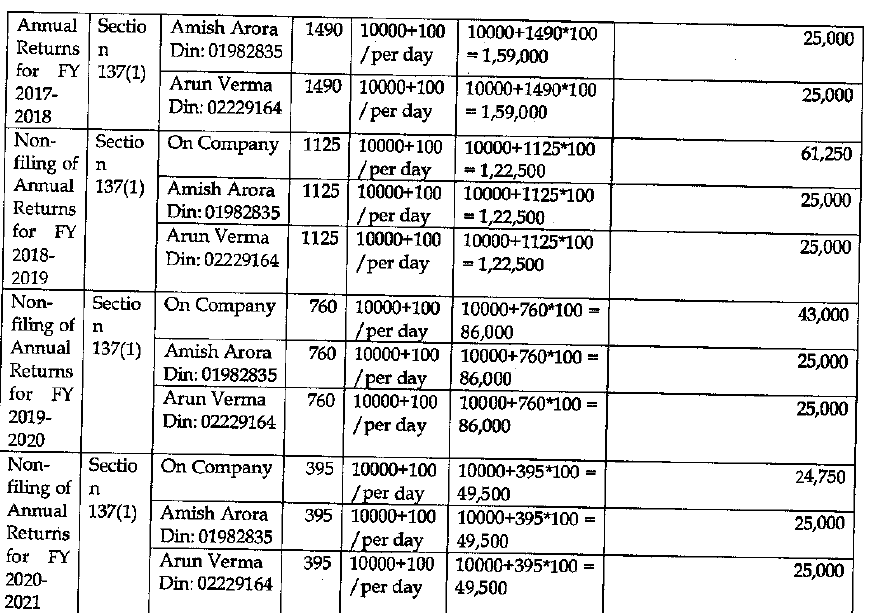

Having considered the facts and circumstances of the case, and after taking into account the factors above, I hereby impose a penalty on Company, and its Directors as per Table Below for violation of Section 137 of the Companies Act 2013 for the financial years 2015-16, 2016-17, 2017-18, 2018-19, 2019-2020 and 2020-2021 and 2020-21

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"