CA Pratibha Goyal | Oct 2, 2020 |

TCS on sale of goods above 50 Lakhs under Income Tax

Provisions of TCS on sale of goods have been inserted by the Finance Act 2020 vide section 206C(1H) of the Income Tax Act. Provisions of this section require the seller, to collect tax on the amount received as sale consideration if it exceeds Rs. 50 Lakhs. CBDT has issued Circular Number 17/2020, dated 29/09/2020 to clarify doubts of Tax Payers.

This article discusses Frequently Asked Questions (FAQs) about the requirement to collect TCS on the sale of goods with effect from 01-10-2020.

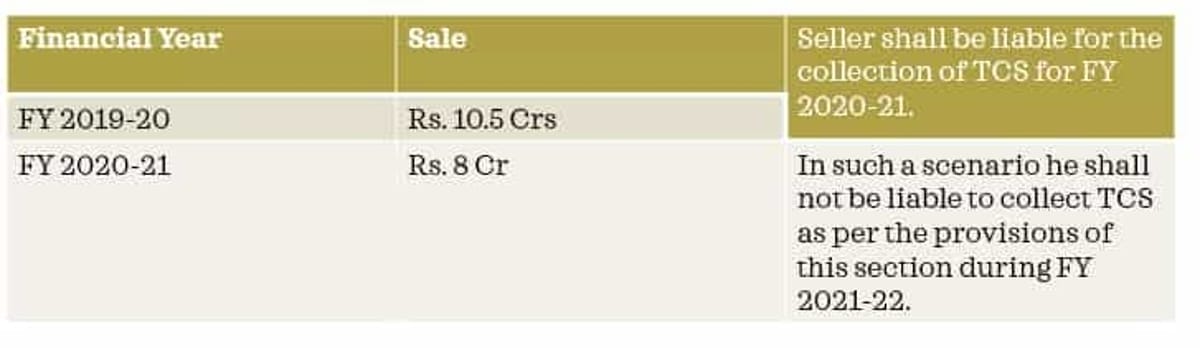

Sellers whose business turnover exceeds Rs. 10 crores in the financial year immediately preceding the financial year of sale are liable to collect TCS on the sale of goods.

This situation has been explained by the below-mentioned example:

TCS shall be collected if the following conditions are satisfied:

TCS on sale of goods shall not be collected in case of:

Tax should be collected at the time of receipt of the amount from the buyer if the value of sale consideration received in a previous year exceeds Rs. 50 lakhs.

The below-mentioned example has been used to explain this concept:

| Particulars | FY2019-20 | FY2020-21 | FY2021-22 | FY2022-23 |

| Sale (A) | 6,000,000.00 | 8,000,000.00 | 7,000,000.00 | 7,000,000.00 |

| Balance Receivable on First Day of Year (B) | – | Rs. 4000000, (Rs. 55 lakhs received on or before 30-09-2020) | 2,000,000.00 | 4,500,000.00 |

| Balance Received (C) | 2,000,000.00 | 10,000,000.00 | 4,500,000.00 | 5,500,000.00 |

| Balance Receivable on Last Day of Year (D) | 4,000,000.00 | 2,000,000.00 | 4,500,000.00 | 6,000,000.00 |

| TCS | Nil, As Section 206C(1H) is applicable from 01-10-2020, no tax to be collected in the financial year 2019-20. | Rs. 3375, Tax will be collected only in respect of sale consideration received on or after 01-10- 2020, i.e. Rs. 45,00,000 * 0.075% = Rs. 4,500 [TCS Rate is 0.1%, but because of COVID the rate has been reduced by 25%] | Nil, as the amount of sale consideration received during the year does not exceed Rs. 50 lakhs. | Rs. 500, tax shall be collected on receipt in excess of Rs. 50 lakhs, i.e. 5,00,000 * 0.1% = 500 |

TCS on sale of goods is not be collected in case of Export of goods.

The CBDT has clarified that provisions of this section shall not be applicable in relation to transactions in securities (and commodities) which are traded through recognised stock exchanges or cleared and settled by the recognized clearing corporation, including recognised stock exchanges or recognized clearing corporations located in International Financial Service Centre (IFSC).

