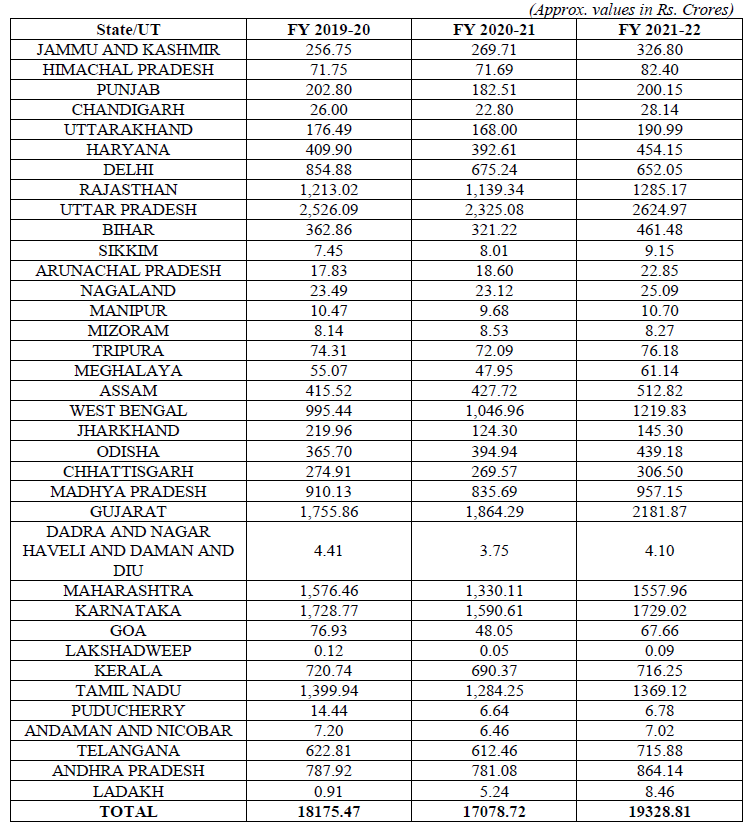

Total Central Tax of Rs. 19328.81 Crores collected on tobacco products: Highest by collected by UP

Reetu | Feb 25, 2023 |

Total Central Tax of Rs. 19328.81 Crores collected on tobacco products: Highest by collected by UP

The Minister of State in the Ministry of Finance, Shri Pankaj Chaudhary in a written reply to a question in the Lok Sabha stated that “Taxes collected from tobacco, similar to taxes collected from other sources, together form part of the overall Gross Tax Revenues (GTR) of the Government of India and are used to fund all schemes and programmes of the Government. In Budget 2022-23, an amount of ₹83,000 Crores has been allocated to fund the requirements of the Department of Health and Family Welfare. This will be met from both capital and revenue receipts of the Government of India.”

The State/UT Wise details of total central goods and services tax (central tax) paid by suppliers having registered for supply of tobacco products is provided in the Table below:

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"