The Income Tax Department, Government of India, has shared the latest TDS rate chart, amended as per the Finance Act 2025. Check below.

Saloni Kumari | Jun 11, 2025 |

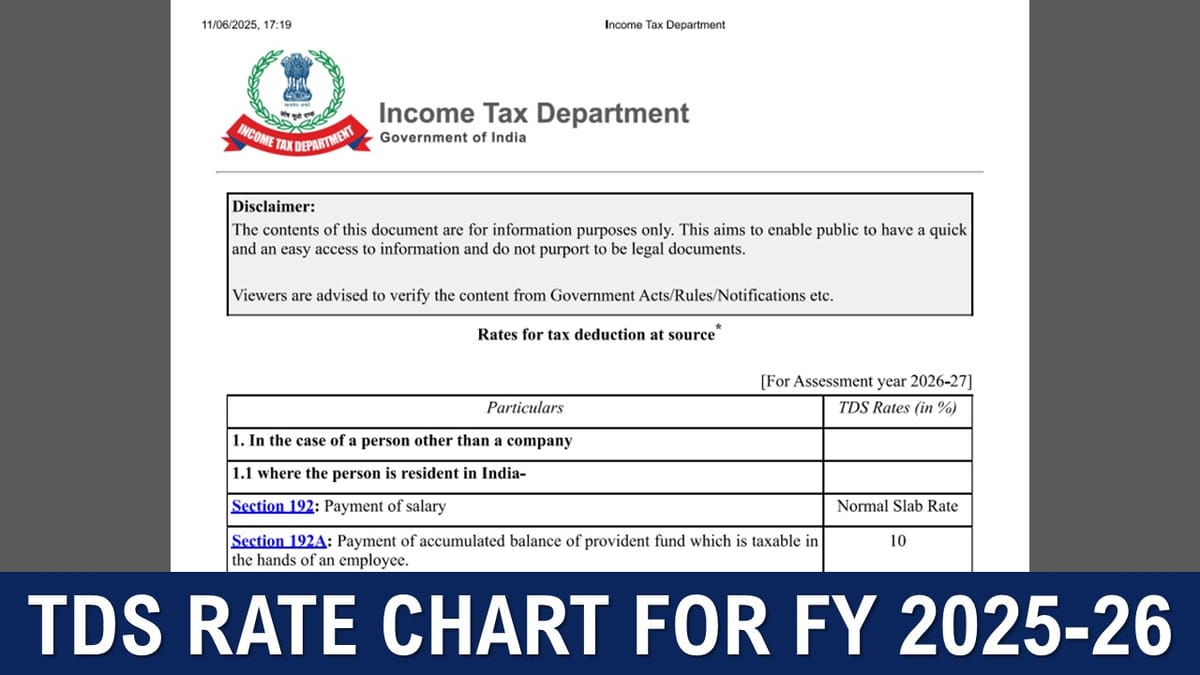

Tax Deduction at Source Rate Chart For FY 2025-26 (AY 2026-27) by Income Tax Department

TDS stands for Tax Deducted at Source, which is a significant revenue-generating mechanism introduced by the Income Tax Department of India.

When you earn income from sources such as salary, rent, or bank interest, the individual paying you the amount deducts a portion of it before paying you. This deducted amount (TDS) is then sent directly to the government. So, instead of you paying the tax later, it’s paid in parts at the time you receive income.

The Income Tax Department, Government of India, has shared the latest TDS rate chart, amended as per the Finance Act 2025, for the Financial Year 2025-26 (Assessment Year 2026-27). This includes the latest TDS percentages for different types of payments, TDS rules for salary, TDS slab rates and updated TDS section chart.

What is TDS?

TDS, or Tax Deducted at Source, is a way through which the Indian government collects tax at the time income is earned, rather than waiting for the financial year to end. It helps reduce tax evasion and ensures a steady flow of revenue to the government throughout the year.

Under TDS, the person or organisation making a payment, such as salary, rent, commission, or interest, is responsible for deducting a certain percentage of tax before giving the remaining amount to the recipient. The one who deducts the tax is known as the deductor, and the person receiving the payment is called the deductee.

The rate at which TDS is deducted depends on several things: the type of payment being made, who is receiving it (whether an individual or a company), and whether the recipient lives in India or outside India. For example, the TDS rate on interest may be different from that on salary.

To know the latest updated rates for TDS, refer to the PDF below

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"