The definition of goods is not given in the Income Tax Act. Definition of goods in various other Acts is given below:

Sale of Goods Act, 1930

‘Goods’ means every kind of movable property other than actionable claims and money; and includes stock and shares, growing crops, grass, and things attached to or forming part of the land which are agreed to be severed before sale or under the contract of sale”

Central Goods and Services Tax Act, 2017

‘Goods’ means every kind of movable property other than money and securities but includes actionable claim, growing crops, grass, and things attached to or forming part of the land which are agreed to be severed before supply or under a contract of supply”

On basis of the above definitions, it can be said that the provision of this section is not applicable to the sale of immovable property.

The CBDT vide Circular No. 17, dated 29-09-2020 has clarified collection of TCS in case of sale of motor vehicles:

Where a person, who is re-selling the goods, falls within the definition of the seller, he will be liable for the collection of tax. However, if a person, re-selling the goods, is not engaged in carrying on of any business, no tax shall be collected under this provision.

For Example, Mr X (a salaried person) buys jewellery of Rs. 55 lakhs from a Jeweller. The Jeweller collects a tax of Rs. 500 (0.1% of Rs. 5 lakhs) under section 206C(1H). If Mr X re-sells the jewellery for Rs. 60 lakhs to the same jeweller, he shall not be liable to collect tax as he is not engaged in any business or profession.

The tax shall be collected by the seller of goods at the rate of 0.1% of the sale consideration exceeding Rs. 50 lakhs if the buyer has furnished his PAN or Aadhaar, otherwise, the tax shall be collected at the rate of 1%.

To provide more funds at the disposal of the taxpayers for dealing with the economic situation arising out of COVID-19 pandemic, the rates of TCS for the specified receipts have been reduced by 25% for the period from 14-05-2020 to 31-03-2021. Hence, the rate of TCS on sale of goods shall be 0.075% till 31-03-2021.

However, if the buyer does not submit the PAN or Aadhaar the benefit of the reduced rate shall not be available.

Threshold limit of Rs. 50 Lakh shall be computed from 1st April 2020. This is because the threshold is based on the yearly receipt. In this connection, it may be noted that this TCS shall be applicable only on the amount received on or after 1st October 2020.

For example, a seller who has received Rs. 1 crore before 1st October 2020 from a particular buyer and receives Rs. 5 lakh after 1st October 2020 would be required to collect tax on Rs. 5 lakh only and not on Rs. 55 lakh [i.e Rs.1.05 crore – Rs. 50 lakh (threshold)] by including the amount received before 1st October 2020.

Yes, TCS is to be collected on the total invoice value including the GST.

Yes, TCS provisions are applicable on the advance amount received for the sale of goods.

As per provisions of the section, the tax should be collected where the amount is received on or after 01-10-2020. Thus, where the event of receipt of sale consideration has occurred before the date of applicability of provision, no liability to collect tax will arise.

As per provisions of the section, the tax should be collected where the amount is received on or after 01-10-2020. Thus, where the event of receipt of sale consideration has occurred after the date of applicability of provision, liability to collect tax will arise.

In the case of branch transfer, we cannot construe it as a sale from one distinct person to another. Thus TCS provisions are not applicable on the same.

| Taxpayer | Date of Deposit |

| Is office of the Govt. and tax is paid without production of income tax challan. | On the same day on which tax is deducted |

| Is office of the Govt. and tax is paid with production of income tax challan. | On or before 7 days from the end of month in which tax is collected. |

| Tax is collected by a person other than office of Government | On or before 7 days from the end of month in which tax is collected. |

| Quarter | Period | Due Date |

| 1st Quarter | 1st April to 30th June | 15th July of the Finacial Year |

| 2nd Quarter | 1st July to 30th September | 15th Oct of the Finacial Year |

| 3rd Quarter | 1st October to 31st December | 15th Jan of the Finacial Year |

| 4th Quarter | 1st January to 31st March | 15th May of the financial year immediately following the financial year in which collection is made |

| Failure to collect tax at source and paid. [Sec 206C (7)] | Tax with interest @ 1% per month |

| Failure in furnish TCS return within stipulated time [U/S 234E] | Rs. 200 per day and shall not exceed the amount of tax deducted/collected. |

| Penalty for failure to furnish quarterly TCS return [271H] | Rs. 10000/- to Rs. 100000/- |

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"