Nidhi | Jun 20, 2025 |

Wrongly Rejected IMS Records? GSTN advises How to Fix Them Fast

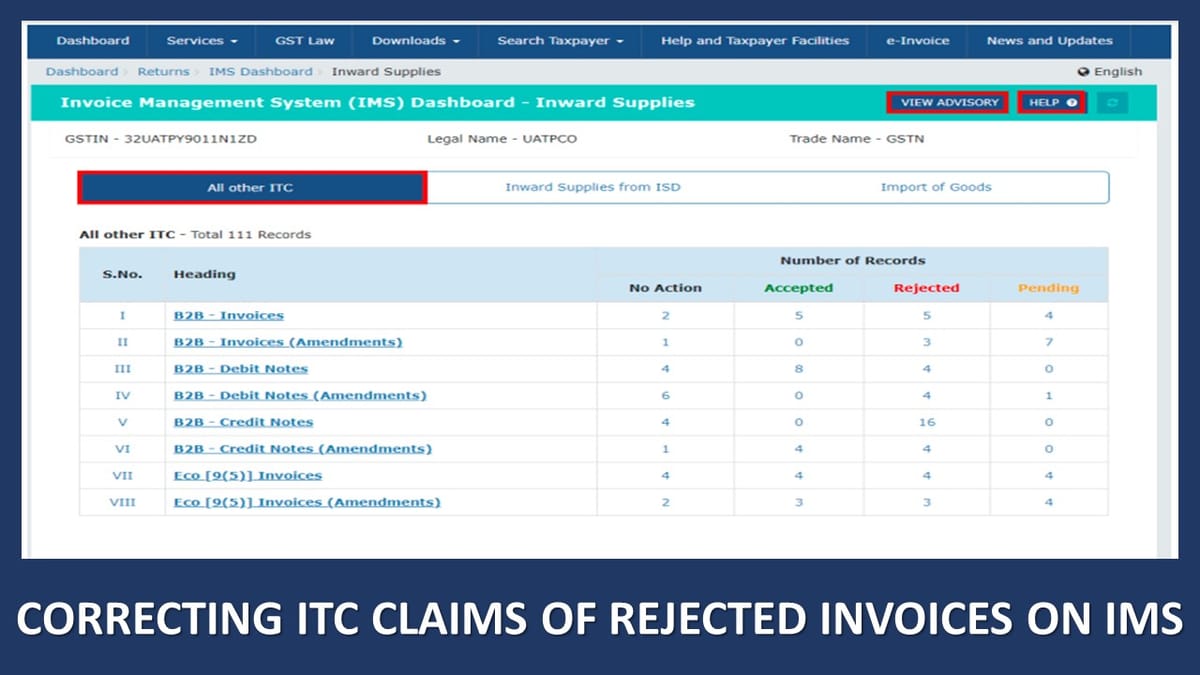

The Integrated Management System (IMS) on the GST portal helps to manage the invoices and their tax credits. It allows the taxpayers to review, accept, reject, or mark invoices pending. This helps in boosting the accuracy in claiming ITC and also reduces the manual workload on businesses so that businesses can operate efficiently. This system also promotes transparency and reduces disputes between suppliers and recipients.

Let us understand different situations for correcting ITC claims of rejected invoices on IMS:

If a recipient has claimed ITC of a wrongly rejected invoice, debit note, or ECO document or debit note in IMS, and has already filed GSTR-3B for that period, they can still claim the ITC. To do this, the recipient should request the supplier to submit the same document again (without making any changes) in GSTR-1A or in the amendment table of a GSTR-1/IFF. After the supplier does this, the recipient will get the ITC of the complete revised value, as the original record was rejected by the recipient. However, the recipient can claim ITC on the re-reported document by the supplier only in the GSTR-2B of the tax period.

What to do in case original record is wrongly rejected?

If the recipient has wrongly rejected a Credit note in IMS and has already filed GSTR-3B, then the recipient can reverse this ITC. To do it, the recipient can request the supplier to submit the same credit note (without making any changes) in the same period’s GSTR-1A or in the amendment table of a later GSTR-1/IFF. Once the supplier reports this, the recipient can accept the credit note on IMS and recalculate GSTR-2B. This will lower the ITC by the full amount of the original credit note.

How to reverse ITC of wrongly rejected Credit note in IMS?

If a supplier had filed a record in GSTR-1/IFF but the recipient wrongly rejected it in IMS, the supplier must submit the same record again (without any changes) in GSTR-1A of the same period or in the amendment table of a later GSTR-1/IFF, within the prescribed time. This will not increase the supplier’s liability because the revised table records only the delta value. Therefore, the difference becomes zero, so there is no extra tax liability.

If a recipient rejects an original credit note, and the supplier submits this in a credit note in GSTR-1A of the same tax period or in the amendment table of GSTR-1/IFF of the future tax period within the prescribed time limit, then the liability of the supplier is added back in their open GSTR-3B return. But if the supplier reports the same credit note again in GSTR-1A of the same period or in the amendment table of a later GSTR-1/IFF within the time limit, the liability of the supplier decreases by the same amount. As the credit note value stays the same, the net effect on the supplier’s liability happens only once.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"