TDS is a particular amount deducted when a payment is made, such as a salary, commission, rent, interest, or professional fees.

Reetu | Apr 8, 2024 |

TDS: Due Dates of Filing TDS Statement, TDS Forms and Certificates; Check Details

TDS full form is Tax Deducted at Source. Under this mechanism, if a person (deductor) is liable to make payment to any other person (deductee) will deduct tax at source and transfer the balance to the deductee. The TDS amount deducted will be sent to the central government.

TDS is a particular amount deducted when a payment is made, such as a salary, commission, rent, interest, or professional fees. TDS rates are set according to an individual’s age and income.

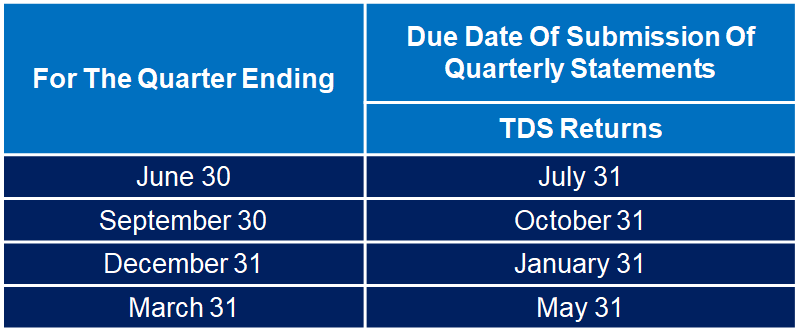

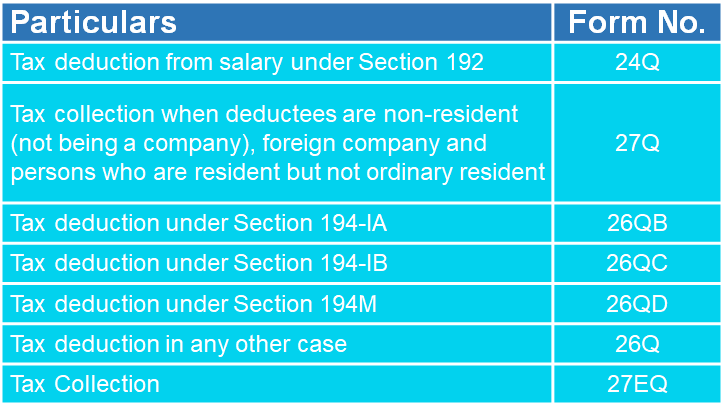

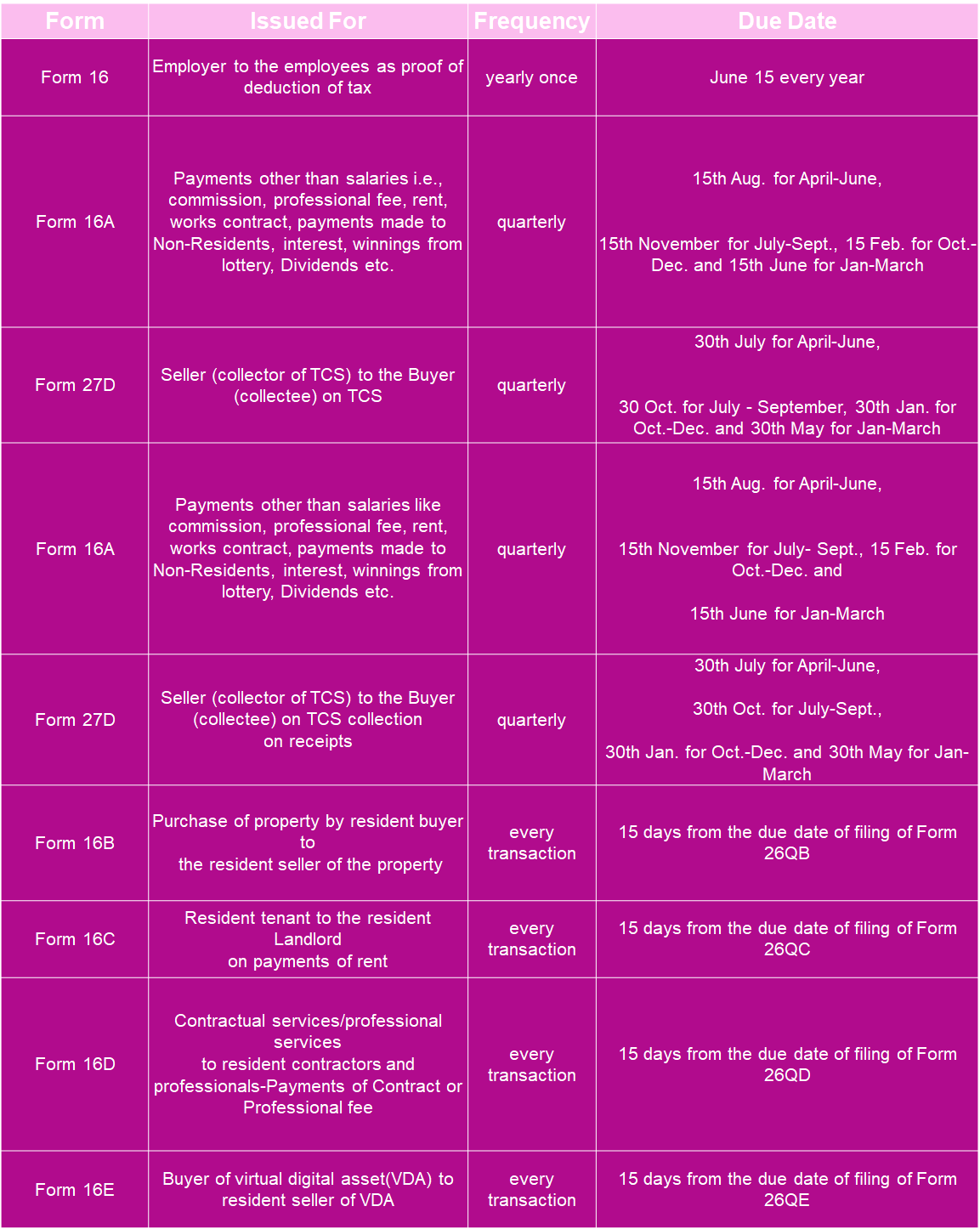

Here in this article, we’ll tell you what are the Due Dates of Filing TDS statements, TDS Forms and Certificates.

TDS certificates are an important component to prove the TDS credit and to claim at the time of filing of Income Tax returns –

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"