vinti | Aug 9, 2022 |

Various Steps Taken by Government, Increased Tax Revenue

Numerous elements, including the quick economic recovery following COVID and increased compliance as a result of numerous government actions, have helped to increase tax revenue. In a written response to a question in the Lok Sabha today, Union Minister of State for Finance Shri Pankaj Chaudhary made this claim.

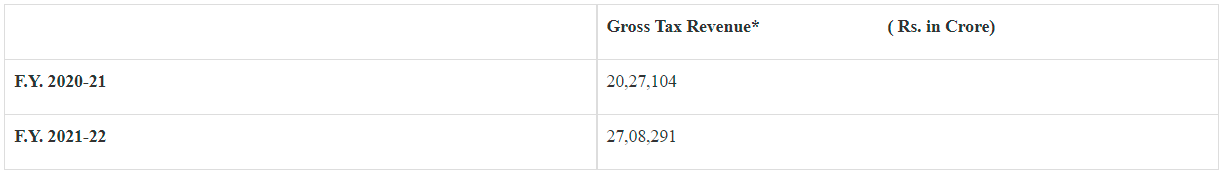

In addition, the Minister provided the following details regarding the collection of Central taxes during the Financial Year 2021–2022 in comparison to the Financial Year 2020–2021:

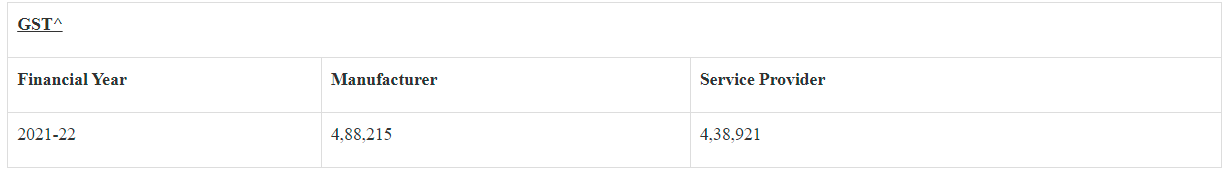

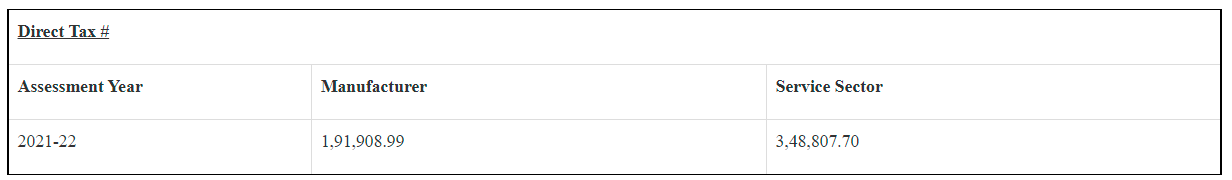

The details of tax collection under the Service Sector and Manufacturing Sector are as under:-

The Minister stated that among other steps, the following has been done towards becoming a five trillion dollar economy and beyond: –

1) In 2021–2022 and 2022–2023, the government boosted its Capex spending by an average of 35% each time. After incorporating the contribution to the States, the budgeted amount for Capex in 2022–23 is Rs. 10.68 lakh crore or 4.1% of GDP.

2) In order to enhance inter-ministerial coordination in the construction of infrastructure for economic transformation, the PM Gatishakti Scheme, which was also proposed in the Budget for 2021–2022 is currently being used as a supplement to the move toward privatization.

3) The National Infrastructure Pipeline of Projects and the Production Linked Incentive Scheme, which was originally announced as a key element of the Atmanirbhar Bharat Mission, will encourage investment and economic growth.

4) In order for bank lending to increase more quickly, the government has recapitalized banks, combined them, and reinforced their balance sheets.

According to the Minister, the actions taken in the past will also aid in the nation’s transition to a five trillion dollar economy. The implementation of the Goods and Services Tax (GST), the Insolvency and Bankruptcy Code (IBC), the lowering of the corporate tax rate, and the rationalization of labour laws, among others, have all increased the ease of doing business, according to the Minister.

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"