Saloni Kumari | Jan 28, 2026 |

Union Budget 2026: Major Expectations, Tax Reforms, and Key Economic Priorities

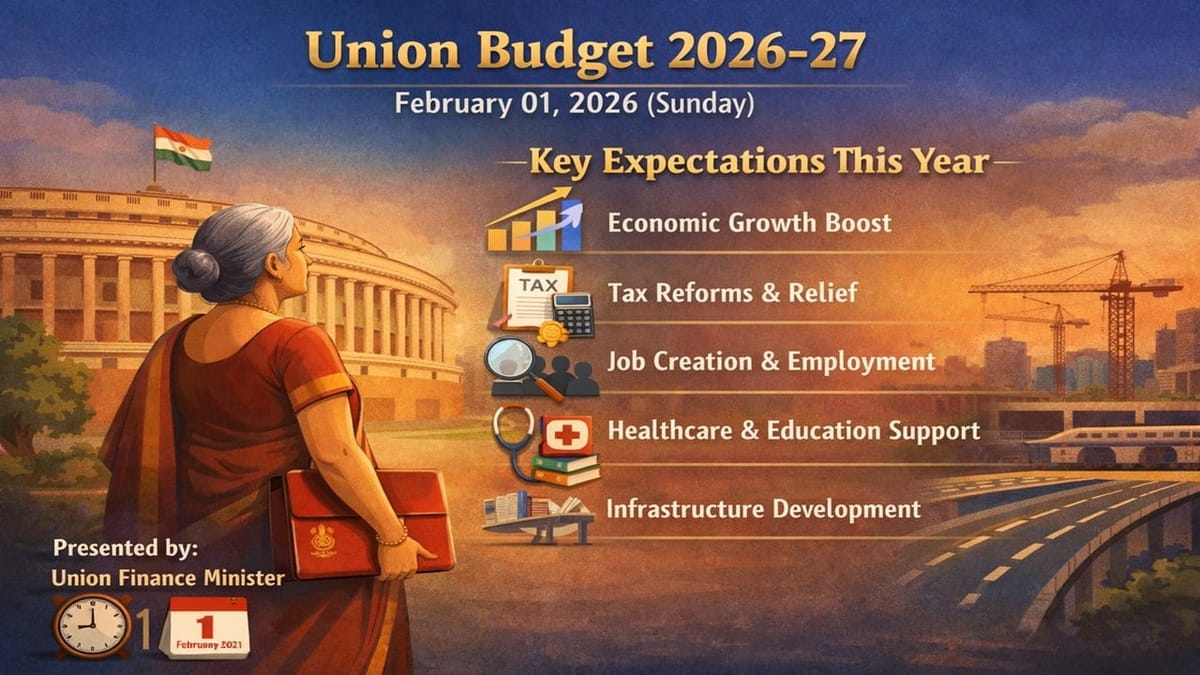

The Union Finance Minister, Nirmala Sitharaman, is about to present the Union Budget 2026-27 on February 01, 2026 (Sunday). Earlier, a debate arose over presenting the budget on Sunday; however, the decision has now been confirmed, and the budget will be presented on Sunday only. Yesterday, on January 27, 2026, the Halwa Ceremony was held at North Block, marking the final stage of the Budget 2026 preparations.

This Budget 2026 will have a significant impact on the new Income Tax Act 2025, which aims to simplify the language of tax rules and compliance. However, these changes were just aimed at simplifying tax language, not at introducing significant changes to the tax policy.

Presently, the economy of India is performing steadily, with stable growth, controlled inflation, and strong investment in infrastructure. The government is also working hard towards long-term plans to support sustainable economic development. The Union Budget 2026 is likely to overcome both short-term financial pressures and long-term structural reforms, aimed at supporting economic growth while keeping government spending under control.

The 2026 budget may reflect that the government will continue to spend on infrastructure projects, social welfare schemes, technology, and clear business regulations. Key areas of focus may include agriculture, healthcare, women’s empowerment, start-ups, and emerging sectors like digital assets.

1. The government may bring some adjustments into the tax slabs and thresholds, while major reductions in the tax rates are not anticipated. The aim is to improve disposable income and consumption demand.

2. The government is reviewing the current capital gains tax rules. There is an expectation that these rules may be simplified or adjusted to encourage more people to invest and increase participation in financial markets.

3. The government has also received proposals to rationalise TDS (Tax Deducted at Source) rates, aimed at decreasing the tax compliance burden for businesses and taxpayers.

4. The government may introduce budget measures to reduce the tax burden on ESOPs (employee stock options) for employees working across different countries. This could help avoid double taxation when global employees pay tax in both India and abroad. The aim is to simplify ESOP taxation, support global employees, and prevent paying tax twice.

5. The upcoming Budget 2026 is highly expected to announce initiatives focused on women’s empowerment, mainly focused on employment, skill development, and safety nets.

6. The Budget 2026 is likely to take effective steps for the agricultural sector or the rural economy of the nation, like improved credit support, modernisation schemes, and income support mechanisms for farmers.

7. The government is likely to continue concessions for senior and super senior citizens in the country concerning their health and tax benefits.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"