As per the announcement made by Income Tax Department, there is mistake in data reported by reporting entity due to which wrong data is reflected in AIS. The Taxpayers are requested to wait till the data of AIS is updated by the Income Tax Department.

CA Pratibha Goyal | Mar 12, 2024 |

Wait for AIS Update: IT Department on glitches in Advance Tax E-Campaign

Taxpayers and Tax Professionals faced another challenge in the Income Tax Department’s Advance Tax E-Campaign.

The Income Tax Administration recommended taxpayers wait for updates about stock market-related data owing to problems, one day after launching a campaign requesting them to pay advance tax per the financial transactions they conducted during the current Financial Year (FY 2023-24).

Wrong notices were sent to taxpayers having Sale Consideration for the sale of shares or immovable property. For Example, you sold a share of Reliance for Rs. 450. Two zeros have been added in this, and the value has been reflected as Rs. 45000. Property sold for Rs. 2 Cr has been shown for Rs. 20 Cr.

This was a matter of concern as This led to inflated Capital Gain. While Tax Professionals have to reply to these erroneous notices, yesterday was the last date to file Form GSTR-1.

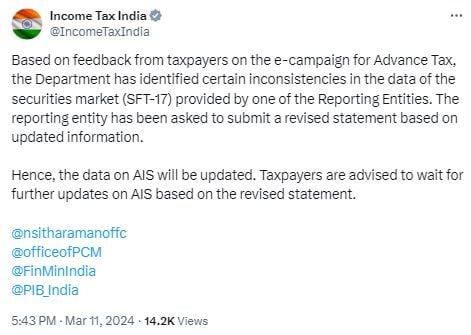

Identifying the errors of the system and the causes and concerns of the taxpayers, the Income Tax Portal Acknowledged the glitches in the Annual Information Statement (AIS). The Income Tax Department has clarified that this mistake was due to an inconsistency in Data reported by one of the reporting entities.

Here is the screenshot of the announcement made by IT-Department on it’s official handle:

The Reporting entity has been asked to submit the revised data and Taxpayers are requested to wait till the data of AIS is updated by the Income Tax Department.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"