Tax Audit: Offline Utilities for filing Statutory Income Tax Form 3CA-3CD & 3CB-3CD for FY 21-22 released

Deepak Gupta | May 5, 2022 |

Tax Audit: Offline Utilities for filing Statutory Income Tax Form 3CA-3CD & 3CB-3CD for FY 21-22 released

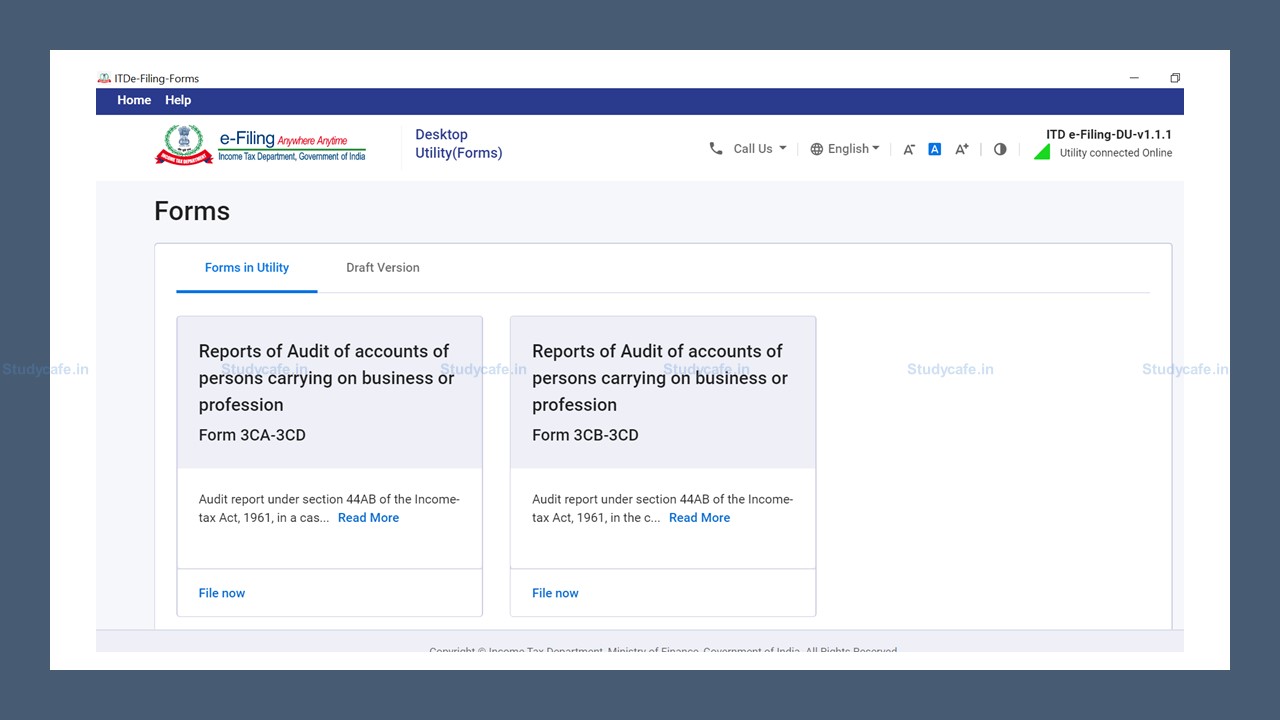

The Good News for Taxpayers is that Tax Audit Utility i.e. Offline Utilities for filing Statutory Income Tax Form 3CA-3CD & 3CB-3CD for FY 21-22 have been released on Income Tax Portal.

Last year the Taxpayers faced many problems in filing Income Tax Returns (ITR) and Tax Audit Reports (TAR) due to revamping of the Income Tax Portal. This time department has been proactive and has released the Forms.

The Utility can be downloaded from the below mentioned link.

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"