Nidhi | Jun 11, 2025 |

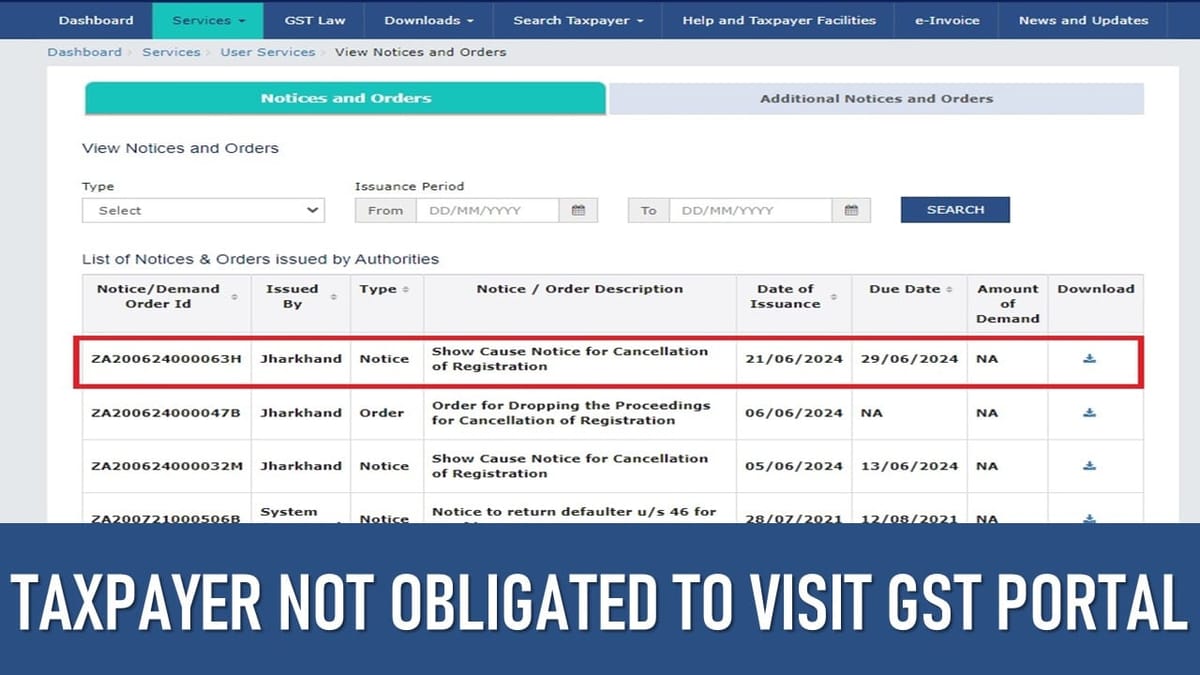

Taxpayer Not Obligated to Visit GST Portal to Receive Show Cause Notices

The petitioner, M/s Micasa’s, GST registration was cancelled on 31.03.2019 and has never been revived since then. The petitioner also did not apply to get its revival. The Tax Department issued show cause notices online on the GST portal. The High Court said the petitioner was not required to check the portal to receive the order as their registration was cancelled.

The revenue said that they did not send any physical notice before passing the final order on 24.04.2024. Due to the absence of natural justice, the order was cancelled by the High Court of Allahabad and the Writ Petition was disposed.

The court allowed petitioner to submit a reply to the show cause notice within 4 weeks. Additionally, the court ordered the tax authorities to pass a fresh order after giving the company a personal hearing, preferably within three months.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"