With only 6 days until the July 31 deadline for submitting Income Tax Return for Assessment Year 2023-24, the topic 'Income Tax Return' has been trending on social media.

Reetu | Jul 25, 2023 |

Why Income Tax Return is trending on Social Media? Govt will Extend ITR Filing Due Date for AY 2023-24? Know All Details

ITR Filing 2023: With only 6 days until the July 31 deadline for submitting Income Tax Return (ITR) for Assessment Year 2023-24, the topic ‘Income Tax Return’ has been trending on social media. “Income Tax Return” hashtag is trending on no.2 at twitter.

While social media users are tweeting about Income Tax Returns, unlike the previous year, there is no such huge demand coming for extending the due date this year, but some association has demanded the same. Not much asking for extension of due date, this is mostly due to the record number of returns filed this year, as well as increased taxpayer knowledge of the benefits of early ITR filing.

According to statistics on the Income Tax e-filing website, almost 4 crore ITRs for the financial year 2023-24 were filed as of July 23. Over 2 crore returns have been processed by the tax department, while over 3.6 crore ITRs have been verified by taxpayers.

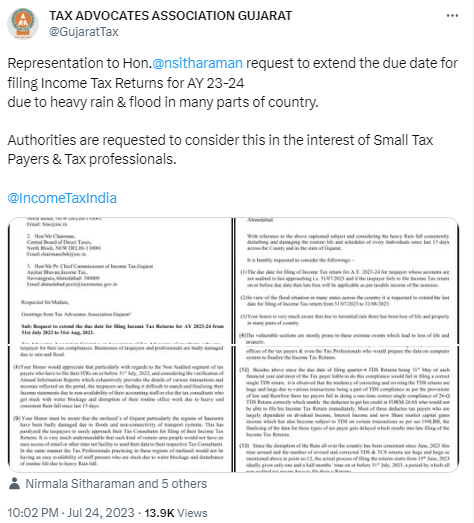

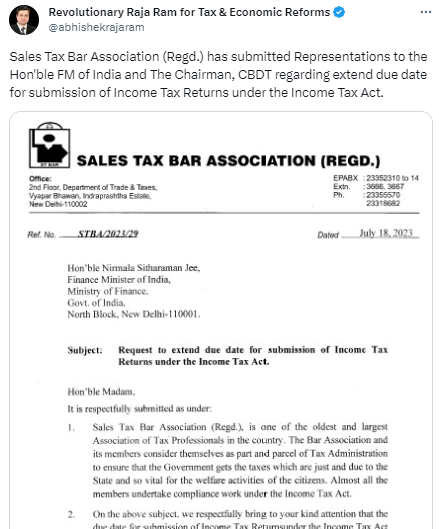

Various CA Association and Tax Association have send representation to Finance minister and CBDT Chairman to extend the due date of filing ITR for various reason.

Tax Advocates Association Gujarat: Read Representation

Sales Tax Bar Association: Read Representation

Only 6 Days left until the deadline and yet there is no intention seen from the government side coming to extend the due date of income tax returns. Earlier on this, Revenue Secretary has kind of confirmed it that ministry of finance was not contemplating any extension of the Income Tax Return due date.

So let’s see what are the consequences of not filing the return of Income on or before the due date.

Late Fees of Rs. 5000/ Rs. 1000 Applicable:

Late Fees u/s 234F of Rs. 5000 is applicable if you don’t file your return on time. This Late fee is restricted to Rs. 1000 if your income is upto Rs. 5000.

This Late Fee is Applicable only if you were required to file ITR as per Law. The same is not applicable if you are filing the ITR without applicability as per Law on a voluntary basis. The same is explained by the mentioned chart:

Carry forward of Losses:

You cannot carry forward any Loss except Loss under the head House Property if you don’t File your return on Time. However, Set-Off of Losses is allowed even in the case of Belated ITR.

Interest on Late Payment of Tax:

Interest @1% per month or part of the month u/s 234A is applicable after the due date of Filing the Income Tax Return.

For Example, Tax Liability comes out to be Rs. 100,000. The Due Date for Filing ITR was 31st July, but the Taxpayer filed it on 2nd August, then an Interest u/s 234A for Rs. 1000 will be applicable.

Delay in Receiving Refunds:

If you File your ITR Late, then your return will be late processed and as a result, your ITR Refund will be delayed.

Benefits of New Tax Regime

Taxpayers opting for New Tax Regime have to file the ITR before the due date. New Tax Regime cannot be opted for in ITR filing, once due date is expired.

Deductions under Chapter VI-A not available

Further, as per section 80AC, deductions in respect of certain incomes under Chapter VI-A [Heading C- Deduction in respect of certain incomes] would not be available.

You May Also Like:

| CA writes to Finance Minister Secretary requesting due date extension | Click Here to Read |

| Extend Due Date for Submission of Income Tax Returns: Sales Tax Bar Association | Click Here to Read |

| Extend Income Tax Return Filing Deadline: Advocates Tax Bar Association | Click Here to Read |

| Chartered Accountants Association represents against e-proceedings tab of the IT portal | Click Here to Read |

| Extend Due Date of Filing Income Tax Return for AY 2023-24: Tax Advocates Association Gujarat | Click Here to Read |

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"