Tax Audit Due Date for FY 2023-24 has been Extended by 7 days by CBDT.

CA Pratibha Goyal | Sep 30, 2024 |

Tax Audit Due Date for FY 2023-24 Extended

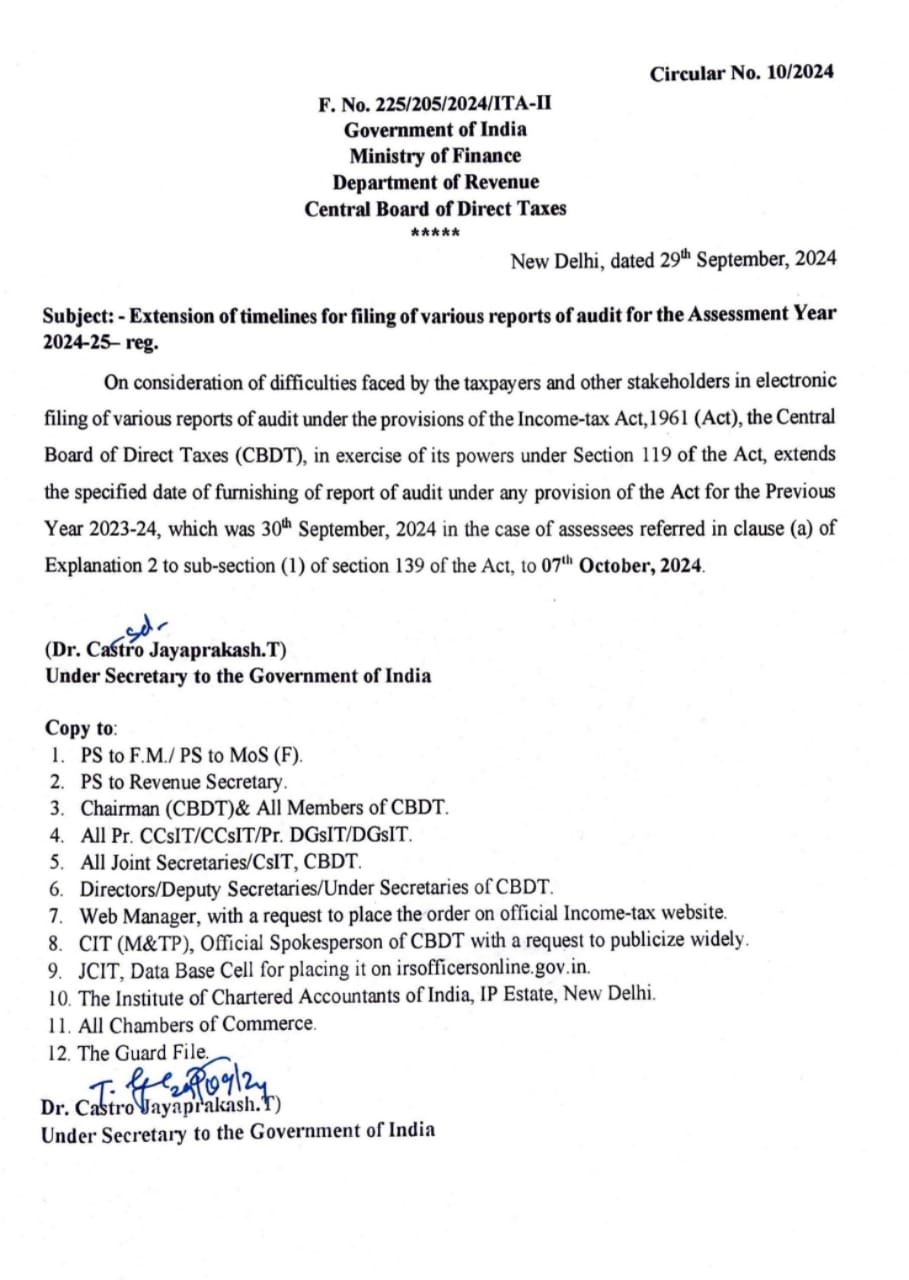

The Central Board of Direct Taxes (CBDT) has extended the due date for filing various reports of audit including Tax Audit for the Previous Year 2023-24, which was 30th September 2024 in the case of assessees referred to in clause (a) of Explanation 2 to sub-section (1) of section 139 of the Act, to 07th October 2024.

Complete Details are available in CBDT Circular Number 10/2024 in 225/205/2024-ITA-II dated 29.09.2024.

As per section 271B the Penalty for Not Filing Tax Audit Report is as under:

As such, the failure of a person, to get his accounts audited in respect of any previous year or furnish a copy of such report as required under section 44AB may attract a penalty equal to 0.5% of the total sales, turnover or gross receipts, or Rs.1.5 lakh whichever is less.

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"