ITAT upheld addition u/s 69A against Senior Citizen who was found with Rs. 95.89 Lakh Cash during Train Journey

CA Pratibha Goyal | Jun 6, 2025 |

95.89 Lakh Cash seizure during Train Journey from Senior Citizen: ITAT uphold addition u/s 69A

Shri Chatru Lal Meena, a resident of Nimod, Sawai Madhopur, was found carrying Rs. 95,89,000 in cash with another individual, Shri Ramavatar Meena, during a train journey in February 2020. The cash was seized under Section 102 CrPC by the GRP, Kota, and later requisitioned by the IT Department under Section 132A of the Income Tax Act.

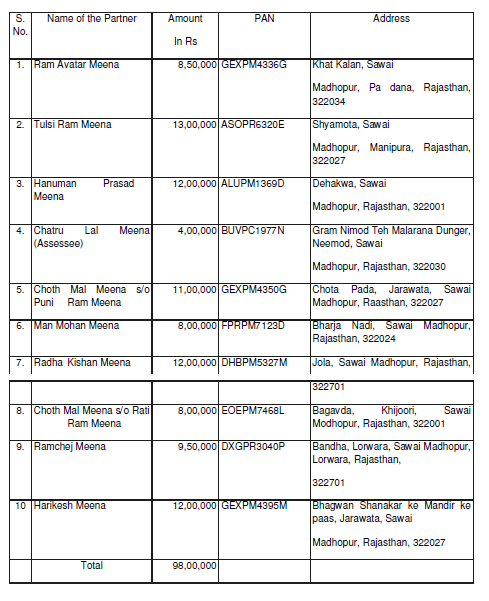

The assessee claimed cash belonged to M/s Meena Construction Works, a partnership firm. He was one of the partners in the firm. The cash was the total contribution of 10 partners, and he was carrying the cash with the intention of machinery purchase from Odisha. Unfortunately, upon reaching Bhubaneshwar it was discovered that the vendor, Shri Ravi Jain proprietor of Shri Mahaveer Associates from whom the said old second-hand machineries was to be purchased was not available due to last minute emergency.

He also filed affidavits and documents to substantiate capital contributions by partners.

However, the Assessing Officer (AO) and CIT(A) rejected the assessee’s explanations, leading to assessments and additions under Sections 69A, 68, 56(2)(x) and tax levied under Section 115BBE.

However, the department argued that the firm was established but it was not registered with any of the government agencies. The Firm has not fulfilled the requirement of registration under GST, allotment of PAN, opening of bank accounts, which are the basic requirements to start any business. There has been no activity in the firm since inception.

The tribunal agreed with AO’s finding that the story of the partnership firm and machinery purchase was fabricated. Lack of evidence like PAN, books of account, and activity made the firm’s existence and cash source dubious.

Accordingly, additions made by the Income Tax Department were affirmed.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"