Reetu | Jul 23, 2024 |

Income Tax Slab Rate as per Budget 2024

The Hon’ble Finance Minister Nirmala Sitharaman presented the Union Budget 2024 in the parliament today. In the Budget, FM has made many changes and a few related to income tax. There have been changes in the tax slab and the New tax regime slab rate has changed. In this article you can check out the latest slab rates for FY 2024-25 | AY 2025-26 as per New and Old Tax Regimes for individuals and Hindu Undivided Family (HUF).

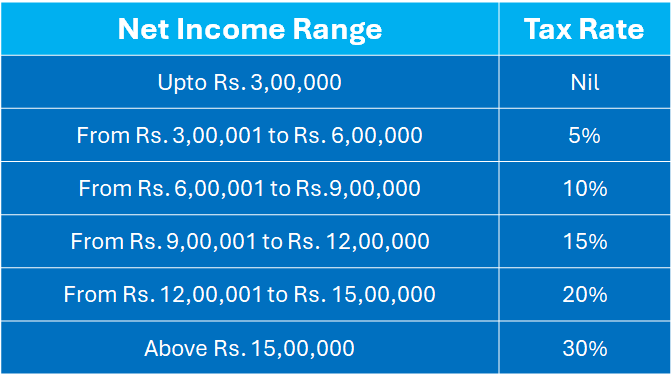

New Slabs as per the New Tax Regime

| Income Tax Range | Rate |

| 0-3L | Nil |

| 3-7L | 5% |

| 7-10L | 10% |

| 10-12L | 15% |

| 12-15L | 20% |

| Above 15L | 30% |

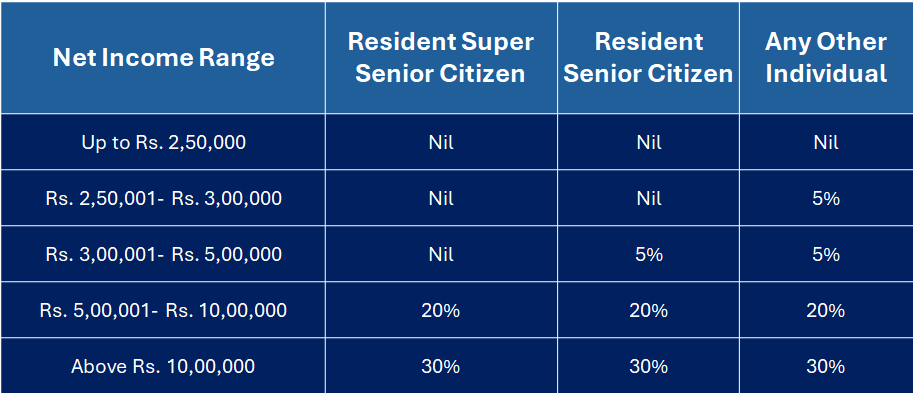

No Change in slabs of the Old Tax Regime

Standard Deduction to Salaried employees has also been increased to Rs.75000 from Rs.50000.

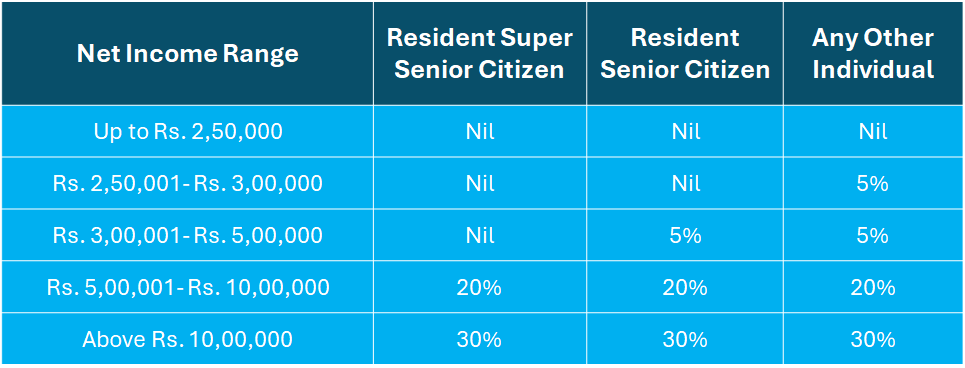

Old Tax Regime

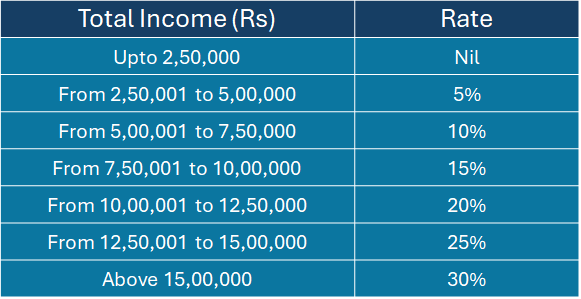

Alternative Tax Regime under section 115BAC (New tax regime)

Surcharge on Income Tax

Health and Education Cess

4% of income-tax and surcharge.

Old Tax Regime

Alternative Tax Regime under section 115BAC (New tax regime)

Surcharge on Income Tax

Health and Education Cess

4% of income-tax and surcharge.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"