The Minister of State of Finance has stated in response to a question raised in Lok Sabha that 109 Prosecutions were launched under the Black Money in 5 years.

Reetu | Aug 8, 2024 |

109 Prosecutions launched under the Black Money in 5 years

The Minister of State in the Ministry of Finance Shri. Pankaj Chaudhary has stated in response to a question raised in Lok Sabha that 109 Prosecution launched under the Black Money in 5 years.

The Minister Shri Sanjay Singh asked the question in Lok Sabha:

Will the Minister of FINANCE be pleased to state:

(a) the details of the detection of illegal and undisclosed foreign assets under the Black Money (Undisclosed Foreign Income and Assets) and Imposition of Tax Act;

(b) the details of prosecution complaints filed under the Black Money (Undisclosed Foreign Income and Assets) and Imposition of Tax Act in the last five years;

(c) the details of asset holders encouraged to bring back black money from abroad, including payment of penal tax; and

(d) the details of asset holders who failed to do so during the last five years and are being prosecuted under the said Act?

The Minister of State in the Ministry of Finance Shri. Pankaj Chaudhary replied:

(a) The details of the detection of illegal and undisclosed foreign assets under the Black Money (Undisclosed Foreign Income and Assets) and Imposition of Tax Act:

i. The Act came into force w.e.f. 01.07.2015.

ii. 648 disclosures involving unreported foreign assets totalling Rs.4164 crores were made during the one-time three-month compliance window under BMA, 2015, which ran from July 1st to September 30th. In such cases, the tax and penalty collected amounted to around Rs.2476 crore.

iii. As on 31.03.2024, orders u/s 10(3)/10(4) of the Act have been passed in about 652 cases raising demand of more than Rs. 17,162 crores (approx.) and 163 prosecutions have been launched.

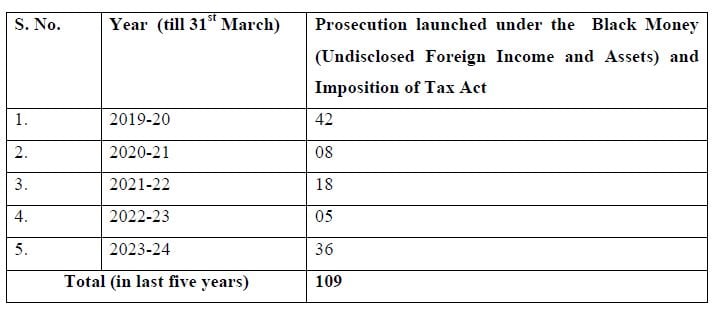

(b) The details of prosecution complaints filed under the Black Money (Undisclosed Foreign Income and Assets) and Imposition of Tax Act in the last five years are as under:

(c) & (d): The disclosure of information about specific assesses is banned except under the provisions of Section 138 of the Income-tax Act of 1961 (borrowed in BMA, 2015 under section 84).

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"