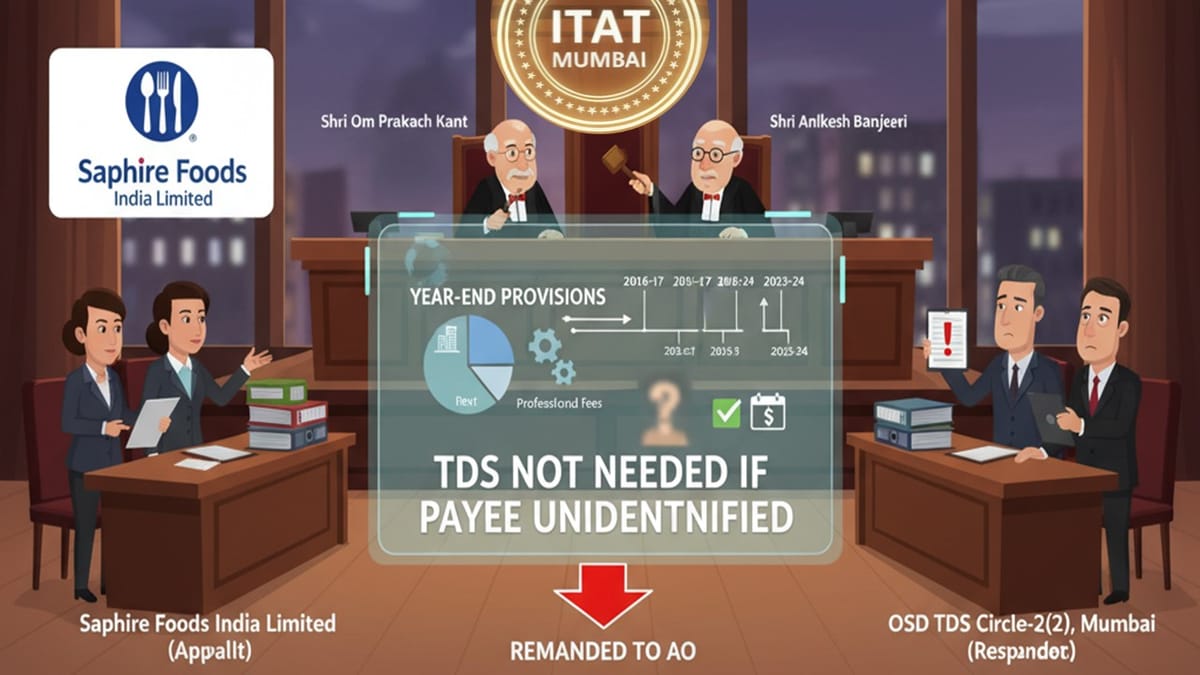

The ITAT Mumbai held that TDS is not required on year-end expense provisions when payees are not identified and directed the Assessing Officer to verify if TDS was later deducted and paid.

Saloni Kumari | Nov 10, 2025 |

TDS Not required on Year-End Expense Provisions Where Payees Are Not Identified, Says ITAT

A company was wrongly treated as a TDS defaulter for year-end expense provisions. The ITAT said TDS is not required on provisional entries if the payee is not identified, provided TDS is deducted when payments are actually made. Therefore, the tribunal allowed the appeal and remanded the case to the assessing officer (AO) to verify the facts again.

The present appeals have been filed by a company named Saphire Foods India Limited (Appellant) against the OSD TDS Circle-2(2), Mumbai (Respondent), in the Income Tax Appellate Tribunal (ITAT) Mumbai Bench “C”, Mumbai. Before Shri Om Prakash Kant (Accountant Member) and Shri Anikesh Banerjee (Judicial Member). The case is related to the assessment years 2016-17, 2018-19, 2019-20, 2020-21, 2021-22 and 2022-23, 2023-24.

This group of appeals was filed by the assessee challenging an order dated May 24, 2025, passed by the CIT(A) under Section 250 of the Income-tax Act, 1961, for the assessment years 2016-17 to 2023-24.

The assessee filed multiple appeals against the Income Tax Department’s decision to treat it as an “assessee in default” under Section 201(1) for not deducting TDS on year-end expense provisions. The issue was the same for all the financial years from 2016-17 to 2023-24; hence, the tribunal thought to hear them all simultaneously and issue a common order for them all.

The assessee is involved in the business of Hotels, Restaurants and Hospitality services (KFC and Pizza Hut).

Facts in Brief

The company had made year-end provisions (estimated expenses like rent, contractor payments, professional fees, etc.) in its accounts. TDS was not deducted at that stage because invoices were not received, and the exact payees were not identified. The company later deducted and paid TDS in the next financial year once the bills were received.

It also disallowed 30% of these expenses in its tax computation under Section 40(a)(ia) according to law for non-deduction of TDS. The tax officer, however, still held the assessee in default and imposed tax and interest under Sections 201(1) and 201(1A), amounting to Rs. 64.5 lakh.

Assessee dissatisfied with the action of the assessing officer, thereafter approached the CIT(A). However, the CIT(A) upheld the decision made by the assessing officer (AO).

Assessee’s Arguments:

The assessee in its favour also cited some earlier judgements titled Karnataka High Court in Subex Ltd. v. DCIT (2023) and ITAT Mumbai in Viacom 18 Media Pvt. Ltd. v. DCIT (2025). In both cases, the authority ruled that when payees are not identifiable and provisions are just accounting entries, TDS is not applicable.

Department’s Argument

Tribunal’s Decision

The tribunal endorsed the arguments served by the assessee that:

Final Outcome

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"