Deepak Gupta | May 26, 2021 |

Tax Compliance Calendar June 2021

Here is the Tax Compliance Calendar for June 2021. The Article contains due dates for GST, Income Tax, ROC Compliances, and some other corporate law compliances.

Note: This Calendar is updated as on 31st May 2021. The Due Dates if extended are subject to change.

| Due Date | Forms to be filed | Taxpayer Type | Period |

| 30-06-2021 | GSTR-7 | Taxpayer who is required to deduct TDS as per GST Act | May-21 |

| 30-06-2021 | GSTR-8 | Taxpayer who is required to collect TCS as per GST Act | May-21 |

| 30-06-2021 | GSTR-6 | A taxpayer having registration of Input Service Distributor (ISD) | May-21 |

| 30-06-2021 | GSTR-5 | Non-Resident Taxpayer | May-21 |

| 30-06-2021 | GSTR-5A | OIDAR | May-21 |

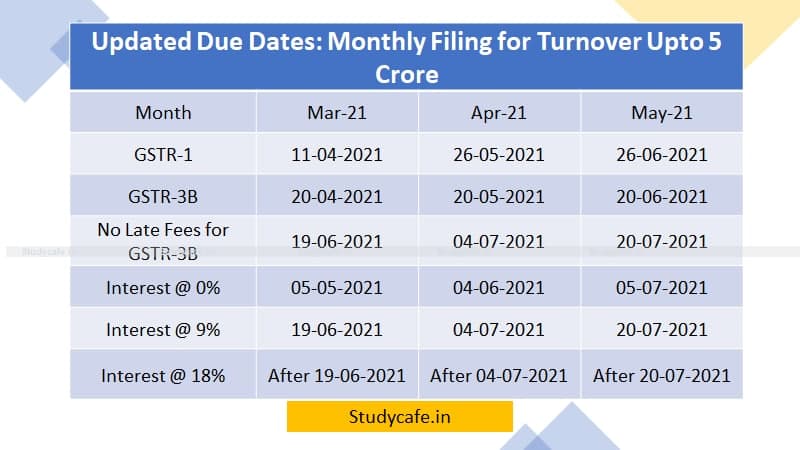

For Taxpayers who have not Opted for QRMP

| Period | Mar-21 | Apr-21 | May-21 |

| GSTR-1 | 11-04-2021 | 26-05-2021 | 26-06-2021 |

| GSTR-3B | 20-04-2021 | 20-05-2021 | 20-06-2021 |

| No Late Fees | 19-06-2021 | 04-07-2021 | 20-07-2021 |

| Interest @ 0% | 05-05-2021 | 04-06-2021 | 05-07-2021 |

| Interest @ 9% | 19-06-2021 | 04-07-2021 | 20-07-2021 |

| Interest @ 18% | After 19-06-2021 | After 04-07-2021 | After 20-07-2021 |

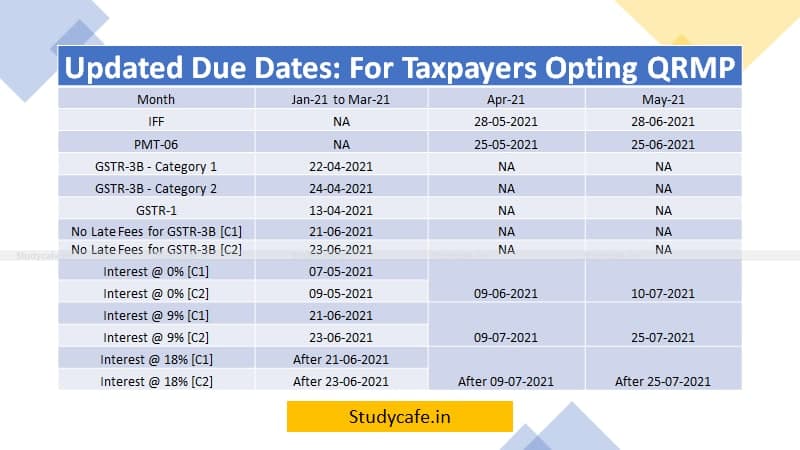

For Taxpayers who have Opted for QRMP

| Period | Jan-21 to Mar-21 | Apr-21 | May-21 |

| IFF | NA | 28-05-2021 | 28-06-2021 |

| PMT-06 | NA | 25-05-2021 | 25-06-2021 |

| GSTR-3B – Category 1 | 22-04-2021 | NA | NA |

| GSTR-3B – Category 2 | 24-04-2021 | NA | NA |

| GSTR-1 | 13-04-2021 | NA | NA |

| No Late Fees for GSTR-3B [C1] | 21-06-2021 | NA | NA |

| No Late Fees for GSTR-3B [C2] | 23-06-2021 | NA | NA |

| Interest @ 0% [C1] | 07-05-2021 | 09-06-2021 | 10-07-2021 |

| Interest @ 0% [C2] | 09-05-2021 | ||

| Interest @ 9% [C1] | 21-06-2021 | 09-07-2021 | 25-07-2021 |

| Interest @ 9% [C2] | 23-06-2021 | ||

| Interest @ 18% [C1] | After 21-06-2021 | After 09-07-2021 | After 25-07-2021 |

| Interest @ 18% [C2] | After 23-06-2021 |

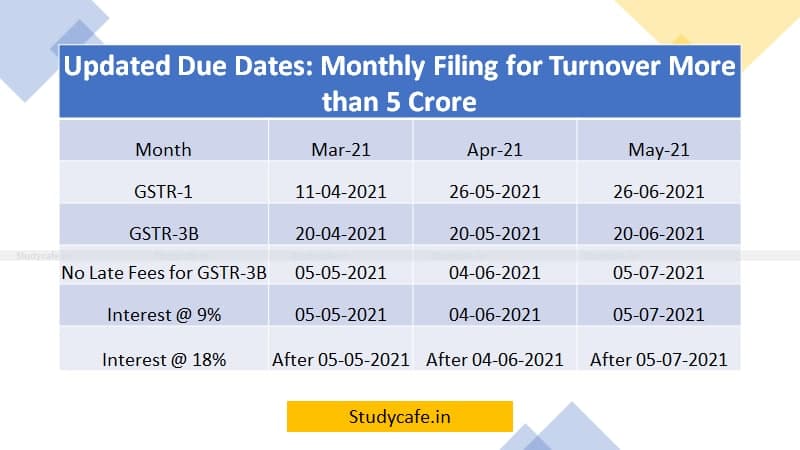

Updated GST Return Due Dates as announced in GST Council Meeting

| Period | Mar-21 | Apr-21 | May-21 |

