The Tax Department of India has updated the Income Tax Return Common Offline Utility.

Reetu | Jul 27, 2024 |

Tax Department released updated ITR Utility on Income Tax Portal for AY 2024-25

The Tax Department of India has updated the Income Tax Return Common Offline Utility. This update comes when only a few days left before the return deadline.

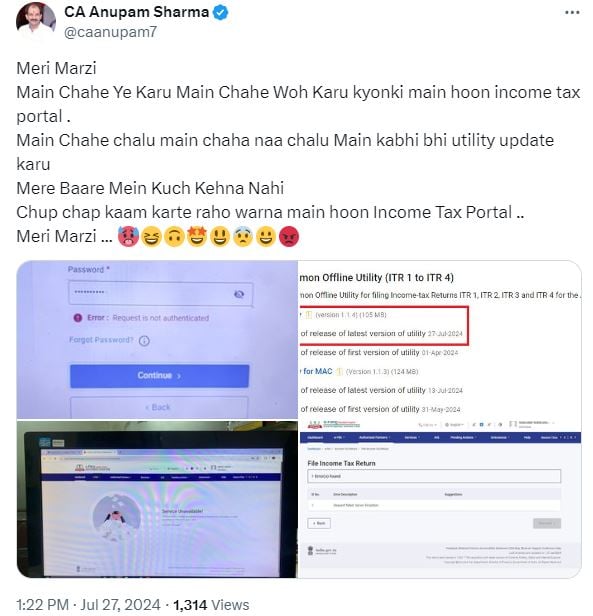

Common Offline Utility for filing Income-tax Returns ITR 1, ITR 2, ITR 3 and ITR 4 for the AY 2024-25.

Date of release of the latest version of the utility: 27-Jul-2024

Taxpayers don’t seem happy with this casual utility updation move of the income tax department. Many users shared their experiences on Twitter to express what this utility has changed.

One user wrote, “MASTERSTROKE!! The Income Tax Department has today casually updated the offline utility (ITR 1 to ITR 4) today, i.e., 27 July 2024. Due Date of filing is 31-July-24.”

Another user said, “Utility update 1.1.4 available on the income tax e-filing portal. Updated today, some time back. Still not able to carry forward losses for HP under the new regime for let-out property. So, what is the change? #incometax #IncomeTaxportal #IncomeTaxSiteIssues #itrfiling”

One Person wrote, “Income tax update utility today, ye sab kya dekhna pad raha he”

A Chartered Accountant posted,”Meri Marzi, Main Chahe Ye Karu Main Chahe Woh Karu kyonki main hoon income tax portal. Main Chahe chalu main chaha naa chalu Main kabhi bhi utility update karu, Mere Baare Mein Kuch Kehna Nahi, Chup chap kaam karte raho warna main hoon Income Tax Portal ..Meri Marzi … 🥵😆🙃🤩😃😨😀😡”

Do tell us in a comment about your experience as well.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"