Nidhi | Sep 8, 2025 |

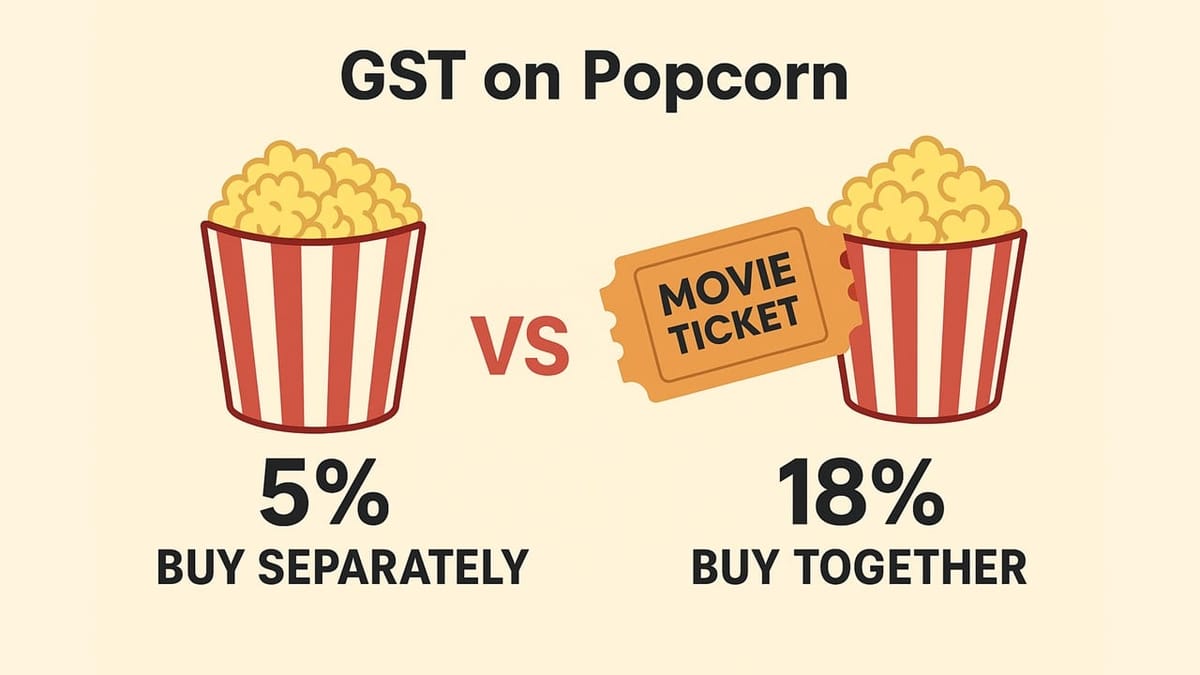

5% GST on Popcorn? It Can Rise to 18% If You Buy It This Way

Recently, the Goods and Services Tax (GST) rates have been reduced on several daily-use goods and essential items, along with other goods, offering significant relief to the common man. One of the GST changes is the GST on popcorn. Earlier, the different types of popcorn were being taxed differently, but this has now been simplified. Now, whether the popcorn is salted or caramelised, it will attract 5% GST. However, it is not always the same, as the tax you pay on popcorn depends on whether you buy popcorn individually or with the movie ticket. Let us know how this works.

If you buy popcorn separately, the GST will be charged at 5%. However, if the popcorn is bought with the movie ticket, it becomes a composite supply. A composite supply is where two goods or services are naturally bundled and cannot be sold individually. Under the composite supply, there is a principal supply, which is the main good, and the other supply comes with the principal supply. For example, in the current situation, if the popcorn is bought with the movie ticket, then the movie ticket is the main supply.

The GST rate applicable to the composite supply depends on the GST rate of the main item, also known as the principal supply, which is the movie ticket. The rates on movie tickets have also been revised by the GST Council. If the ticket’s price is Rs 100 or less, then the GST rate is only 5%. On the other hand, if your movie ticket costs more than Rs 100, the GST rate is 18%, and this rate also applies to the popcorn.

Therefore, we can say that if you buy the popcorn separately, the GST rate is 5% but if you buy the popcorn with the movie ticket, whose price is more than Rs 100, you will have to pay the GST applicable to the Movie Ticket at 18%, as it is the main supply. Let us understand this with a practical example. Assume that the price of the popcorn is Rs 100 and the price of a movie ticket is Rs 200.

Therefore, whether you buy popcorn individually or with the movie ticket, it can make a major difference in the GST you pay.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"