| GSTR-1 | 11-04-2021 | 26-05-2021 | 26-06-2021 |

| GSTR-3B | 20-04-2021 | 20-05-2021 | 20-06-2021 |

| No Late Fees for GSTR-3B | 05-05-2021 | 04-06-2021 | 05-07-2021 |

| Interest @ 9% | 05-05-2021 | 04-06-2021 | 05-07-2021 |

| Interest @ 18% | After 05-05-2021 | After 04-06-2021 | After 05-07-2021 |

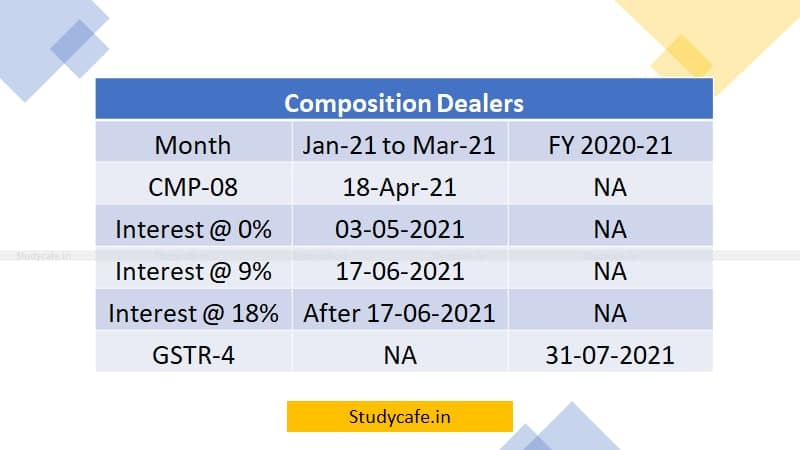

| Period | Jan-21 to Mar-21 | FY 2020-21 |

| CMP-08 | 18-Apr-21 | NA |

| Interest @ 0% | 03-05-2021 | NA |

| Interest @ 9% | 17-06-2021 | NA |

| Interest @ 18% | After 17-06-2021 | NA |

| GSTR-4 | NA | 31-07-2021 |

| Due Date | Forms to be filed/Downloaded | Taxpayer Type | Period |

| 07-06-2021 | TDS/TCS Challan | A taxpayer who is required to deduct TDS or collect TCS | May-21 |

| Original: 15-06-2021 Extended: 30-06-2021 | Form 24G | An office of the Government where TDS/TCS has been paid without the production of a challan | May-21 |

| Original: 15-06-2021 Extended: 15-07-2021 | Form 16 | An employer who has deducted TDS on Salary | FY 2020-21 |

| 15-06-2021 | Form 16A | A taxpayer who has deducted TDS other than Salary | Jan-21 to Mar-21 |

| 15-06-2021 | A taxpayer who are required to pay Advance Tax | The first instalment of advance tax for the assessment year 2022-23 | |

| 30-06-2021 | Linking Aadhaar number with PAN | ||

| 30-06-2021 | Payment of tax under the Direct Tax Vivad se Vishwas Act, 2020 without additional charge | ||

| 30-06-2021 | TDS Return | A taxpayer who are required to deduct TDS | Jan-21 to Mar-21 |

| 30-06-2021 | Statement of financial transaction | A taxpayer who are required to File Form 61A | FY 2020-21 |

| Due Date | Forms to be filed | Compliance Applicability | Period |

| 30-06-2021 | DPT-03 | Company Required to file Annual Return for Deposit & Exempted Deposit | FY 2020-21 |

| Due Date | Forms to be filed | Taxpayer Type | Period |

| 15-06-2021 | Electronic Challan & Return (ECR) for EPF | An employer who is required to make a contribution to the Provident fund | May-21 |

| 15-06-2021 | ESI Challan | An employer who is required to make ESI Payment | May-21 |

Disclaimer: The List is inclusive, not exhaustive

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"